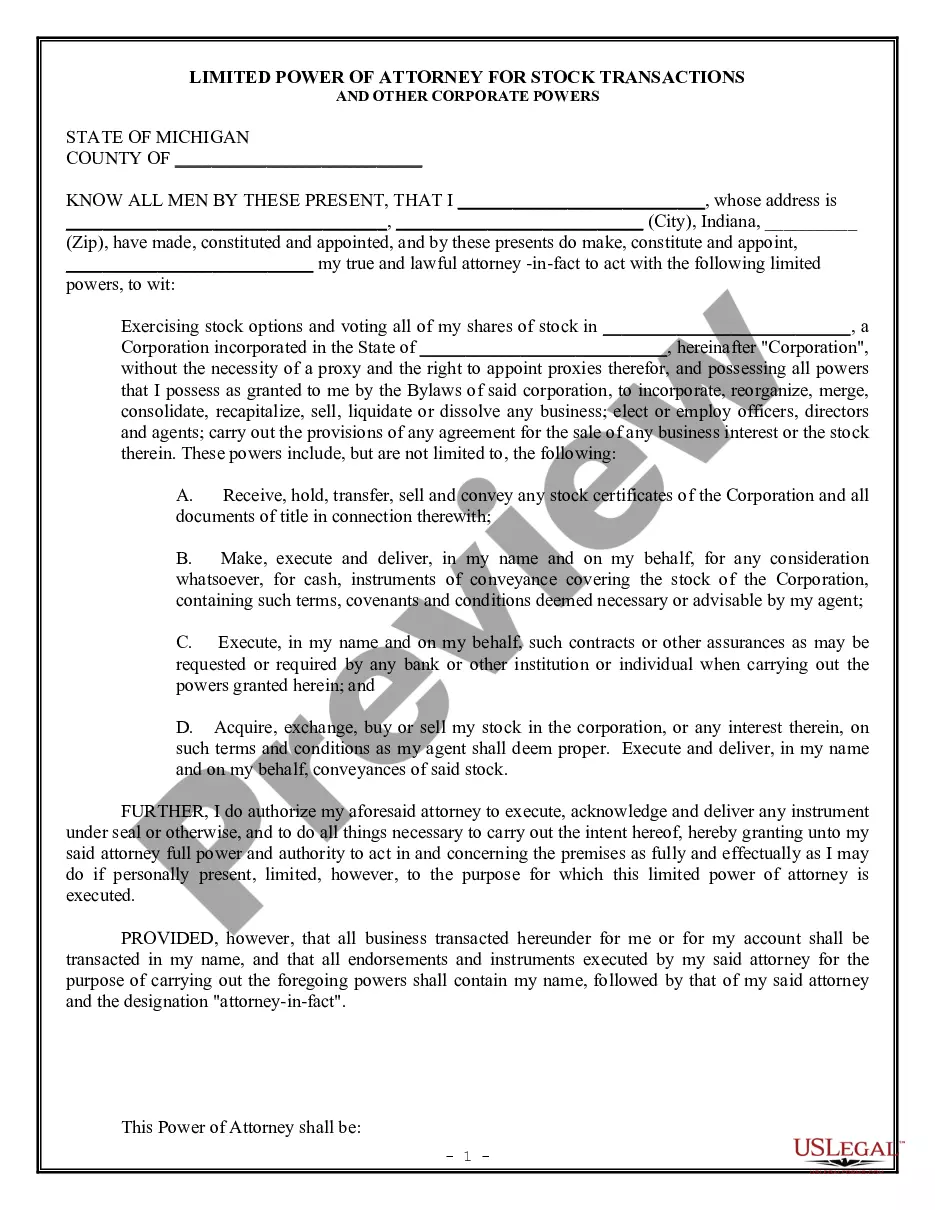

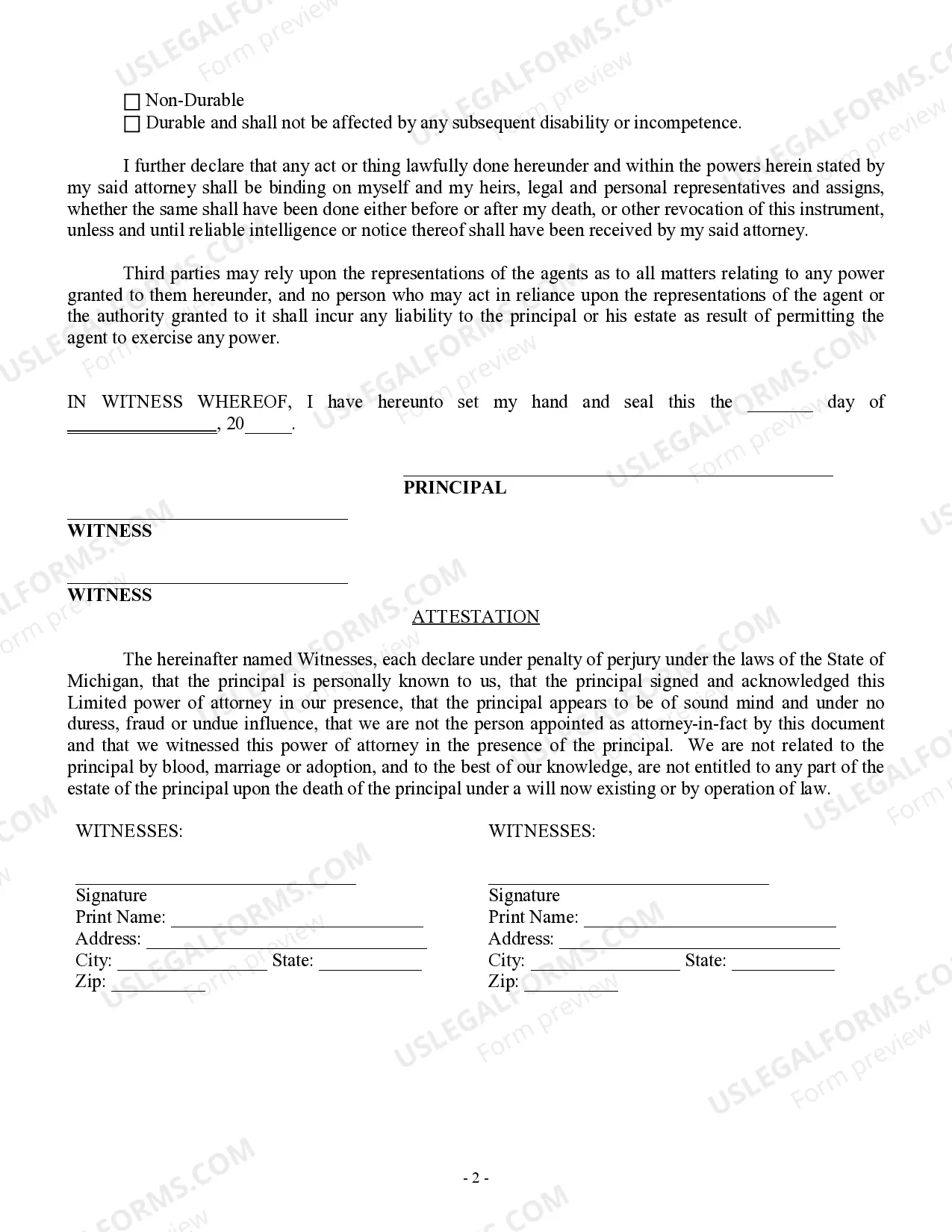

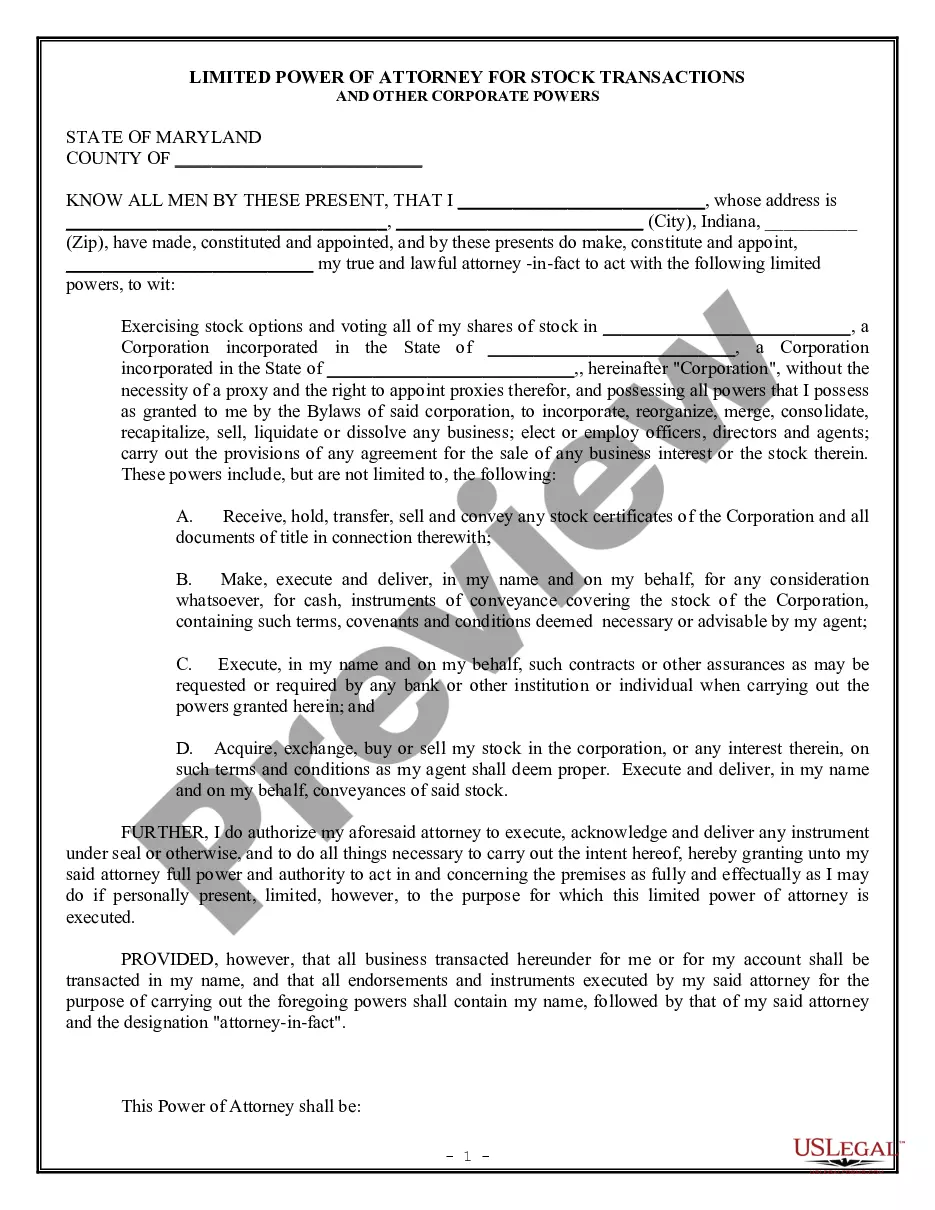

Michigan Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Michigan Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Have any form from 85,000 legal documents including Michigan Limited Power of Attorney for Stock Transactions and Corporate Powers on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Limited Power of Attorney for Stock Transactions and Corporate Powers you would like to use.

- Read description and preview the template.

- When you’re confident the sample is what you need, click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable sample. The platform provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Limited Power of Attorney for Stock Transactions and Corporate Powers easy and fast.

Form popularity

FAQ

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

Can the Power of Attorney be used by the agent to take my money or property without my permission? Unfortunately, you can run the risk that the agent you choose to give your Power of Attorney could abuse the power by spending your money or taking your money without your knowledge or worse without your permission.

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian. The power of attorney ends at death.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

The biggest limitation on a power of attorney is that it can only be signed when the principal is of sound mind.If the principal is unable to make decisions, the principal's family will need to go to court to become a court appointed guardian before they can make financial or medical decisions.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.