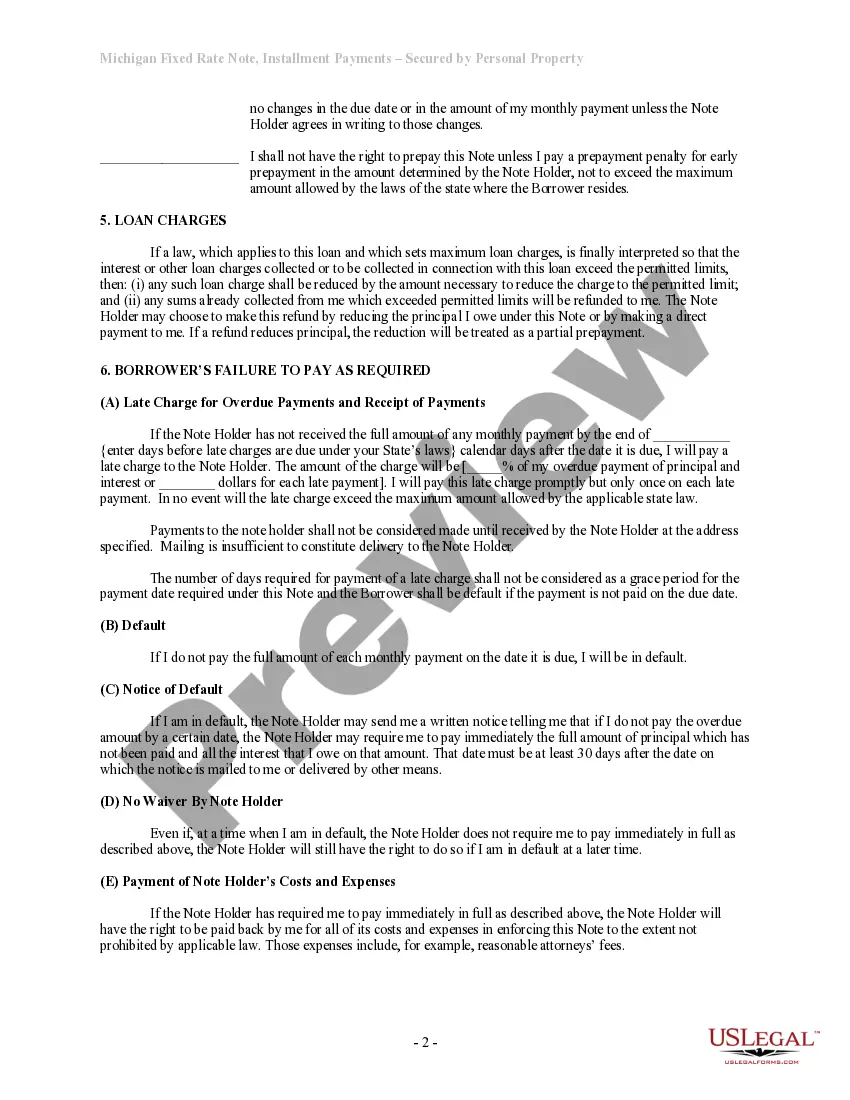

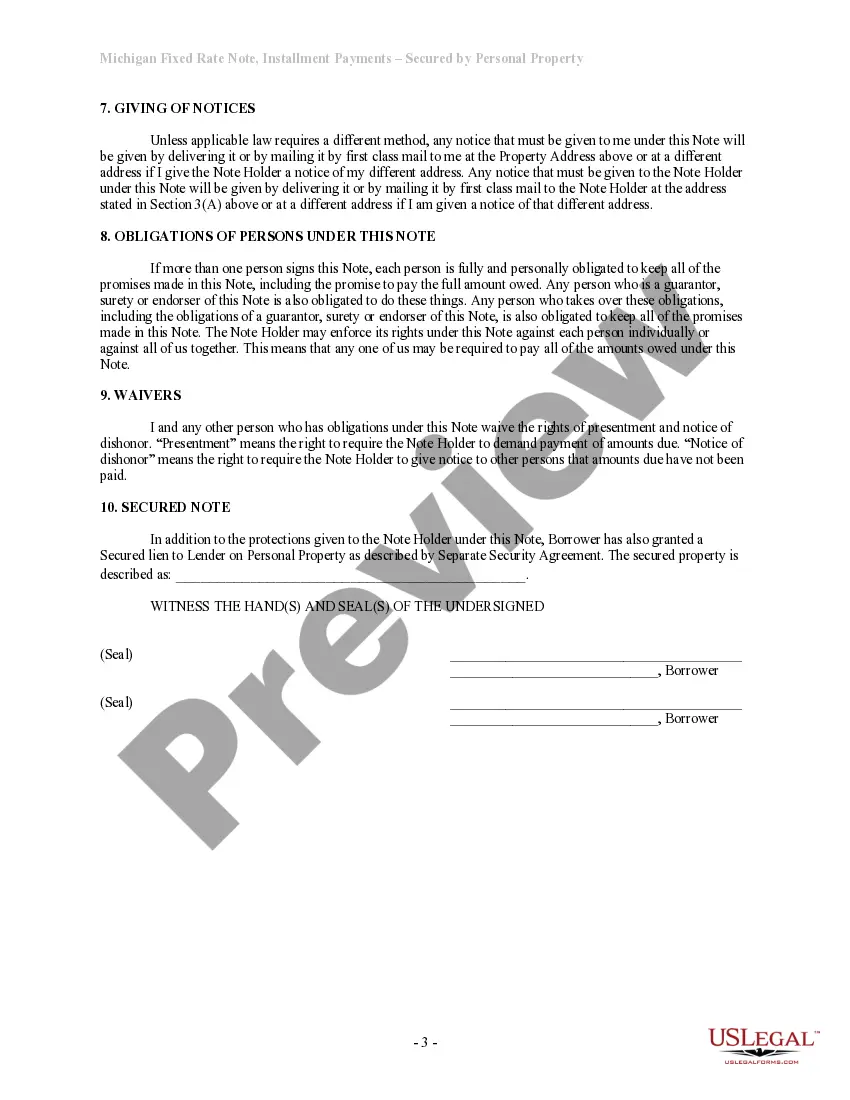

Michigan Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Personal Property?

Get any template from 85,000 legal documents including Michigan Installments Fixed Rate Promissory Note Secured by Personal Property on-line with US Legal Forms. Every template is drafted and updated by state-licensed attorneys.

If you already have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Installments Fixed Rate Promissory Note Secured by Personal Property you need to use.

- Read through description and preview the template.

- When you are confident the template is what you need, click on Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in one of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable sample. The service will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Michigan Installments Fixed Rate Promissory Note Secured by Personal Property easy and fast.

Form popularity

FAQ

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

After issuance, a Promissory Note must be stamped according to the regulations of the Indian Stamp Act.All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note or promissory letter is a legal instrument similar in nature to any common law contract.When all of these conditions are addressed in the promissory note details and it is signed by both parties, the promissory note meets all the elements of a legally binding contract.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.