Michigan Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Finding the right authorized record design can be quite a have difficulties. Of course, there are plenty of templates available on the net, but how will you obtain the authorized form you need? Use the US Legal Forms web site. The support delivers 1000s of templates, including the Michigan Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), that can be used for organization and personal needs. Every one of the forms are inspected by pros and fulfill federal and state specifications.

When you are already listed, log in for your profile and then click the Down load key to have the Michigan Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Utilize your profile to search from the authorized forms you may have ordered formerly. Proceed to the My Forms tab of your profile and get one more backup in the record you need.

When you are a fresh consumer of US Legal Forms, here are easy instructions that you should follow:

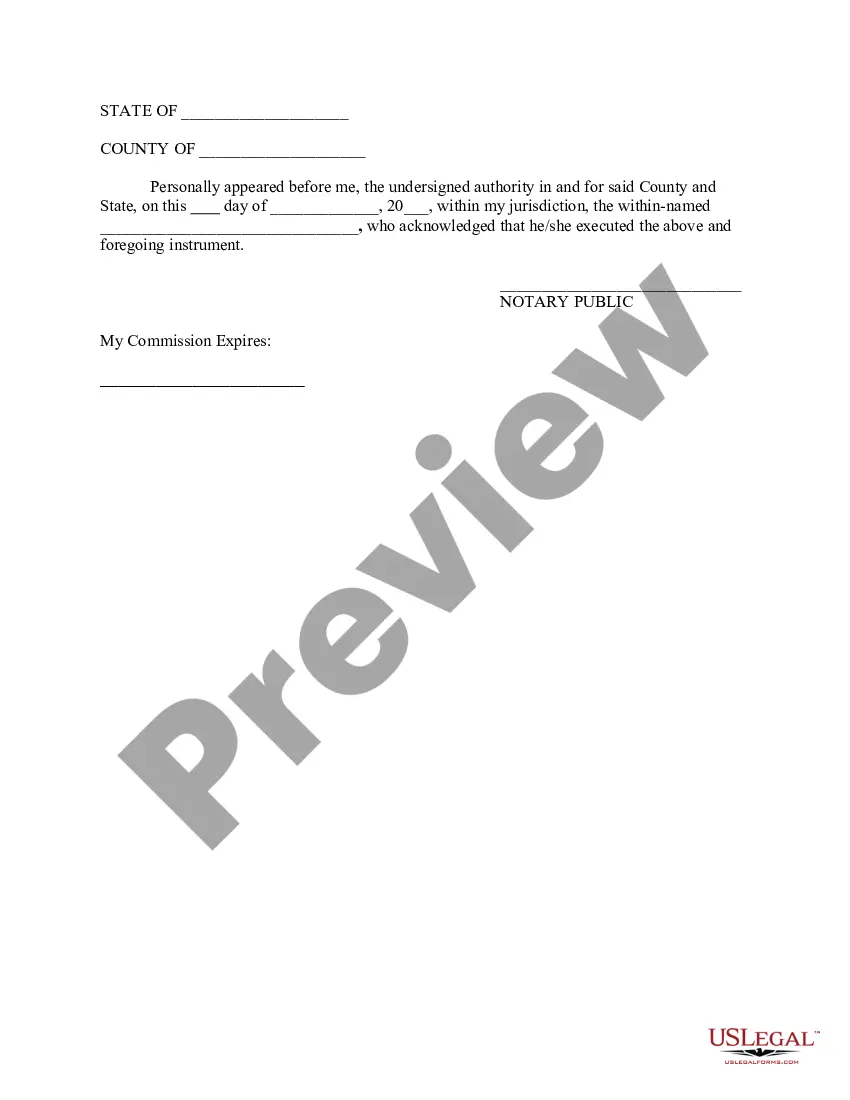

- First, be sure you have selected the appropriate form for the area/state. You are able to look through the shape making use of the Preview key and look at the shape information to guarantee this is basically the right one for you.

- If the form is not going to fulfill your preferences, make use of the Seach area to get the correct form.

- Once you are certain the shape is suitable, select the Acquire now key to have the form.

- Choose the prices strategy you need and type in the required information and facts. Build your profile and pay money for your order using your PayPal profile or Visa or Mastercard.

- Pick the document format and download the authorized record design for your gadget.

- Total, edit and print and sign the received Michigan Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

US Legal Forms may be the largest collection of authorized forms in which you can discover different record templates. Use the service to download professionally-made paperwork that follow status specifications.

Form popularity

FAQ

A surviving spouse who isn't in a community property state and whose name isn't on the car loan isn't responsible for the loan. So, it may be your choice whether to assume payments if the car goes to you after probate. This is also true for any other beneficiary whose name is not on the loan.

If a person dies intestate, and the person owned a vehicle, the person's spouse automatically becomes the owner of the vehicle. If the decedent owned more than one vehicle, the surviving spouse may choose one of the vehicles.

The executor of your dad's estate should see to it that ownership is transferred to you under the terms of his will. Once it is, then you can register it. If there was no will and no court awarded you ownership of the car your best bet would be to consult an attorney.

If your situation meets those requirements, you can use this Secretary of State Form TR-29 to transfer the vehicle(s) to the deceased person's heirs. The person signing the form certifies that there is no probate proceeding pending for the decedent's estate and that no probate proceeding will be started in the future.

Once you have the legal authority to transfer the car's ownership, you'll need to complete the process through the state department of motor vehicles (DMV), including providing documentation such as a death certificate, your photo identification, and a letter from the court.

In most cases, the spouse's will determines what happens to their property. So, you must look over the will with an attorney to see if you're entitled to their property. However, if your husband didn't have a will, you may automatically inherit the property, depending on your state's laws.

Motor Vehicles. If a decedent dies with no probate assets (i.e., owns nothing in their name alone) except for one or more motor vehicles whose total value is not more than $60,000, title to the vehicles can be transferred by the Secretary of State without opening an estate in the Probate Court.

A. Complete the Secretary of State Form TR- 29, Certification From The Heir to a Vehicle, available at a Secretary of State office or at .sos.state.mi.us; b. Attach the vehicle title (if available) to the form; c. Present a certified copy of the death certificate of the vehicle owner; d.