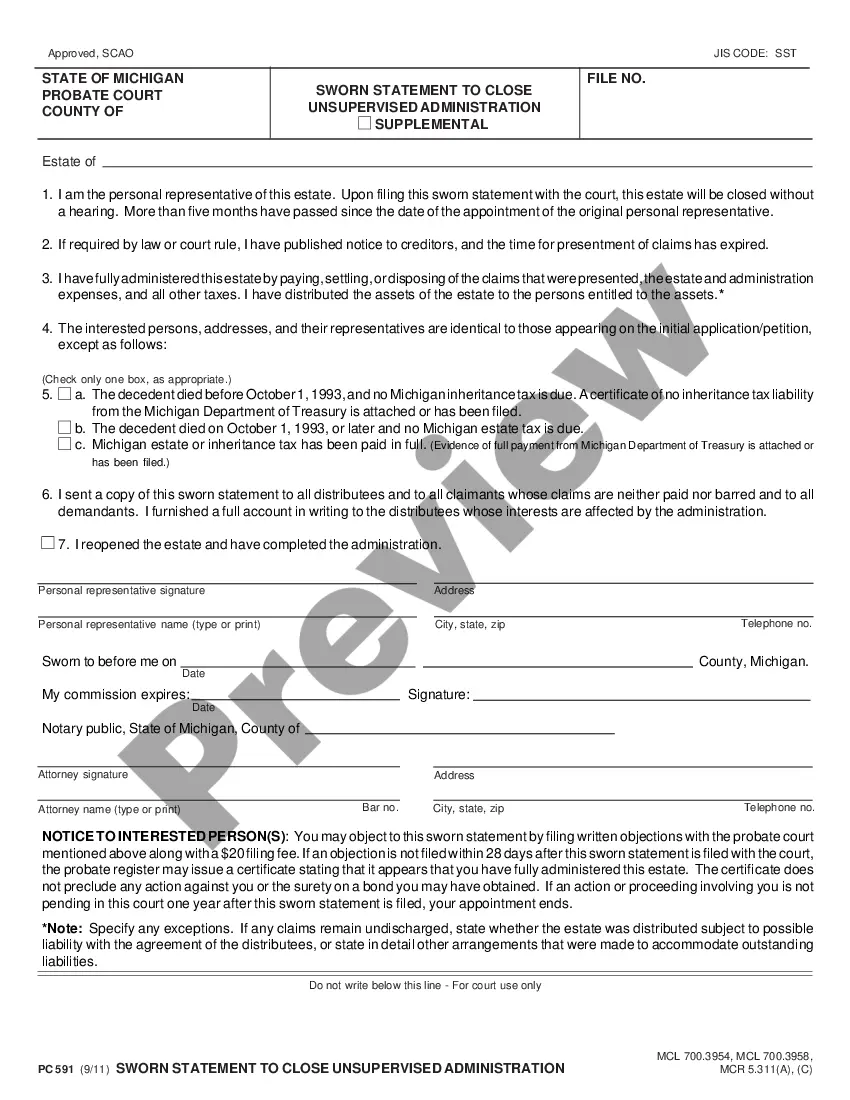

Michigan Sworn Statement to Close Unsupervised Administration is a legal document used to declare a deceased person's estate closed after all of their assets have been distributed without court oversight. This document is commonly used when an estate is unable to use the probate court process, such as when the deceased had a small estate or did not have a valid will in place. The Michigan Sworn Statement to Close Unsupervised Administration includes the name and address of the deceased, the date of death, the name of the personal representative responsible for managing the estate, the names of all heirs and beneficiaries of the estate, a list of all assets and property distributed, a statement of the estate's liabilities, and a certification of the sworn statement. There are two types of Michigan Sworn Statement to Close Unsupervised Administration: a Form 641 and a Form 642. Form 641 is used when the deceased left a valid will, and Form 642 is used when there is no valid will.

Michigan Sworn Statement to Close Unsupervised Administration

Description

How to fill out Michigan Sworn Statement To Close Unsupervised Administration?

Dealing with official documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Michigan Sworn Statement to Close Unsupervised Administration template from our service, you can be certain it complies with federal and state laws.

Dealing with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Michigan Sworn Statement to Close Unsupervised Administration within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Michigan Sworn Statement to Close Unsupervised Administration in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Michigan Sworn Statement to Close Unsupervised Administration you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

How Do You Close A Decedent's Estate In Michigan? SWORN STATEMENT. PETITION FOR COMPLETE ESTATE SETTLEMENT WITH TESTACY PREVIOUSLY ADJUDICATED (MCL 700.3952) PETITION FOR ADJUDICATION OF TESTACY AND COMPLETE ESTATE SETTLEMENT (MCL 700.3953) CLOSING AN ESTATE THAT WAS REOPENED. AN ATTORNEY CAN HELP YOU CLOSE AN ESTATE.

What must I do to close the estate? The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

What Are The Steps Required To Close An Estate Through Informal Probate In Michigan? Prepare the inventory and pay the inventory fees. Pay any creditors and taxes. Pay remaining bills. Distribute assets appropriately. If the estate is open for more than one year, file a Notice of Continued Administration.

Closing the Estate The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.

An estate in unsupervised administration can be closed by filing a ?Sworn Statement to Close Unsupervised Administration? (PC591), or a ?Petition for Adjudication of Testacy and Complete Estate Settlement? (PC594), or a ?Petition for Complete Estate Settlement, Testacy Previously Adjudicated? (PC593).

The length of time that it will take to complete the probate of an estate will depend on many factors. If the estate is valued under $25,000, the process can be completed fairly quickly. For unsupervised and supervised probates, the process of probating the estate will generally take at least seven months to complete.