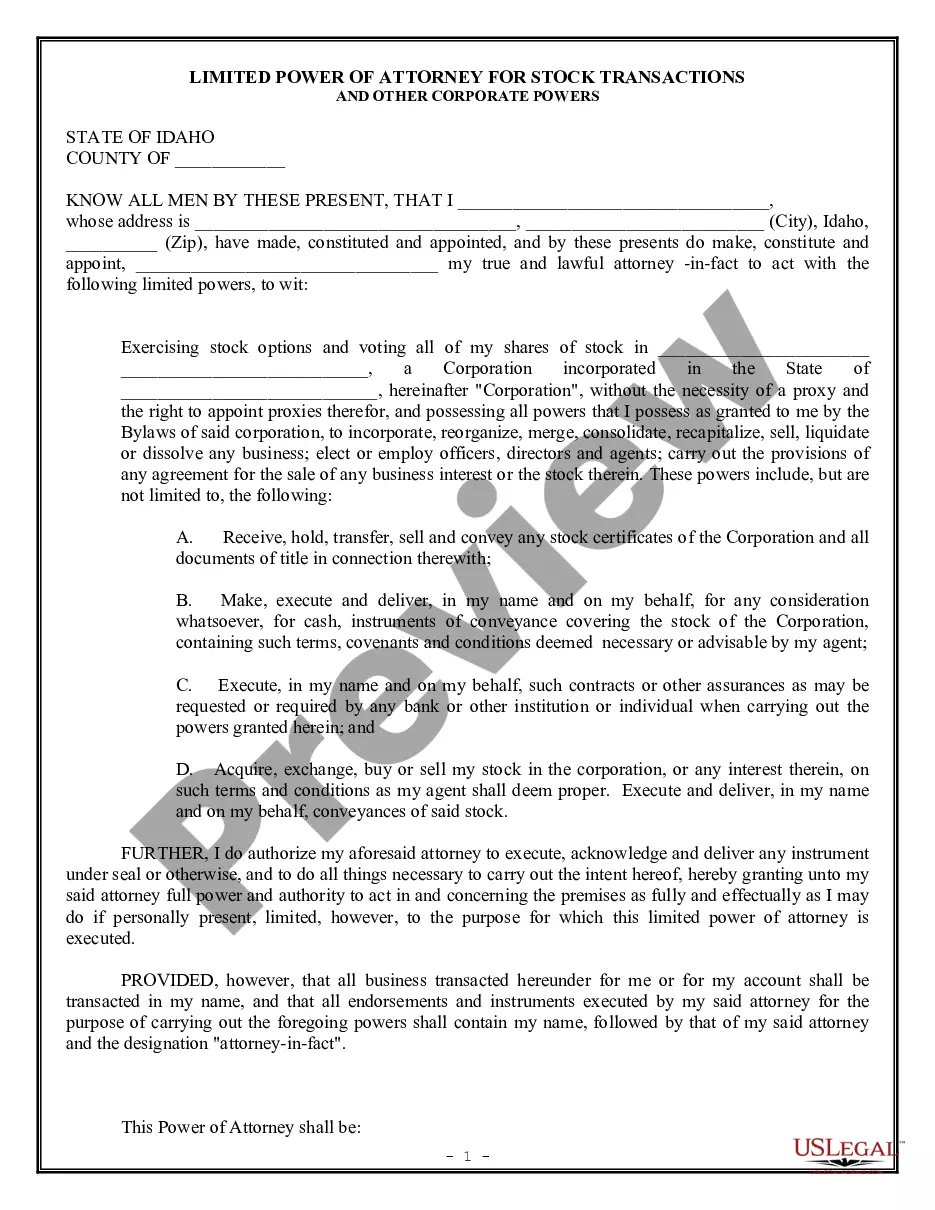

Michigan Business Registration — Co-Partnership (effective January 1, 2007) is a partnership between two or more people that registers with the State of Michigan to become a legally recognized business entity. This type of registration allows the partners to operate the business under the legal name of the partnership, and to share in the profits and losses of the business. The partners are also jointly and severally liable for the debts and obligations of the business. Types of Michigan Business Registration — Co-Partnership (effective January 1, 2007) include limited liability partnerships (LLP), limited partnerships (LP) and general partnerships (GP). Laps provide limited liability protection to partners while still allowing them to conduct business as a partnership. LP and GP are business entities where the partners are personally liable for the debts and obligations of the business.

