Michigan Acknowledgment for a Personal Representative

Description Michigan Personal Representative Form

How to fill out Acknowledged Michigan Estate?

Have any template from 85,000 legal documents including Michigan Acknowledgment for a Personal Representative online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you already have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

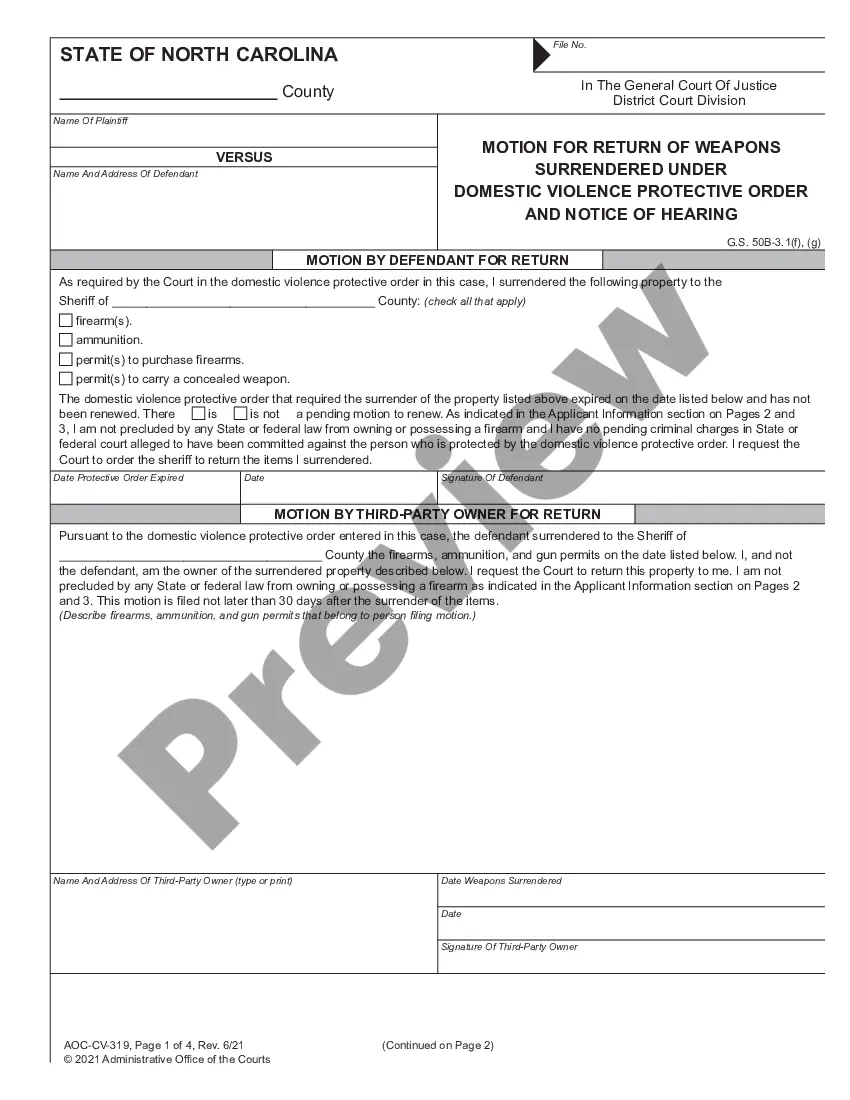

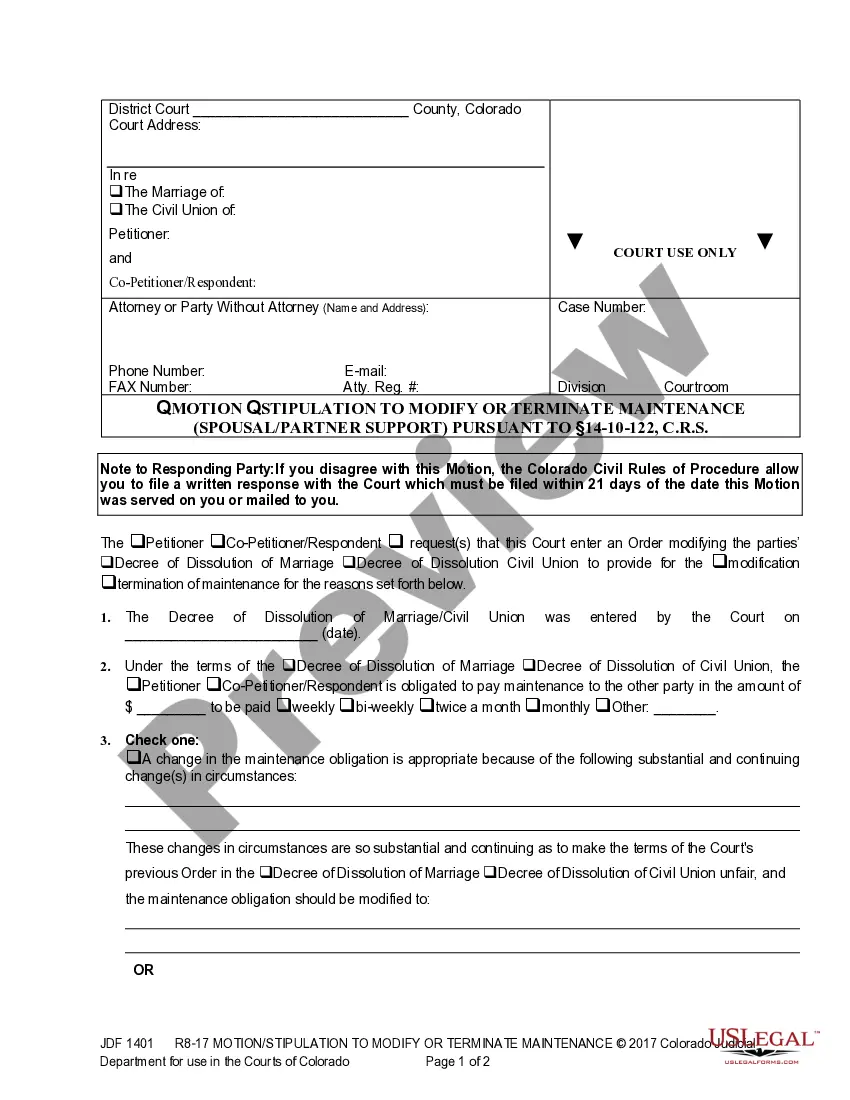

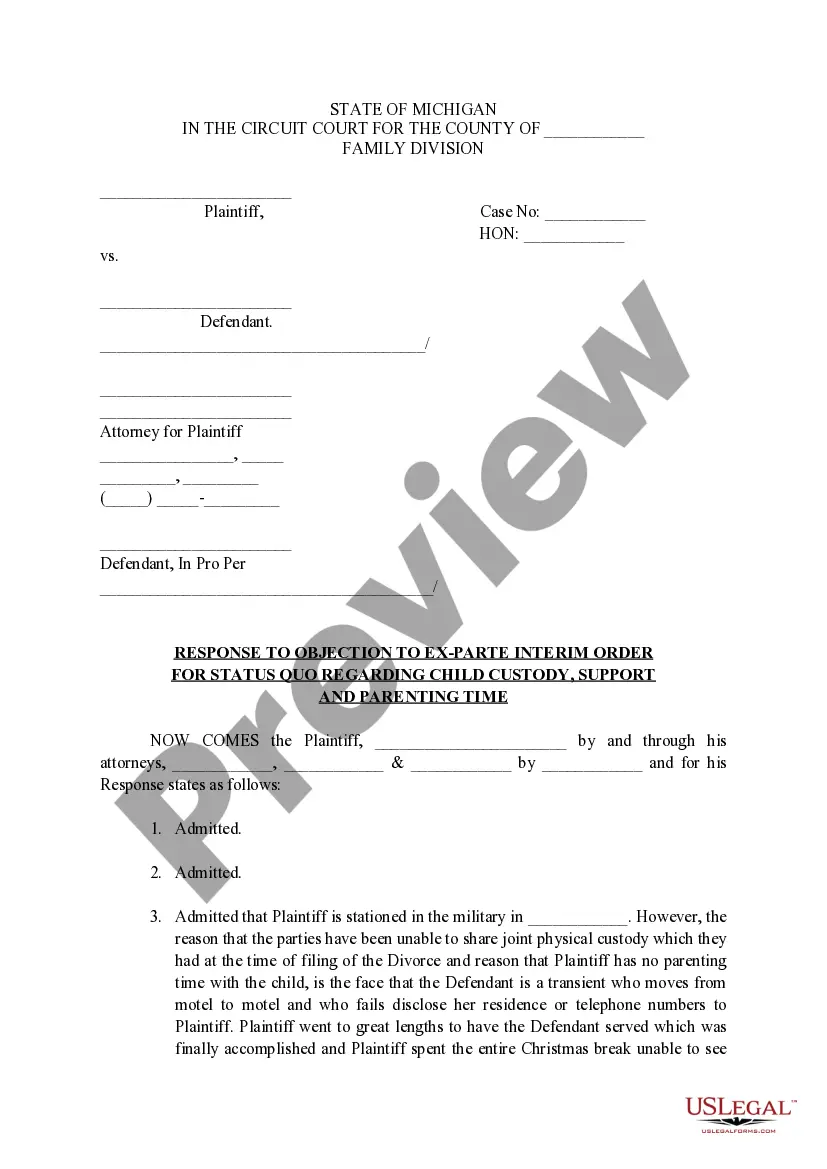

- Check the state-specific requirements for the Michigan Acknowledgment for a Personal Representative you would like to use.

- Look through description and preview the template.

- Once you’re sure the sample is what you need, click on Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable sample. The platform gives you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Acknowledgment for a Personal Representative fast and easy.

Michigan For Personal Form popularity

Michigan Representative Estate Other Form Names

Michigan Personal Representative Pdf FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A personal representative is the person, or it may be more than one person, who is legally entitled to administer the estate of the person who has died (referred to as 'the deceased'). The term 'personal representatives', sometimes abbreviated to PR, is used because it includes both executors and administrators.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

The primary difference between the Personal Representative (PR) and the person appointed under a power of attorney the attorney in fact (the POA) is that the PR is administering the estate after the person has passed away and the POA is caring for the person while they are incapacitated, but still living.