Michigan Acknowledgment for a Limit Partnership

Description

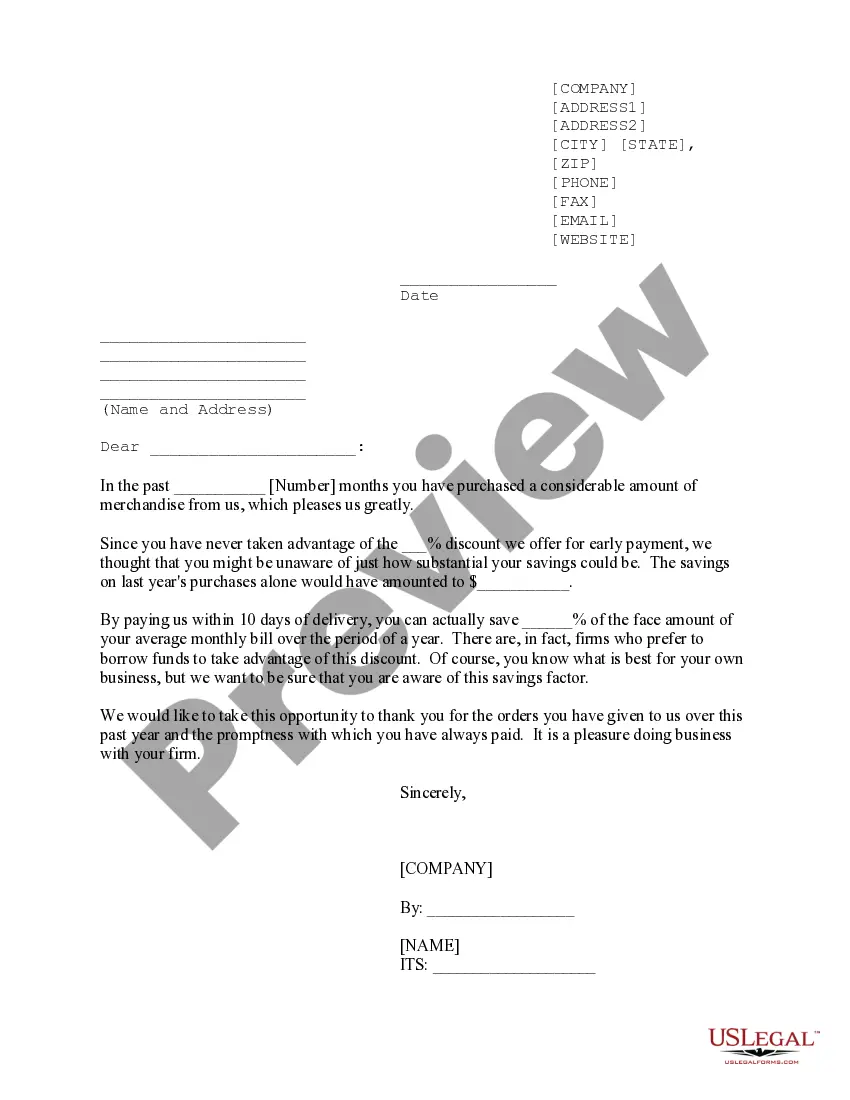

How to fill out Michigan Acknowledgment For A Limit Partnership?

Have any template from 85,000 legal documents including Michigan Acknowledgment for a Limit Partnership on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have already a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Acknowledgment for a Limit Partnership you would like to use.

- Read through description and preview the sample.

- When you’re confident the sample is what you need, click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the right downloadable sample. The service gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Acknowledgment for a Limit Partnership fast and easy.

Form popularity

FAQ

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

LLCs protect owners against personal liability for business debts and lawsuits. This safeguards the personal assets for all owners. In a general partnership, owners have unlimited, personal liability for the businesses' debts, including, but not limited to, the acts of employees.

A taxpayer must remit any liability by the due date of the return. S-Corporations - MI Form 4891 is not required for an S-Corporation return. Partnerships- MI Form 4891 is not required for a Partnership return.

Types of businesses that typically form LLC partnerships: Companies whose owners want liability protection from the business while still being involved in the day-to-day management and operations. Since LLC partnerships can be formed by most types of businesses, they're generally a good fit for most people.

General Partnership: Limited Partnership: Limited Liability Partnership: Public Private Partnership:

The key differences between them is the partners in each kind of partnership are different for example: in general partnerships they each are responsible for everything that happens with the business, limited partnerships one partner is responsible for the whole business while one is just responsible for the money they

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

About the City Partnership Tax The Michigan Department of Treasury began processing returns and associated payments in 2017 on behalf of the City of Detroit for the 2016 tax year. Beginning with the 2016 tax year, all returns and payments must be sent to the Michigan Department of Treasury.

The Michigan (MI) state sales tax rate is currently 6%.