Michigan Business Registration - Co-Partnership

Description

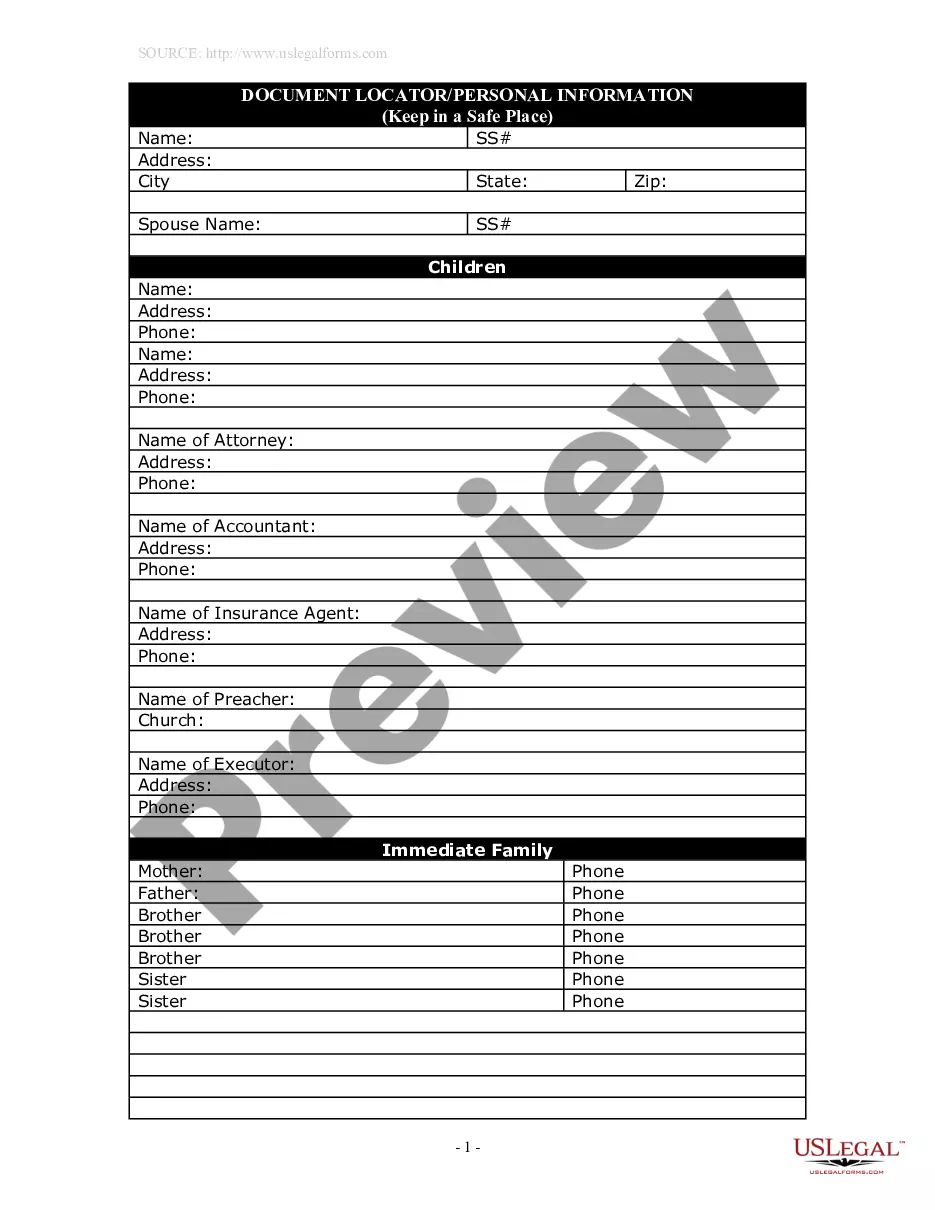

How to fill out Michigan Business Registration - Co-Partnership ?

How much time and resources do you often spend on drafting official paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for an appropriate blank. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, such as the Michigan Business Registration - Co-Partnership (effective January 1, 2007).

