Michigan Instructions for Small Estates are documents used to transfer ownership of assets from a deceased individual to the rightful beneficiaries without having to go through the probate process. The documents are available in two types of instructions: Affidavit of Small Estate and Transfer Without Probate. The Affidavit of Small Estate is used when the deceased's estate is valued at $15,000 or less. It is a sworn statement by the beneficiary of the estate that all heirs have been notified and the assets of the deceased have been properly distributed. The affidavit must be notarized and filed with the Register of Deeds in the county where the deceased resided at the time of death. The Transfer Without Probate is used when the estate is valued at more than $15,000 and up to $80,000. It requires a certified copy of the death certificate and the form must be completed and signed by all heirs of the estate. The form must be filed with the Register of Deeds in the county where the deceased resided at the time of death. Both types of instructions provide a quick and easy way to transfer ownership of the deceased's assets without having to go through the lengthy and expensive probate process.

Michigan Instructions for Small Estates

Description

How to fill out Michigan Instructions For Small Estates?

US Legal Forms is the simplest and most economical method to locate appropriate formal templates.

It’s the largest internet-based collection of business and personal legal documents prepared and validated by attorneys.

Here, you can discover printable and fillable forms that adhere to national and local laws - just like your Michigan Instructions for Small Estates.

Review the form description or preview the document to ensure you have located the one that meets your needs, or search for another one using the search feature above.

Click Buy now when you’re confident of its compatibility with all requirements, and select the subscription plan that suits you best.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the file onto their device.

- Subsequently, they can access it in their profile under the My documents section.

- And here’s how to obtain a correctly drafted Michigan Instructions for Small Estates if you are using US Legal Forms for the first time.

Form popularity

FAQ

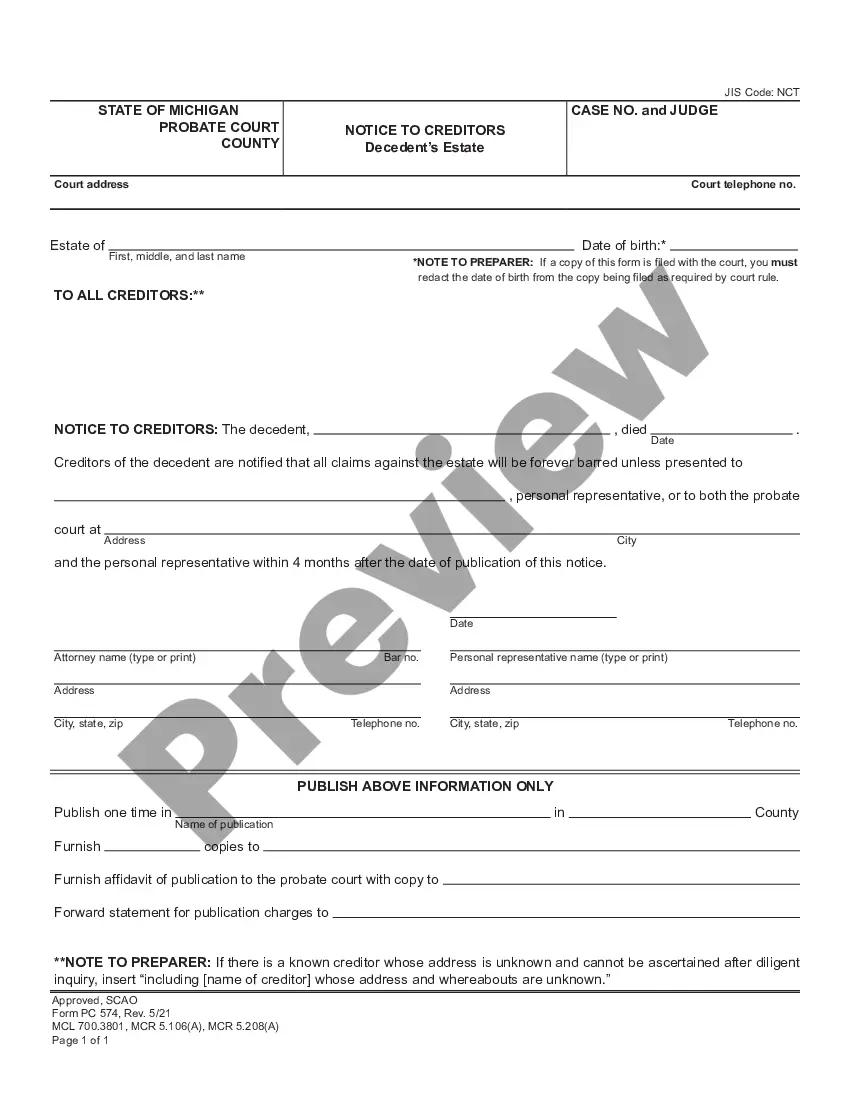

Settling an Estate in Michigan A petition to open probate is filed with the court.A notice is sent out to the heirs and creditors. The executor takes inventory of the assets and lists them.The next job of the executor is to file any tax returns, pay taxes owed, and pay any other debts.

How Do You Close A Decedent's Estate In Michigan? SWORN STATEMENT. PETITION FOR COMPLETE ESTATE SETTLEMENT WITH TESTACY PREVIOUSLY ADJUDICATED (MCL 700.3952) PETITION FOR ADJUDICATION OF TESTACY AND COMPLETE ESTATE SETTLEMENT (MCL 700.3953) CLOSING AN ESTATE THAT WAS REOPENED. AN ATTORNEY CAN HELP YOU CLOSE AN ESTATE.

A Michigan small estate affidavit is a document that allows a petitioner, known as an ?affiant,? to stake a claim on property from the estate of a deceased loved one, known as the ?decedent.? In Michigan, this process is available to estates that have a value of $15,000 ? as adjusted for cost of living (see below) ? or

If you are serving as the personal representative (executor) of someone's estate, you might be wondering how quickly after their death you must file probate. Unlike some states, Michigan does not have a required filing deadline for a probate case.

The dollar limit can change each year. If a person dies in 2023, an estate must be valued at $27,000 or less to be small. If a person died in 2022, an estate must be valued at $25,000 or less. If a person died in 2020 or 2021, an estate must be valued at $24,000 or less.

Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.