The Michigan Contract for the International Sale of Goods with Purchase Money Security Interest is a legally binding agreement that governs the sale of goods between parties located in different countries when a security interest is granted by the buyer to the seller. This contract is specifically designed to incorporate the United Nations Convention on Contracts for the International Sale of Goods (CSG) and Michigan state laws. When drafting a Michigan Contract for the International Sale of Goods with Purchase Money Security Interest, it is essential to include relevant keywords such as: 1. International Sale of Goods: This keyword highlights the global nature of the transaction, indicating that the contract applies when goods are being sold between parties residing in different countries. 2. Purchase Money Security Interest: This keyword signifies the security interest or lien that is granted by the buyer to the seller in exchange for financing provided by the seller. It ensures that the seller has a legal claim to the goods in case the buyer defaults on payment. 3. United Nations Convention on Contracts for the International Sale of Goods (CSG): The CSG is an international treaty that establishes uniform rules for the formation of contracts and the rights and obligations of the buyer and seller in international sales transactions. Including this keyword emphasizes the use of these uniform rules within the Michigan contract. Different variations of the Michigan Contract for the International Sale of Goods with Purchase Money Security Interest may include: 1. Conditional Sales Contract with Purchase Money Security Interest: This type of contract outlines a conditional sales agreement where the transfer of ownership is contingent upon the buyer fulfilling specific conditions, such as making full payment within a specified time frame. 2. Chattel Mortgage Agreement: This type of contract involves the buyer granting a security interest in personal property (chattel) to the seller to secure the payment of the purchase price. It establishes the seller's ability to repossess the goods in case of default. 3. Consignment Agreement with Purchase Money Security Interest: This contractual arrangement allows a seller to consign goods to a buyer for sale while retaining ownership until the goods are sold. The agreement includes a purchase money security interest to ensure the seller's rights if the buyer fails to pay for the goods. In conclusion, the Michigan Contract for the International Sale of Goods with Purchase Money Security Interest is a comprehensive legal agreement used in cross-border transactions to ensure the enforceability of contracts, uniformity of international sales rules, and protection of the seller's interests through a security interest. It is crucial to tailor the contract to meet the specific requirements of the parties involved and the type of goods being sold.

Michigan Contract for the International Sale of Goods with Purchase Money Security Interest