To obtain and complete an appropriate Michigan Business Registration - Co-Partnership (effective January 1, 2007) blank, adhere to these easy steps:

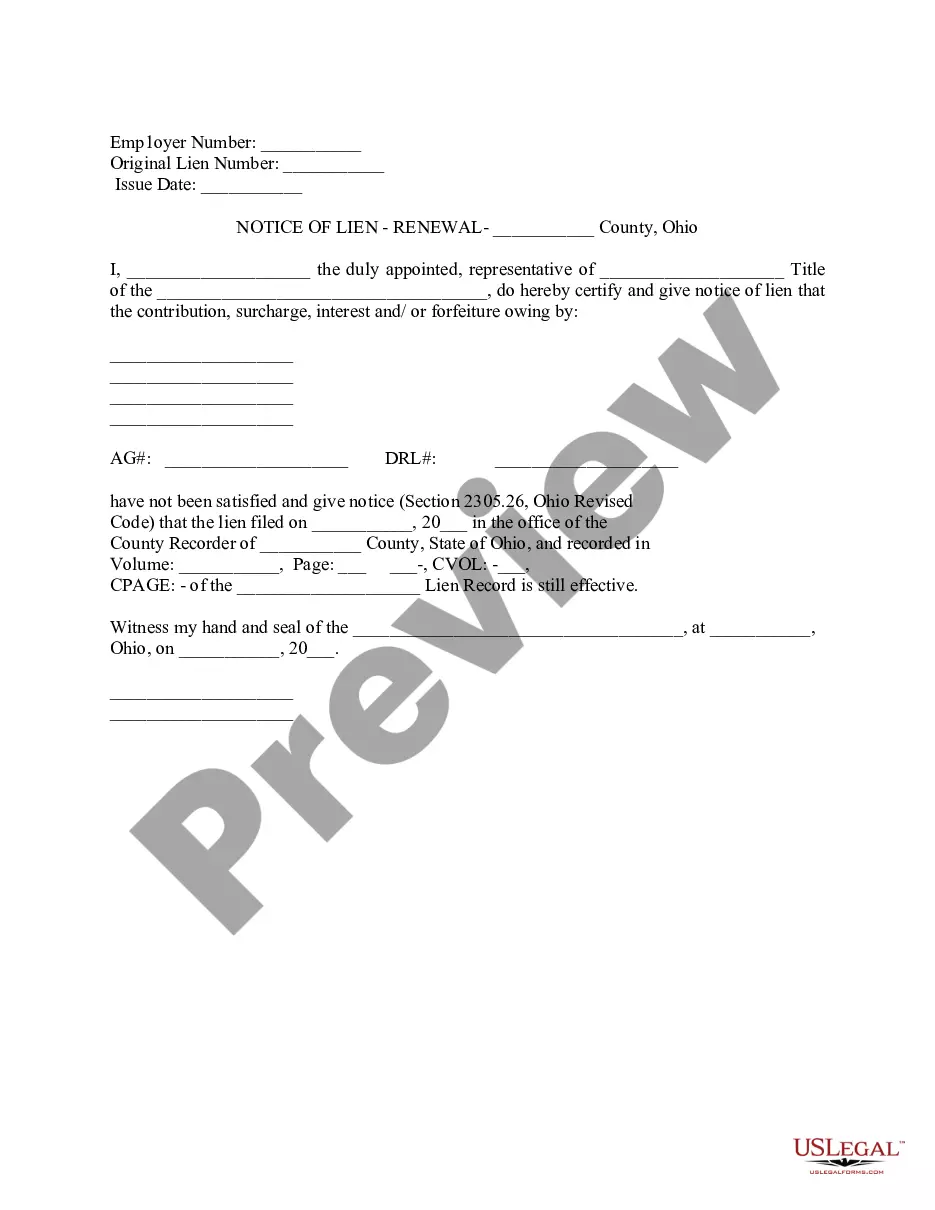

- Examine the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Michigan Business Registration - Co-Partnership (effective January 1, 2007). If not, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Michigan Business Registration - Co-Partnership (effective January 1, 2007) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

Any taxes due should be paid with Form 5460. Complete this form if the following applies: A partnership whose partners are subject to the tax on all or part of their distributive share of net profits must generally make payments of Estimated Income Tax.

For corporate income tax purposes, Michigan adopts the federal income tax treatment of a general partnership and its partners, as set out in IRC Sec. 701 through IRC Sec. 761. Partnerships are not required to pay the corporate income tax.

Any taxes due should be paid with Form 5460. Complete this form if the following applies: A partnership whose partners are subject to the tax on all or part of their distributive share of net profits must generally make payments of Estimated Income Tax.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Michigan income tax must be paid on income earned, received, or accrued while living in Michigan. Nonresidents: A person whose permanent home for the entire year was in another state is a nonresident. Michigan income tax must be paid on income earned from Michigan sources.

Steps to Create a Michigan General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Michigan state tax identification numbers.

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax.

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor.