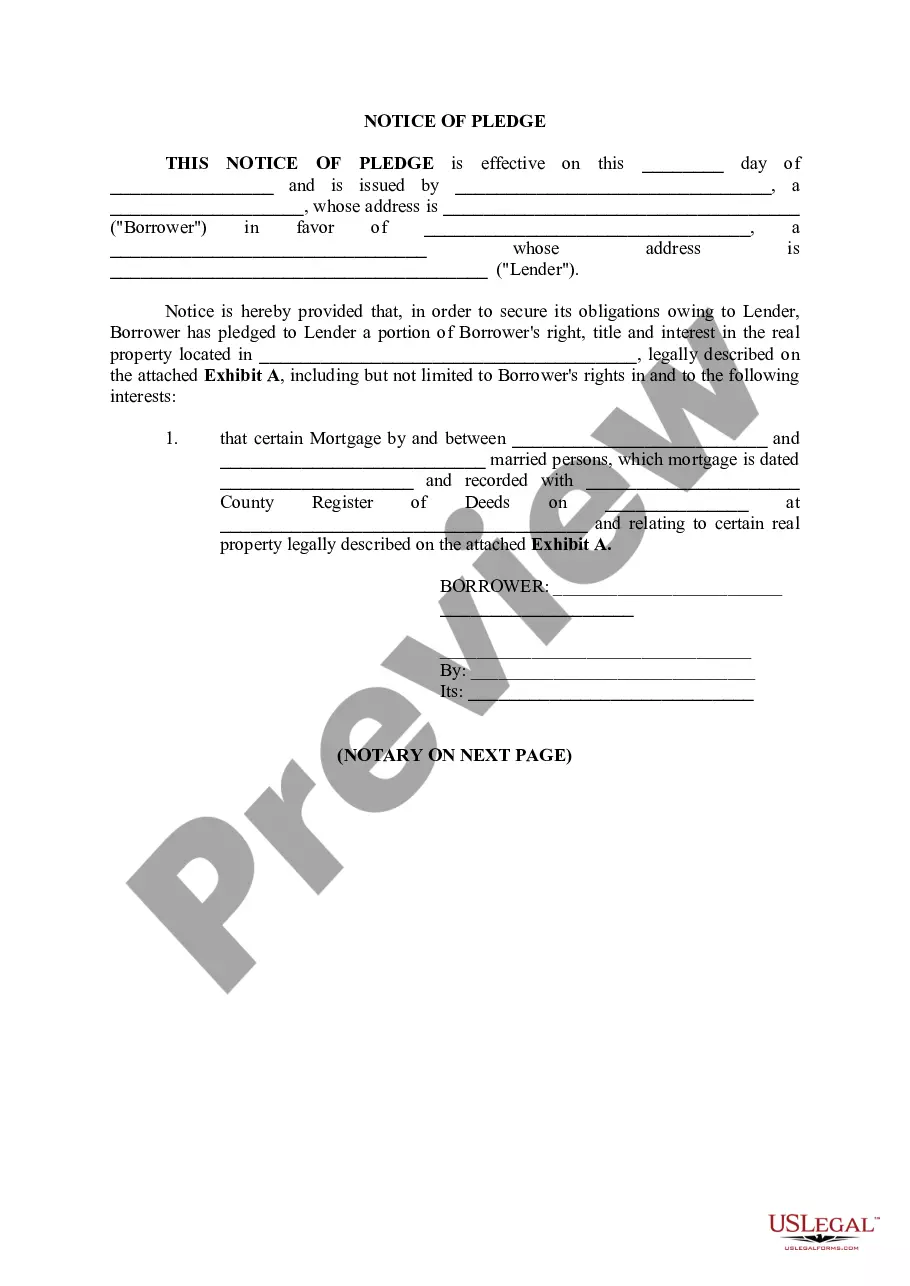

Michigan Notice of Pledge to Secure

Description

How to fill out Michigan Notice Of Pledge To Secure?

Get any template from 85,000 legal documents such as Michigan Notice of Pledge to Secure online with US Legal Forms. Every template is prepared and updated by state-accredited lawyers.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Notice of Pledge to Secure you would like to use.

- Read description and preview the sample.

- Once you are sure the sample is what you need, click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the appropriate downloadable template. The service will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Michigan Notice of Pledge to Secure easy and fast.

Form popularity

FAQ

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan.Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Collateral is a pledge against repayment of a loan.If I can't repay the loan, the bank or person who gave me the loan can take my house as payment. A pledge is any promise or guarantee, not necessarily for a loan. Collateral is always a pledge; a pledge is not necessarily collateral.

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.If a borrower defaults on a loan (due to insolvency or another event), that borrower loses the property pledged as collateral, with the lender then becoming the owner of the property.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

By Practical Law Finance. This is a standard form of pledge agreement to be used in connection with a syndicated loan agreement. It is intended to create a security interest over equity interests and promissory notes owned by the grantors. The grantors are usually the borrower, its parent and its subsidiaries.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds.Pledged assets can include cash, stocks, bonds, and other equity or securities.

Third-party pledge is a pledge that secures the principal debt of another person than the pledger. 1.5.A person who has given a pledge for the security of his or her own debt is not considered a private pledger. 1.6.