Michigan Refund of Fees, Other than Franchise Fees, is a program from the Michigan Department of Treasury that provides refunds to businesses that have paid certain taxes, fees, and assessments that are not related to the franchise tax. These include taxes and fees such as the Michigan Business Tax (MBT), the Michigan Retailers’ Occupation Tax (ROT), the Michigan Utility Tax, the Michigan Insurance Premium Tax, Michigan Liquor Taxes, and certain local taxes and assessments. The refund is based on the amount of the taxes or fees paid and is available to businesses that have paid the taxes or fees in the current or previous three tax years. There are four different types of Michigan Refund of Fees, Other than Franchise Fees, available: the Michigan Retailers’ Occupation Tax Refund, the Michigan Business Tax Refund, the Michigan Utility Tax Refund, and the Michigan Insurance Premium Tax Refund.

Michigan Refund of Fees, Other than Franchise Fees

Description

How to fill out Michigan Refund Of Fees, Other Than Franchise Fees?

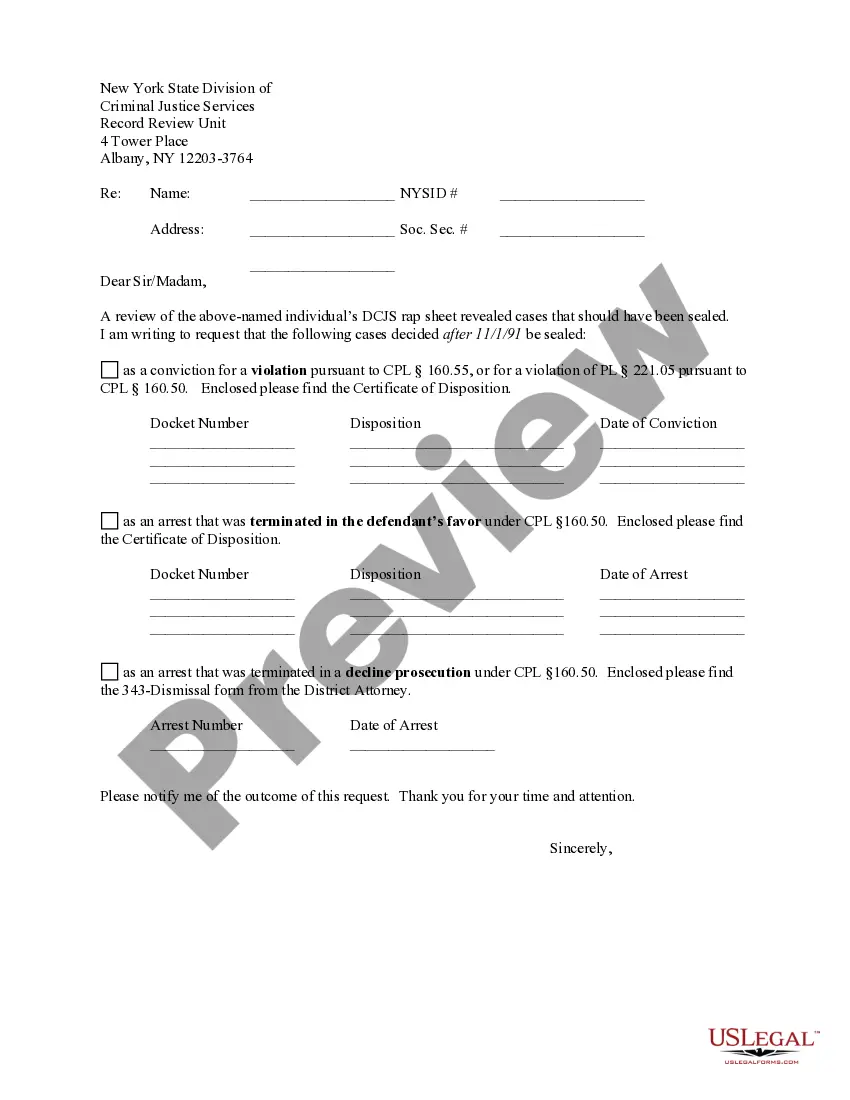

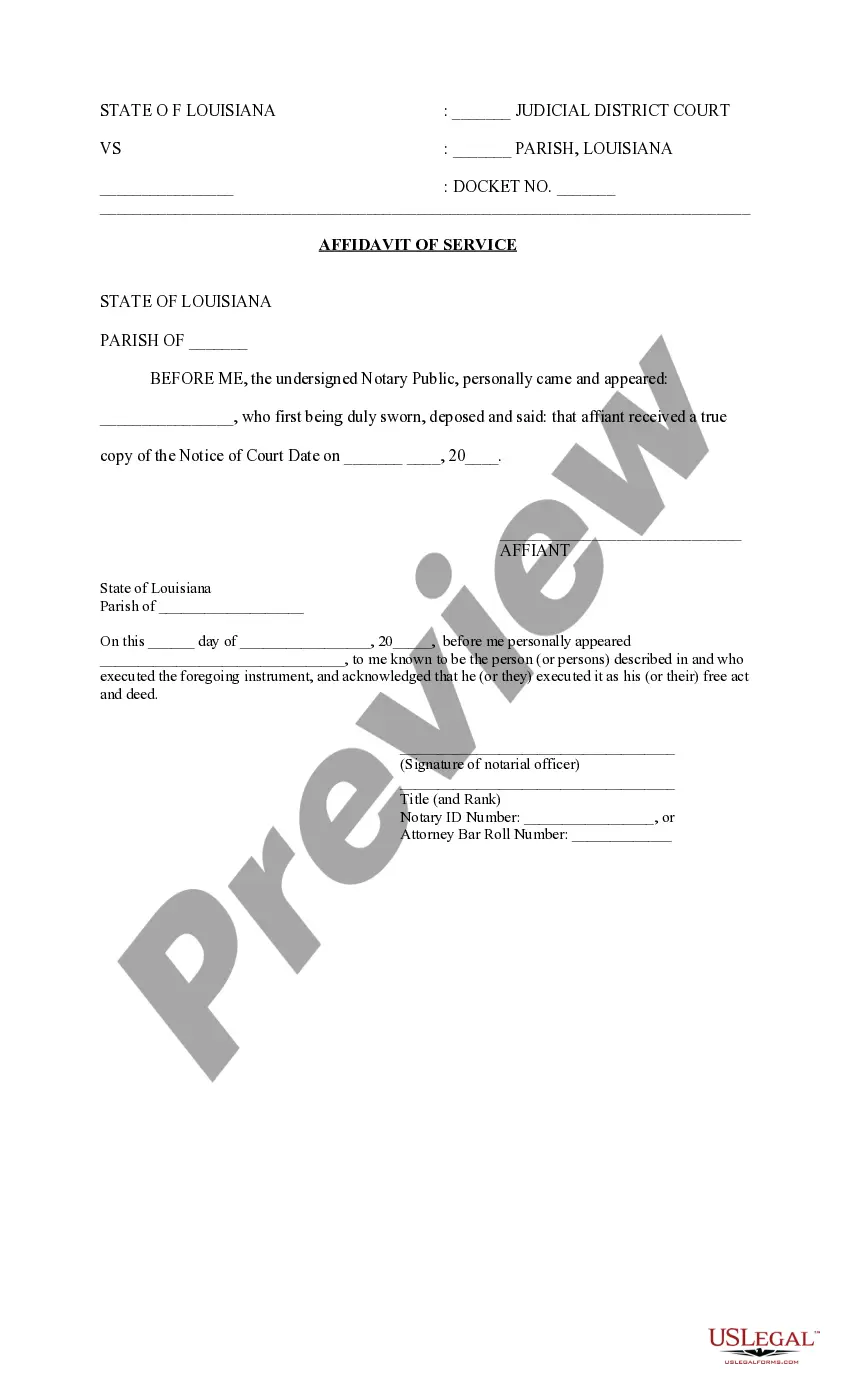

Working with legal documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Michigan Refund of Fees, Other than Franchise Fees template from our service, you can be sure it complies with federal and state regulations.

Working with our service is simple and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Michigan Refund of Fees, Other than Franchise Fees within minutes:

- Make sure to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Michigan Refund of Fees, Other than Franchise Fees in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Michigan Refund of Fees, Other than Franchise Fees you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Registration plates, or tabs issued for 1978 and thereafter shall be returned by the owner within 30 days following the date of transfer or assignment.

