Michigan Demand Bond

Description

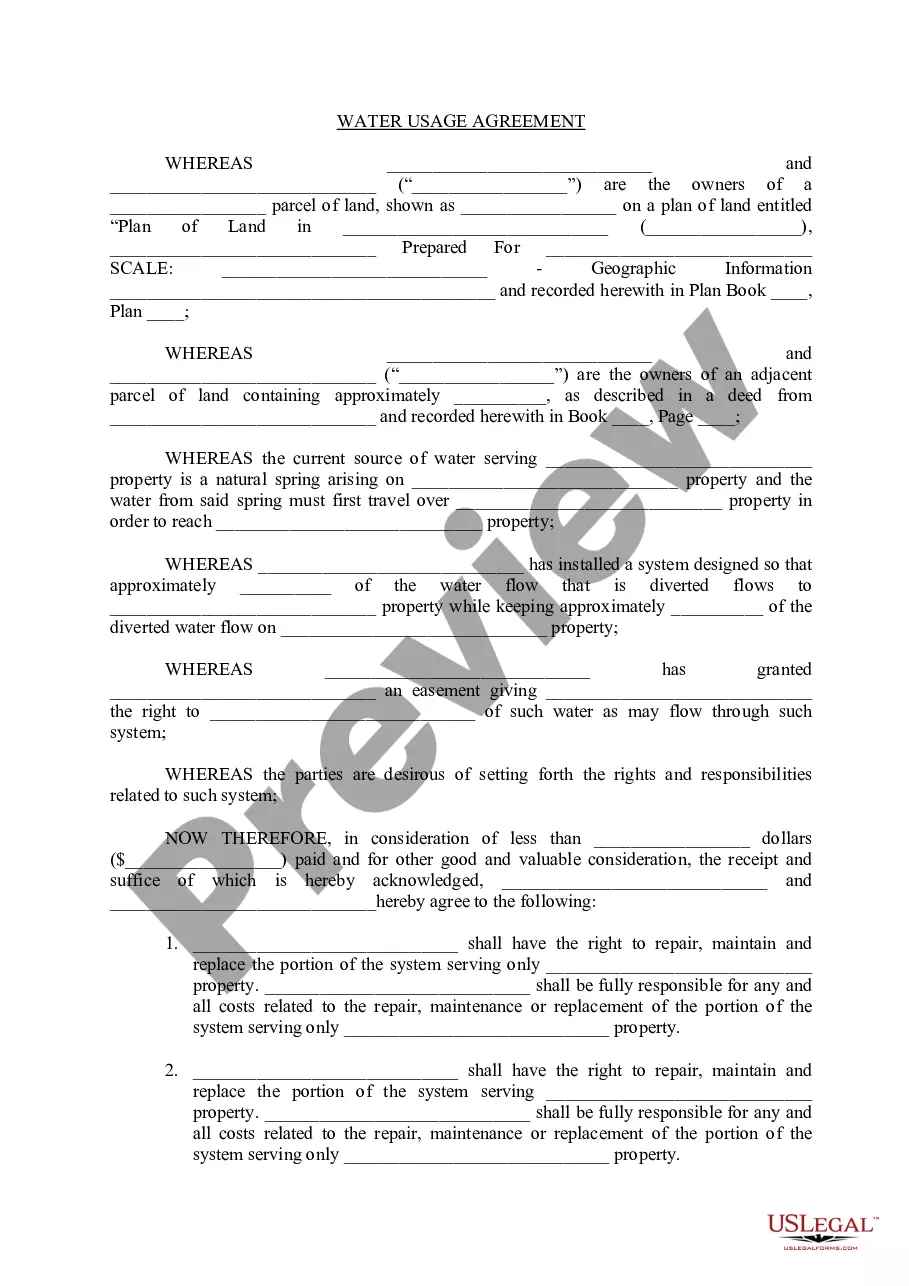

How to fill out Demand Bond?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Michigan Demand Bond in moments. If you already have a membership, Log In and download the Michigan Demand Bond from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab in your account.

If you want to use US Legal Forms for the first time, here are simple steps to get you started: Make sure you have selected the right form for your area/region. Click the Preview button to examine the content of the form. Review the form description to ensure that you have chosen the correct form. If the form does not meet your criteria, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for an account. Process the payment. Use a Visa or Mastercard or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Michigan Demand Bond. Each template added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the form you need.

- Access the Michigan Demand Bond with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Bond conditions in Michigan can vary based on the type of bond and the individual circumstances of the case. Generally, these conditions may include restrictions on travel, regular check-ins with a probation officer, or maintaining employment. Understanding the specific terms of your Michigan Demand Bond is essential, as violating these conditions can lead to serious consequences. For assistance in navigating these terms, consider utilizing the resources available on the US Legal Forms platform.

Yes, you can leave the state of Michigan on a bond, but it depends on the terms set by the court. Typically, a Michigan Demand Bond may have specific conditions that limit travel outside the state. It is crucial to check with your attorney or the court to understand these conditions. Staying informed will help you avoid any legal issues while traveling.

The difficulty of obtaining a surety bond can vary based on your financial history and the type of bond you need. Generally, if you have a strong credit score and a solid business record, securing a Michigan Demand Bond may be straightforward. If your financial background raises concerns, you might face additional scrutiny. Working with a reliable platform like USLegalForms can simplify the process and guide you through the requirements.

To obtain a surety bond in Michigan, start by assessing your specific bonding needs. Then, gather the required documentation, which typically includes your personal and business information, financial statements, and any relevant licenses. Next, reach out to a licensed surety bond provider, like USLegalForms, to get a quote. After reviewing the terms, finalize the agreement to secure your Michigan Demand Bond.

Licensed contractors who need a Michigan contractor license bond may start the process by filling out a short online quote form with the surety company. After providing information about the bond type and amount, and a review of credit, pricing for the bond is provided, and payment can be made.

How is Bond Determined in Michigan? A defendant's prior criminal record, including juvenile offenses. ... A defendant's record of appearance or nonappearance at court proceedings or flight to avoid prosecution. ... A defendant's history of substance abuse or addiction.

The court in fixing the amount of the bail shall consider and make findings on the record as to each of the following: (a) The seriousness of the offense charged. (b) The protection of the public. (c) The previous criminal record and the dangerousness of the person accused.

Bond: Also known as a Personal Recognizance bond, this bond allows the inmate to be released by signing their name, thereby assuring the courts that they will appear at their next schedule court date. P.R. bonds are still assigned a cash value, but no cash is required.

You must promise not to commit any further criminal offenses while released on bond. You may be required to have no contact with certain individuals, such as victims or witnesses. The judge may impose travel limitations on you, such as requiring you to stay within a certain jurisdiction.

Under Michigan rules, the bail bond company cannot charge more than a 10% non-refundable fee to put up the bail for the client. For example, if the bail is set at $10,000, then the bail bond company can charge the client $1,000 which is non-refundable.