Michigan Sworn Closing Statement, Summary Proceeding, Small Estates

Description

How to fill out Michigan Sworn Closing Statement, Summary Proceeding, Small Estates?

Have any template from 85,000 legal documents such as Michigan Sworn Closing Statement, Summary Proceeding, Small Estates online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Sworn Closing Statement, Summary Proceeding, Small Estates you want to use.

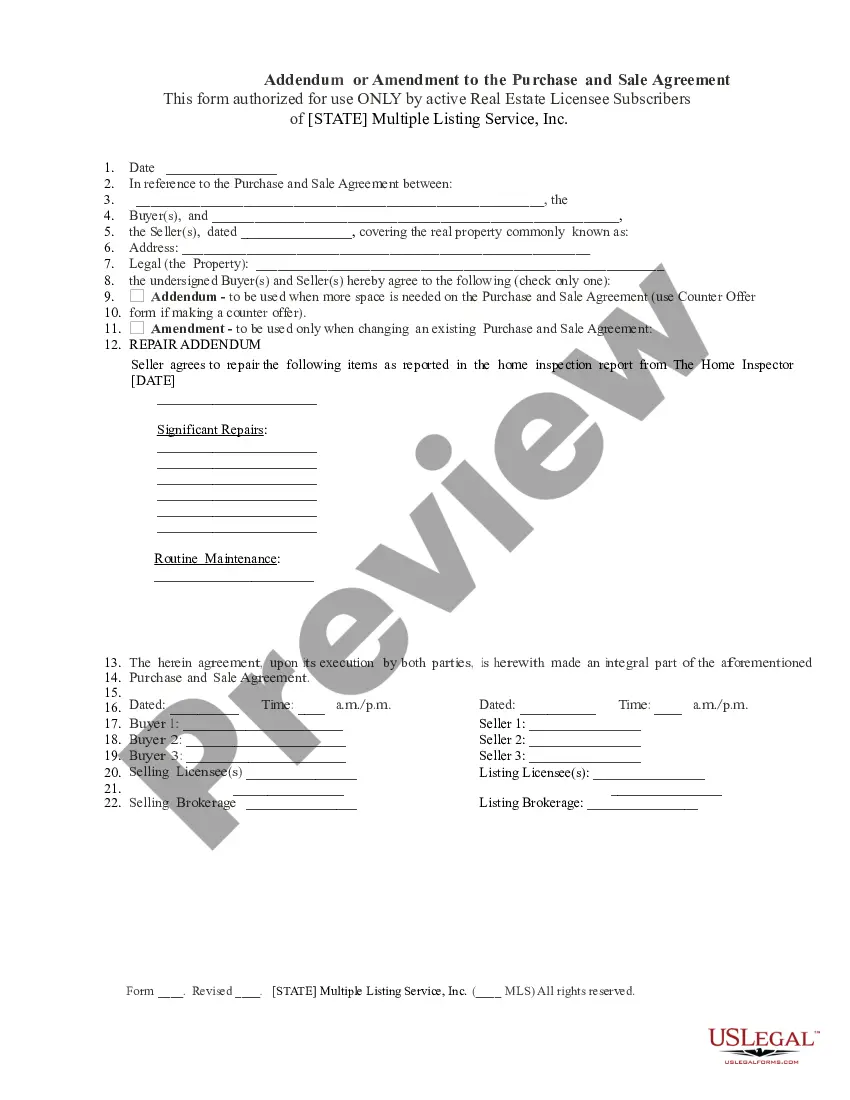

- Look through description and preview the sample.

- As soon as you are confident the template is what you need, click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by bank card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the appropriate downloadable sample. The platform will give you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Michigan Sworn Closing Statement, Summary Proceeding, Small Estates easy and fast.

Form popularity

FAQ

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

The difference between an unsupervised estate and a supervised estate is the involvement of the probate court.It needs to be filed with the court. It does not need to be in an unsupervised estate, but that inventory establishes the starting point for the supervised representative's accounts.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies in 2020, an estate must be valued at $24,000 or less to be small. If a person dies in 2019 or 2018, an estate must be valued at $23,000 or less.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

To close the estate you must file a specific document with the court that says you finished administering the estate and did what you were required to do as the personal representative. You may also need to get receipts from the estate beneficiaries and make a final accounting.