Description

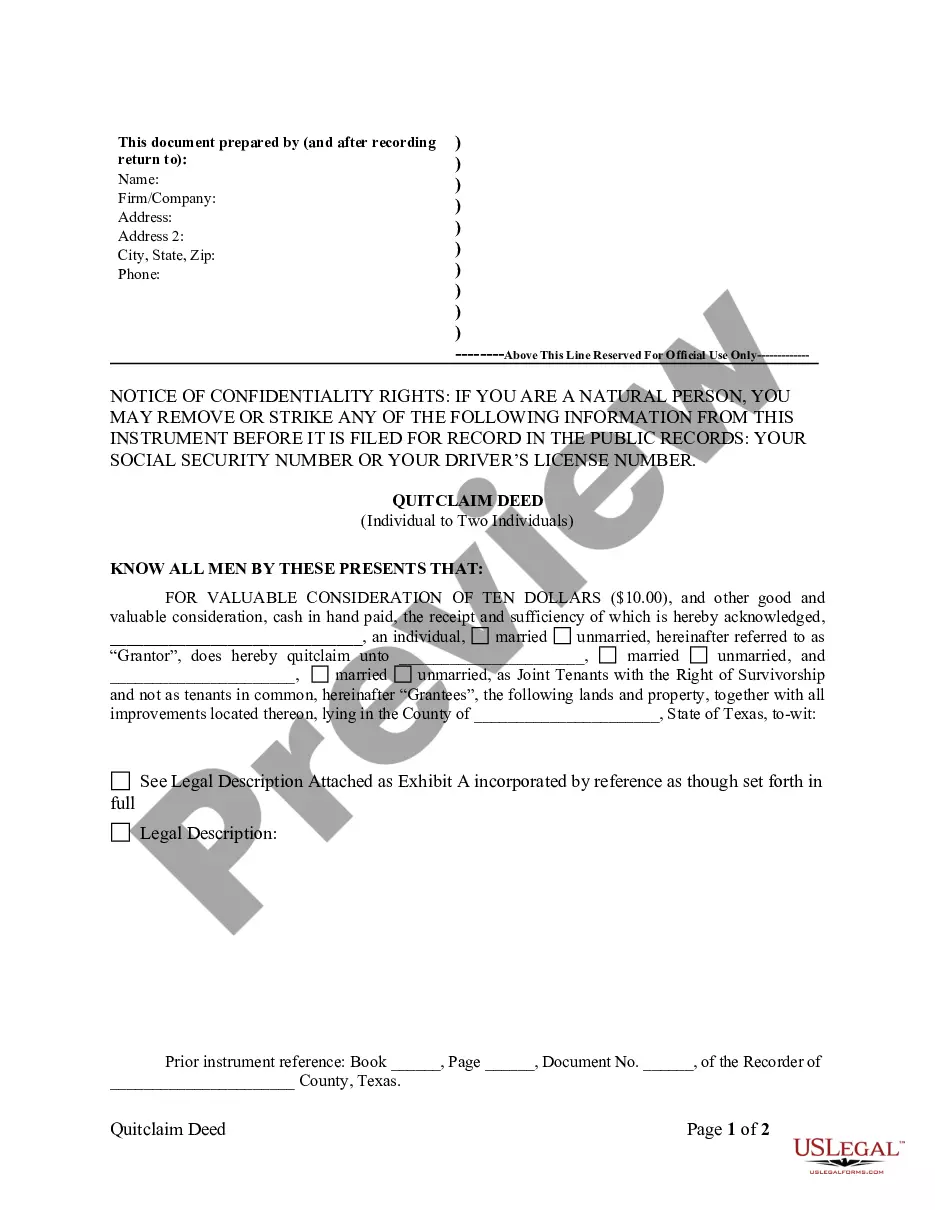

How to fill out Michigan Contract For The International Sale Of Goods With Purchase Money Security Interest?

Finding the right authorized record template can be a have a problem. Of course, there are a variety of templates accessible on the Internet, but how do you find the authorized form you want? Take advantage of the US Legal Forms website. The service delivers a huge number of templates, including the Michigan Contract for the International Sale of Goods with Purchase Money Security Interest, that can be used for company and private needs. Every one of the forms are checked out by experts and meet up with federal and state specifications.

If you are previously signed up, log in in your profile and click on the Acquire button to obtain the Michigan Contract for the International Sale of Goods with Purchase Money Security Interest. Make use of your profile to search from the authorized forms you possess acquired earlier. Check out the My Forms tab of your respective profile and have one more duplicate of the record you want.

If you are a fresh end user of US Legal Forms, here are basic recommendations that you should adhere to:

- Initially, be sure you have chosen the right form for your personal town/state. It is possible to look over the shape utilizing the Review button and read the shape explanation to guarantee it is the right one for you.

- If the form is not going to meet up with your preferences, take advantage of the Seach discipline to obtain the correct form.

- Once you are sure that the shape is acceptable, click on the Buy now button to obtain the form.

- Opt for the pricing strategy you need and type in the needed information and facts. Design your profile and buy an order utilizing your PayPal profile or charge card.

- Select the submit formatting and acquire the authorized record template in your gadget.

- Full, edit and print and signal the attained Michigan Contract for the International Sale of Goods with Purchase Money Security Interest.

US Legal Forms will be the greatest library of authorized forms that you can see different record templates. Take advantage of the service to acquire skillfully-created paperwork that adhere to status specifications.

Form popularity

FAQ

These elements include: All parties considered competent enough to enter into a contract. Appropriate subject matter. Consideration ? whether the contract is mutually beneficial. Mutuality of agreement between parties. Mutuality of obligation between parties.

How Can I Prove That Someone Breached a Contract? A Valid Contract Must Exist. ... The Plaintiff Fulfilled Their Legal Obligation. ... The Defendant Didn't Fulfill Their Legal Obligation. ... The Plaintiff Incurred Damages Due to the Breach.

AN ACT to enact the uniform commercial code, relating to certain commercial transactions in or regarding personal property and contracts and other documents concerning them, including sales, commercial paper, bank deposits and collections, letters of credit, bulk transfers, warehouse receipts, bills of lading, other ...

A contract is only legally binding if it is mutually beneficial to both parties involved. This is commonly referred to as consideration. When a party promises to do something without getting something in return, the deal will usually be unenforceable in court.

AN ACT to create a commission relative to labor disputes, and to prescribe its powers and duties; to provide for the mediation and arbitration of labor disputes, and the holding of elections thereon; to regulate the conduct of parties to labor disputes and to require the parties to follow certain procedures; to ...

Lesson Summary. A contract is a legal agreement between two or more parties in which they agree to each other's rights and responsibilities. Offer, acceptance, awareness, consideration, and capacity are the five elements of an enforceable contract.

AN ACT to promote the health, safety and welfare of the people by regulating the maintenance, alteration, health, safety, and improvement of dwellings; to define the classes of dwellings affected by the act, and to establish administrative requirements; to prescribe procedures for the maintenance, improvement, or ...

Public Acts. Bills that have been approved by the Legislature and signed into law by the Governor, filed with the Secretary of State, and assigned a Public Act number.

AN ACT to provide for the election of inspectors of mines in certain cases and the appointment of their deputies, for the appointment of such inspectors of mines and their deputies until the election and qualification of the first inspectors of mines, to prescribe their powers and duties and to provide for their ...

Article 9 of the Uniform Commercial Code requires a financing statement to include the name of the debtor. It is important to set forth the exact legal name of the debtor in any filings that are made.