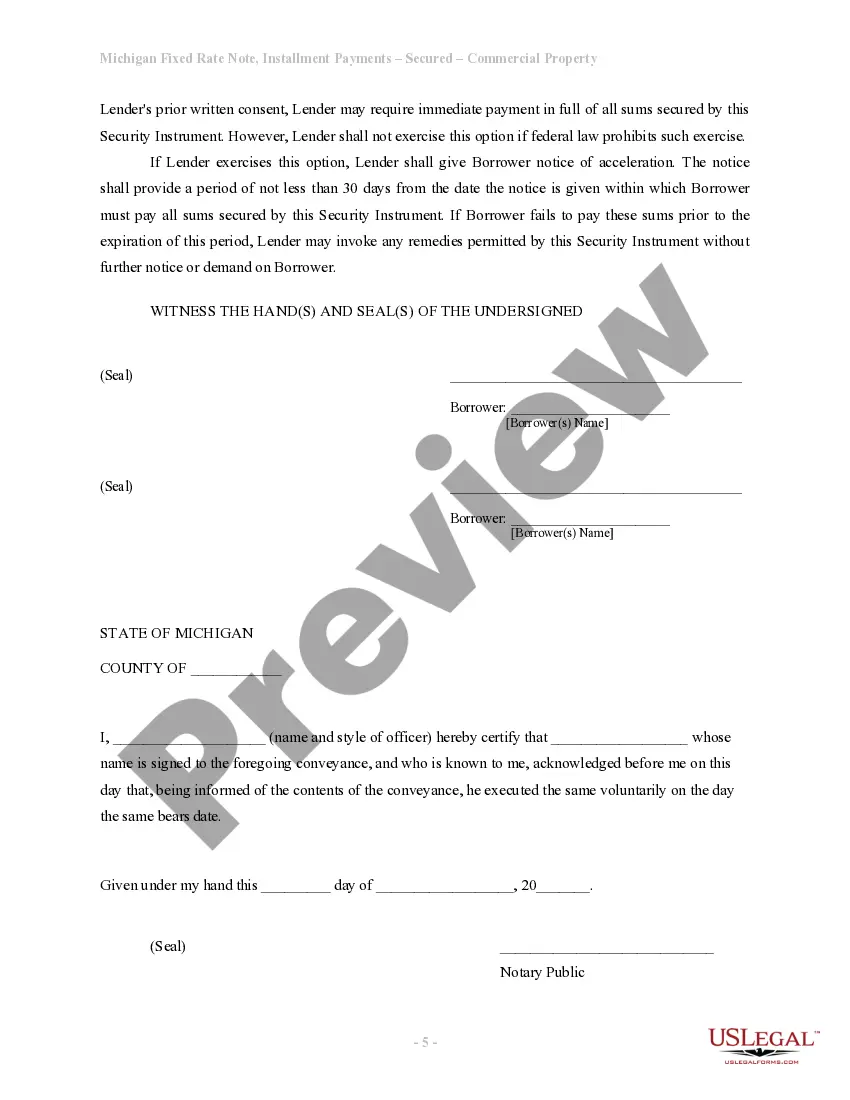

Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description Promissory Note Michigan

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Get any form from 85,000 legal documents such as Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate on-line with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you already have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate you want to use.

