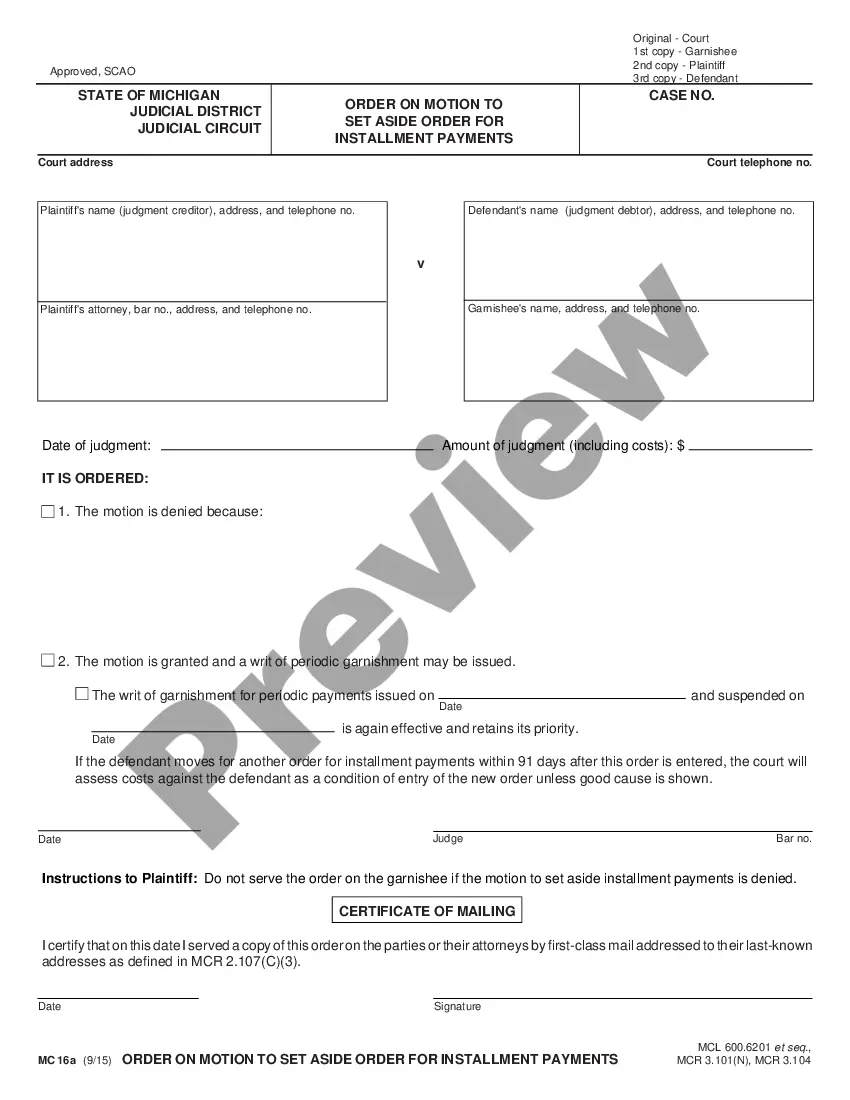

This Order Regarding Installment Payments is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Order Regarding Installment Payments

Description

How to fill out Michigan Order Regarding Installment Payments?

Obtain any template from 85,000 legal documents including Michigan Order Regarding Installment Payments online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you currently hold a subscription, Log In. Once on the form’s page, hit the Download button and navigate to My documents to access it.

If you have not subscribed yet, adhere to the instructions below.

With US Legal Forms, you will consistently have immediate access to the relevant downloadable sample. The platform offers you entry to documents and categorizes them to ease your search. Utilize US Legal Forms to acquire your Michigan Order Regarding Installment Payments swiftly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Order Regarding Installment Payments you wish to utilize.

- Examine the description and preview the template.

- When confident that the sample meets your needs, simply select Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Remit payment using either of the two available methods: by credit card or via PayPal.

- Select a format to download the document in; two options are provided (PDF or Word).

- Download the file to the My documents section.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

In Michigan, one parent cannot legally prevent the other parent from seeing their child without a court order. This act may be considered a violation of parenting rights and could result in legal repercussions. It's essential to establish a formal agreement or parenting plan, especially regarding the Michigan Order Regarding Installment Payments for support. If you're looking for guidance or legal documents, USLegalForms can help you create comprehensive agreements that protect everyone’s rights.

In Michigan courts, the 7 day rule serves as a guideline for expediting certain motions. This rule mandates that courts address specific motions, including those related to payment schedules, promptly within seven days. Understanding this timeframe is crucial for those involved in financial disputes, making the Michigan Order Regarding Installment Payments process smoother. You can access resources on USLegalForms to better understand this rule and streamline your legal filings.

The 7 day order rule in Michigan states that if a party is required to fulfill payment obligations, the court must issue an order regarding installment payments within seven days of the motion being filed. This rule ensures timely decisions that facilitate compliance and avoid delays. If you need help navigating this process, consider using USLegalForms to find the necessary paperwork tailored to the Michigan Order Regarding Installment Payments.

The new Michigan garnishment law introduces a framework for handling debts through installment payments. Under this law, individuals can now request a Michigan Order Regarding Installment Payments to manage their financial obligations more effectively. This order allows for a court-approved plan that can help alleviate the burden of immediate debt repayment. To comply with the new regulations, it's important to understand your rights and options available through tools like US Legal Forms, which can guide you through the filing process.

The installment payment process under a Michigan Order Regarding Installment Payments allows individuals to make payments over a specified timeframe instead of paying a lump sum. Typically, this order outlines the amount due, the payment schedule, and any applicable interest. To ensure compliance, the parties involved must adhere to the terms set forth in the order. For assistance with creating or understanding these orders, consider using the US Legal Forms platform, which provides resources and templates tailored for Michigan residents.

Individuals can complete Form 9465, Installment Agreement Request. If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.

Pay directly from a checking or savings account (Direct Pay) (Individuals only) Pay electronically online or by phone using Electronic Federal Tax Payment System (EFTPS) (enrollment required) Pay by check, money order or debit/credit card.

With a short-term payment plan, you must pay what you owe the IRS in 120 days or less (no more than four months). When you handle your tax debt this fast, you don't have to pay the IRS a set-up fee.With a long-term plan (also called an installment agreement), you have up to 72 months (6 years) to pay what you owe.

If you owe less than $10,000 to the IRS, your installment plan will generally be automatically approved as a "guaranteed" installment agreement. Under this type of plan, as long as you pledge to pay off your balance within three years, there is no specific minimum payment required.

Don't panic. If you cannot pay the full amount of taxes you owe, you should still file your return by the deadline and pay as much as you can to avoid penalties and interest. You also should contact the IRS to discuss your payment options at 800-829-1040.