Michigan Business Registration — Dissolution (effective January 1, 2007) is a process for legally ending a business entity’s existence in the state of Michigan. This process is required when a business entity is no longer operating, and it must be completed before the business can be dissolved. The dissolution process involves filing the appropriate forms and documents with the Michigan Department of Licensing and Regulatory Affairs (LARA). Depending on the type of business entity, different forms may be required. The two types of Michigan Business Registration — Dissolution (effective January 1, 2007) are as follows: 1. Administrative Dissolution: This type of dissolution is for corporations and limited liability companies that have failed to file the required annual report and/or pay the annual registration fee. 2. Voluntary Dissolution: This type of dissolution is initiated by the owners of the business entity. The owners must file the articles of dissolution with LARA and the other required documents. In both cases, the business entity must provide the necessary documentation to LARA, including a statement of intent, articles of dissolution, and any other documents required by the state. Once the dissolution is approved, the business is no longer legally recognized in the state of Michigan.

Michigan Business Registration - Dissolution (effective January 1, 2007)

Description

How to fill out Michigan Business Registration - Dissolution (effective January 1, 2007)?

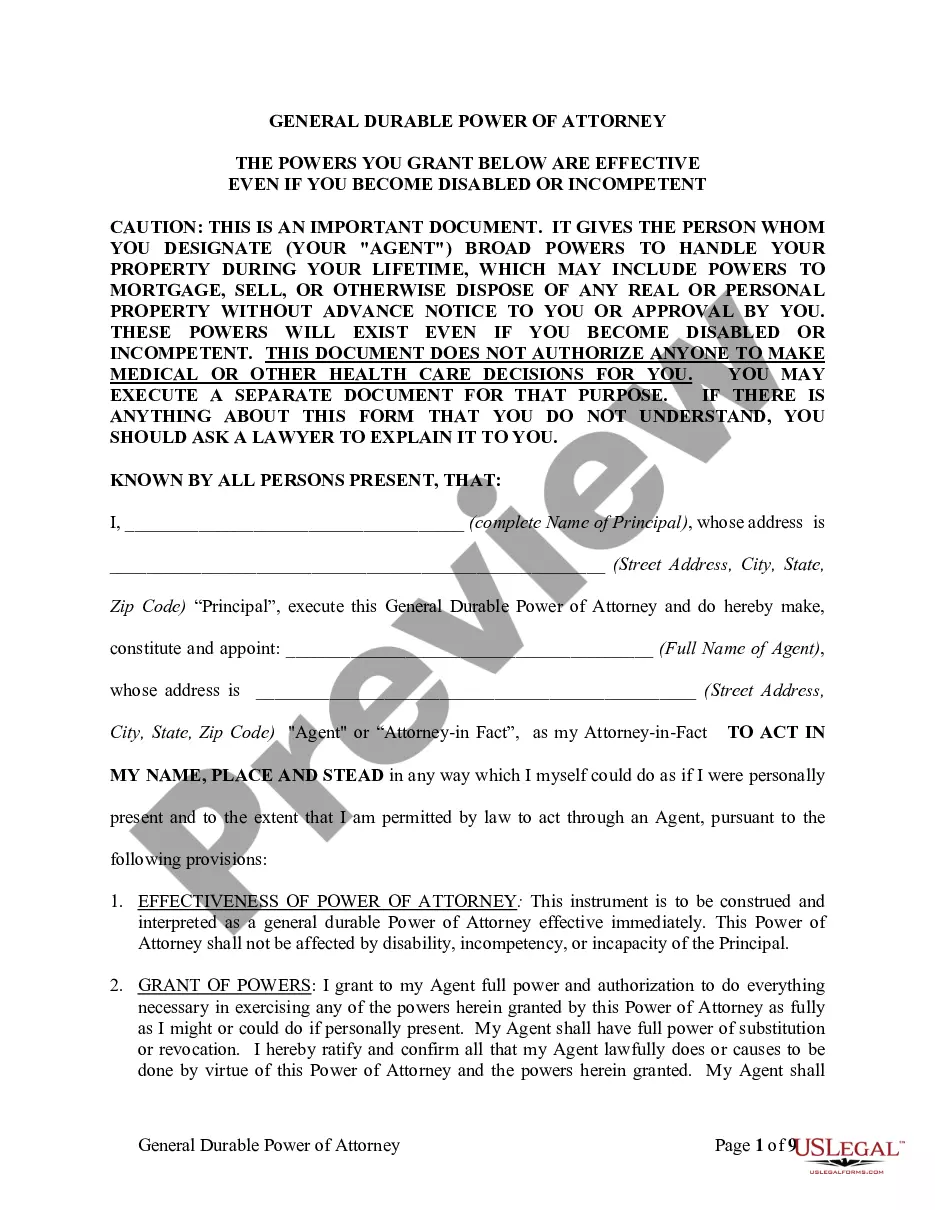

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are verified by our experts. So if you need to prepare Michigan Business Registration - Dissolution (effective January 1, 2007), our service is the perfect place to download it.

Obtaining your Michigan Business Registration - Dissolution (effective January 1, 2007) from our catalog is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Michigan Business Registration - Dissolution (effective January 1, 2007) and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Use this form only if you discontinued or made changes to your business. Complete all sections that apply. Changes provided on this form may also be completed electronically at mto.treasury.michigan.gov.

Look at the Adjusted Gross Income amount on your federal tax form. (Form 1040NR, Line 11.) If that amount is less than $5,000, you are not required to file a State of Michigan tax form. If you are required to file a State of Michigan tax form, you must file MI 1040 plus MI Schedule NR and Schedule 1.

For the 2022 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child in 2022.

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor.

You can use the business entity search managed by the Michigan Department of Licensing and Regulatory Affairs. Search by business name, ID number or an individual's name to find out if a business is registered in Michigan.

The personal exemption amount for 2023 is $5,400.

The dissolution of a corporation by action of the board or shareholders requires the filing of a Certificate of Dissolution. A tax clearance must be requested from the Michigan Department of Treasury within 60 days of the filing the dissolution.

How do you dissolve an Michigan Limited Liability Company? To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.