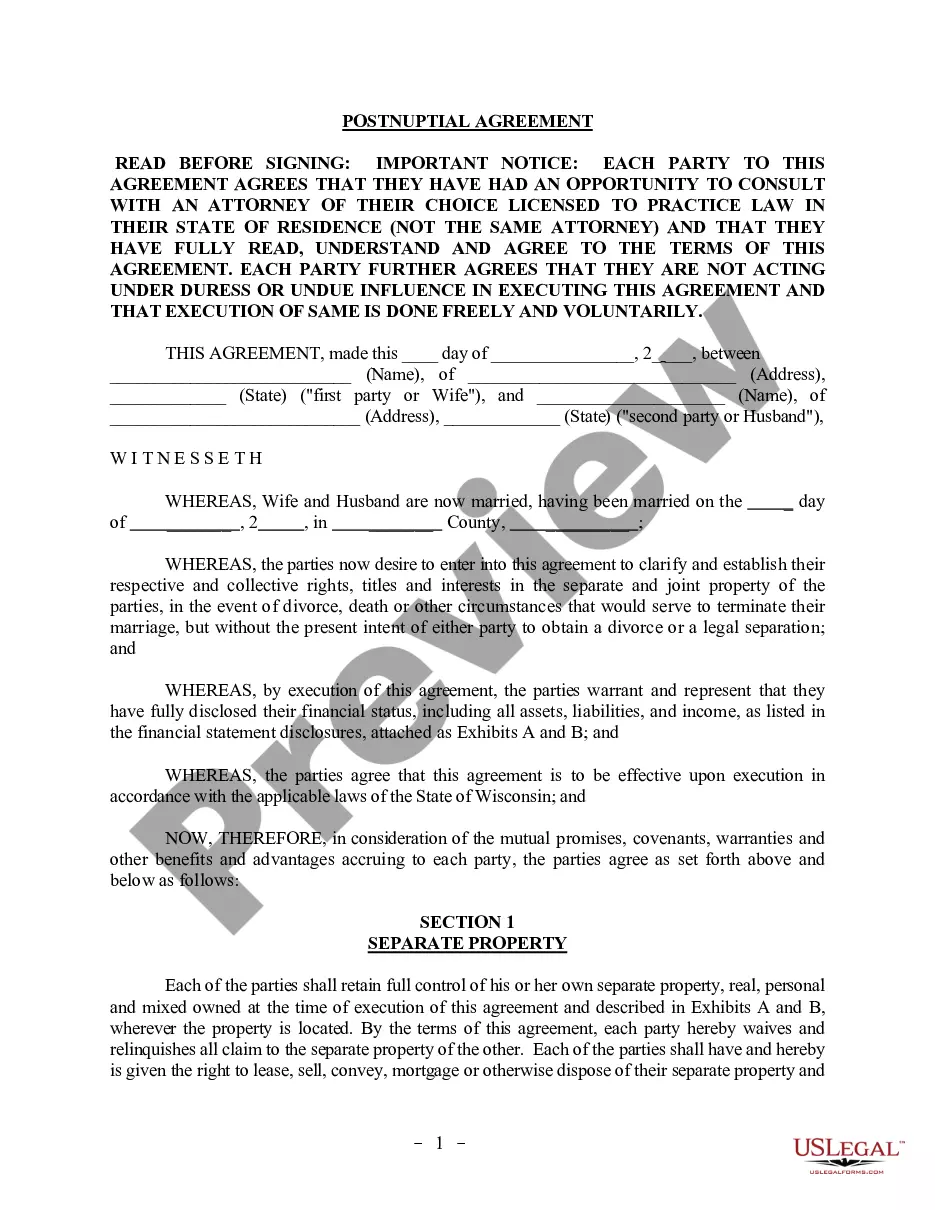

The Michigan Personal Balance Sheet is an organized financial document used to track and record an individual's assets, debts, and net worth. It is a simple way to track total net worth, including liquid and non-liquid assets, liabilities, and net worth. The Michigan Personal Balance Sheet is designed to help individuals gain insight into their financial position and plan for their future. There are two types of Michigan Personal Balance Sheet: the Standard Balance Sheet and the Advanced Balance Sheet. The Standard Balance Sheet is the most basic version and is ideal for those just starting out with their finances. It includes sections for assets, liabilities, and net worth. The Advanced Balance Sheet is more detailed and includes additional categories for tracking investments, retirement savings, and other financial items.

Michigan Personal Balance Sheet

Description

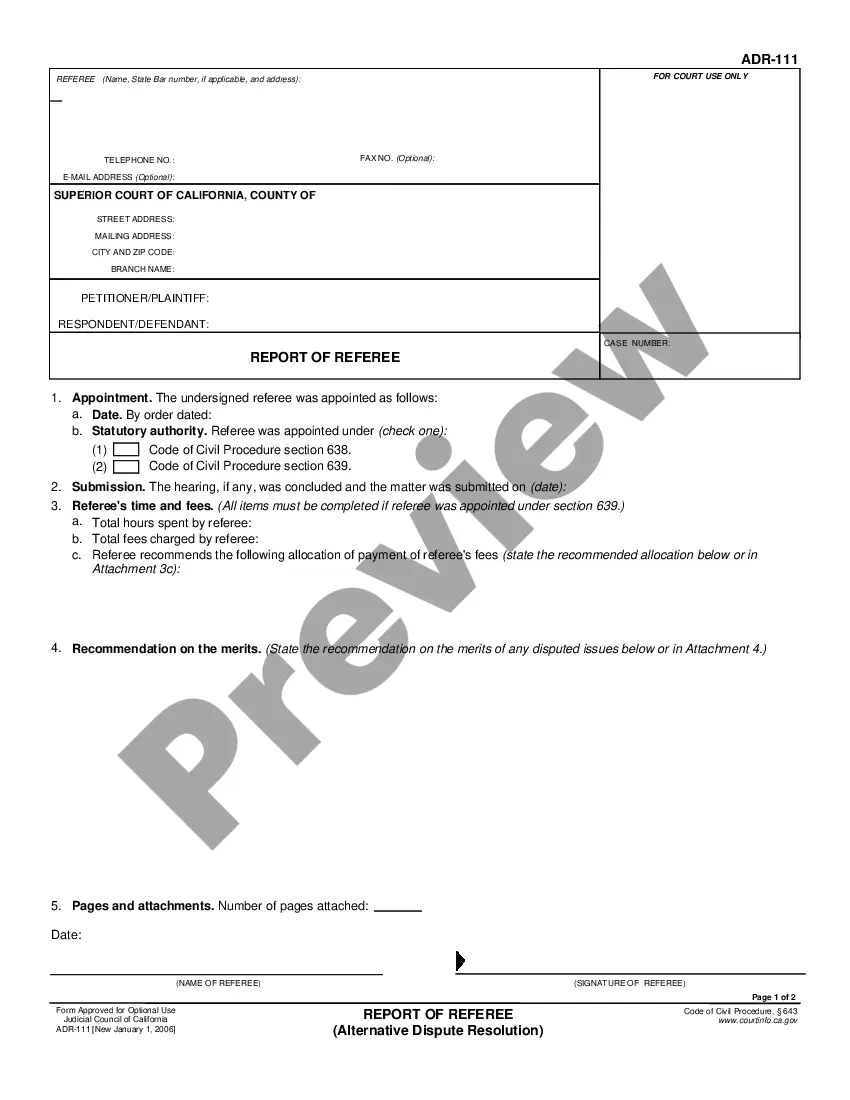

How to fill out Michigan Personal Balance Sheet?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are examined by our experts. So if you need to complete Michigan Personal Balance Sheet, our service is the perfect place to download it.

Obtaining your Michigan Personal Balance Sheet from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it suits your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Michigan Personal Balance Sheet and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

A balance sheet is a statement of a business's assets, liabilities, and owner's equity as of any given date. Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; annually). A balance sheet is comprised of two columns. The column on the left lists the assets of the company.

Owning vs Performing: A balance sheet reports what a company owns at a specific date. An income statement reports how a company performed during a specific period. What's Reported: A balance sheet reports assets, liabilities and equity. An income statement reports revenue and expenses.

A balance sheet is calculated by balancing a company's assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity.

Personal Balance Sheet. A balance sheet is the second type of personal financial statement. A personal balance sheet provides an overall snapshot of your wealth at a specific period in time. It is a summary of your assets (what you own), your liabilities (what you owe), and your net worth (assets minus liabilities).

How to make a balance sheet in 8 steps Step 1: Pick the balance sheet date.Step 2: List all of your assets.Step 3: Add up all of your assets.Step 4: Determine current liabilities.Step 5: Calculate long-term liabilities.Step 6: Add up liabilities.Step 7: Calculate owner's equity.

A balance sheet is a statement of a business's assets, liabilities, and owner's equity as of any given date. Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; annually).

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website.

A personal balance sheet is something that's important to have in your financial toolbox to help you make sense of your unique situation and grow your wealth. It might sound daunting to build everything from scratch, but it's really as simple as working out your total assets and liabilities.