To check the status of your Michigan state refund online, visit Michigan.gov. You may also call 1-517-636-4486. For e-filed returns: Allow two weeks from the date you received confirmation that your e-filed state return was accepted before checking for information.

The customer must provide the following information on Form 5633: identifying information of the purchaser and seller; the purchase for which a refund of tax is claimed; and. a statement signed by the seller indicating that the seller paid tax on the original transaction and will not seek a refund of that tax.

Michigan Corporate Income Tax (CIT) The CIT imposes a 6% corporate income tax on C corporations and taxpayers taxed as corporations federally. The CIT has one credit, the small business alternative credit, which offers an alternate tax rate of 1.8% of adjusted business income.

When you transfer or assign a title of a registered vehicle before placing the new license plate or tab on it, you may apply for a refund. Return your registration and unused plate or tab within 30 days from the date of transfer or title assignment.

12/ $30 for 4,000 pounds or less to $129.50 for 2/3 of regular registration fee for 129.00 86.00 - 2,000 pounds or less; $29 for 2,001 to 48,001 pounds and over.

?A refund of fees paid for annual, quarterly or consecutive monthly registration is only possible if requested before the beginning of the registration period.

Complete this form if your partnership conducted business activities in the City of Detroit, whether or not an office or place of business was maintained in the city. Complete this form if you are claiming a Renaissance Zone Deduction on your Form 5458.