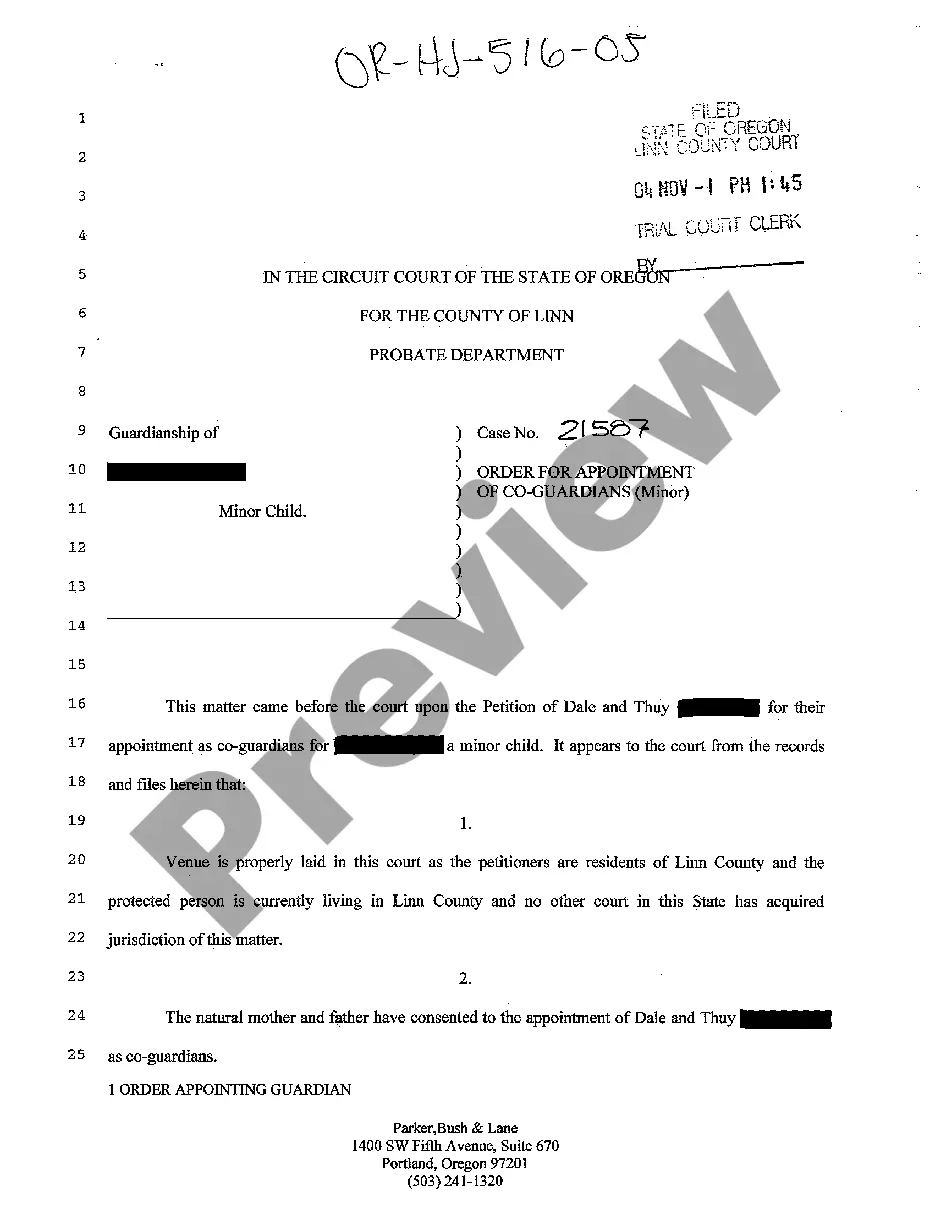

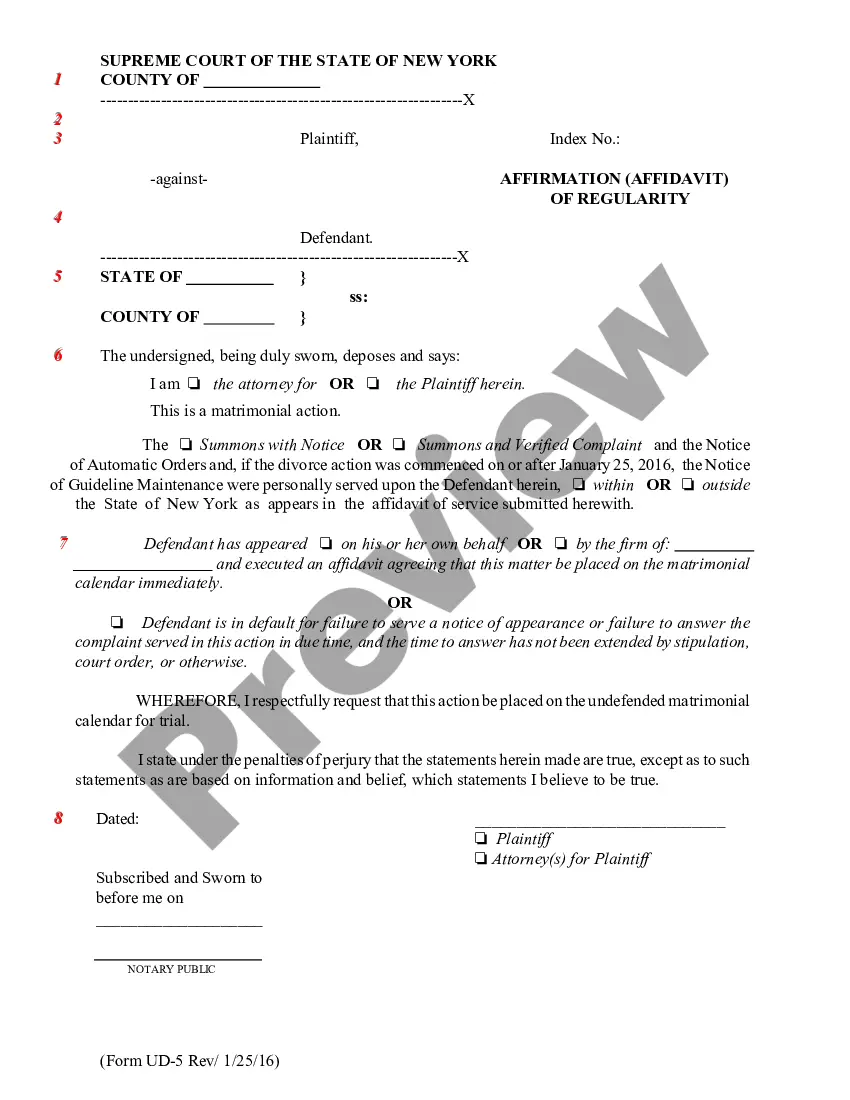

- Look through description and preview the sample.

- Once you’re confident the template is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by bank card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the proper downloadable sample. The platform gives you access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate easy and fast.

Form popularity

FAQ

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.

No. California promissory notes do not need to be notarized or witnessed for validity.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.