Michigan Earnest Money Promissory Note

Description

How to fill out Earnest Money Promissory Note?

Locating the appropriate legitimate documents template can be a challenge.

Naturally, there are numerous designs accessible online, but how do you identify the exact type you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, including the Michigan Earnest Money Promissory Note, suitable for both commercial and personal needs.

You can review the document with the Preview button and read the document details to confirm it is the correct one for you.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Michigan Earnest Money Promissory Note.

- You can use your account to view the legitimate documents that you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/area.

Form popularity

FAQ

Yes, a promissory note is legal in Michigan even if it is not notarized. The agreement still holds legal weight as long as it contains all the essential elements needed for validity. However, notarization can offer additional assurance and may simplify enforcement in case of a disagreement. For further guidance, uslegalforms provides accessible templates that clarify legal requirements.

A promissory note is a written agreement between one party (you, the borrower) to pay back a loan given by another party (often a bank or other financial institution).

As promissory notes are legal and enforceable, banks will often accept them as they know they can get their money back if you fail to repay the loan. For your promissory note to be legal, you can print off a promissory note template online, fill in your details and sign it.

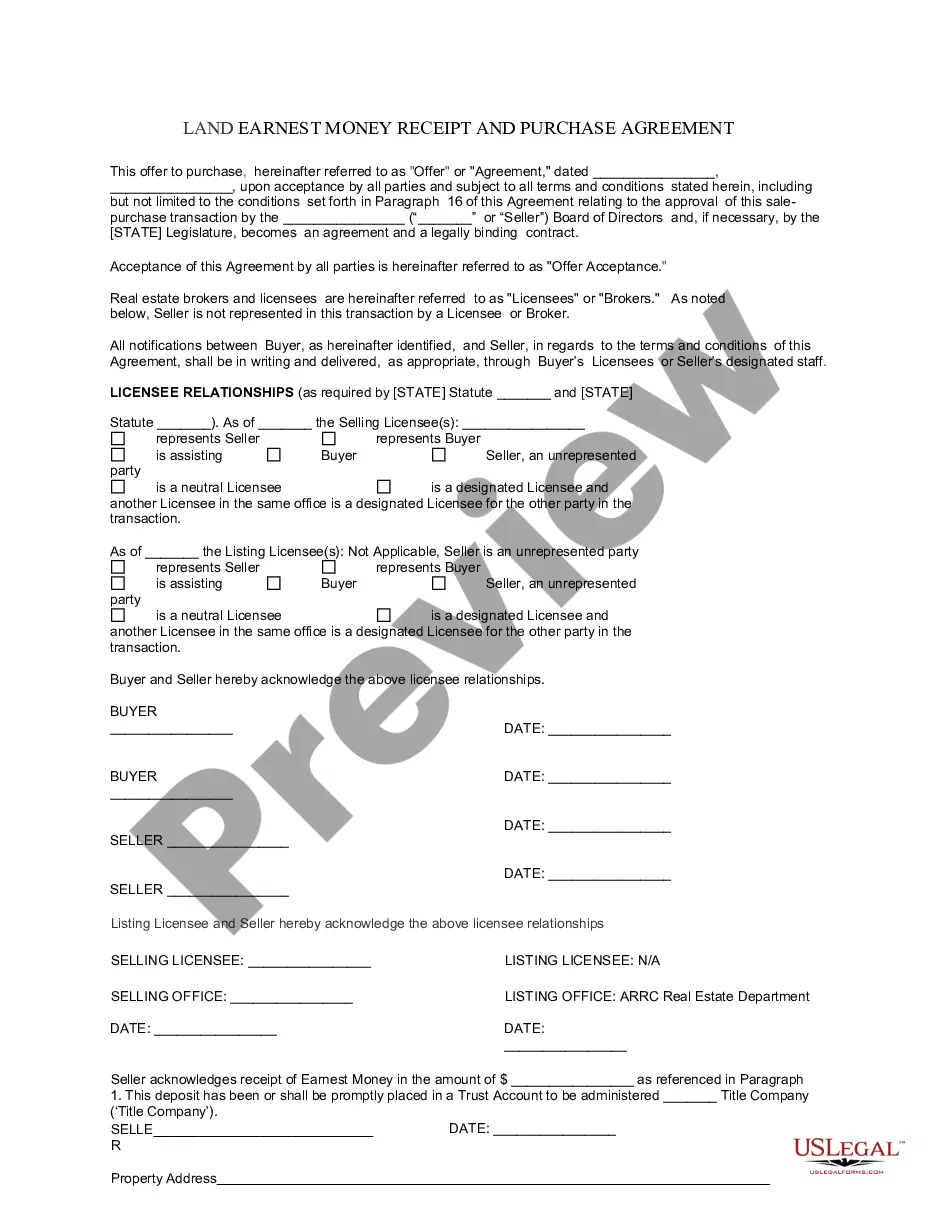

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

For sophisticated or corporate investors, promissory notes can be a good investment. These instruments provide a reasonable reward for those who are willing to accept the risk. However, promissory notes that are marketed broadly to the general public often turn out to be scams.

When to Use a Promissory Note? A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

An earnest promissory note shows good faith commitment to purchase an asset and outlines the aspects of the purchase agreement between a buyer and seller.

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete.

The parties should sign only one original note, and the seller or escrow agent should keep that document. If you are the buyer, you will want to keep the note in the hands of an escrow agent or company.

A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower.