The Michigan Demand for Collateral by Creditor refers to a legal concept in the state of Michigan that allows a creditor to demand collateral from a borrower when there is a default on a debt. This demand gives the creditor the right to seize and sell the collateral in order to satisfy the outstanding debt. In Michigan, there are two primary types of Demand for Collateral by Creditor: 1. Security Agreement: Under a security agreement, the borrower and the creditor agree that the collateral will serve as security for the debt. This agreement is usually signed at the time the loan is made and specifies the details of the collateral, such as the type, quantity, and location. In case of default, the creditor has the right to demand the collateral and may initiate legal proceedings for its seizure. 2. UCC-1 Financing Statement: A UCC-1 Financing Statement is a legal document filed with the Secretary of State's office in Michigan. It serves as a public notice to other potential creditors about the creditor's interest in the collateral. In case of default, the creditor can rely on the UCC-1 filing to support their demand for collateral. This type of demand allows the creditor to proceed with the proper legal channels to take possession of and sell the collateral. Both types of Demand for Collateral by Creditor provide legal mechanisms for the creditor to protect their interests and ensure the repayment of a debt. It is important for both borrowers and creditors to be aware of these rules and regulations when entering into a credit agreement in Michigan. Keywords: Michigan, Demand for Collateral by Creditor, collateral, default, creditor, borrower, security agreement, UCC-1 Financing Statement, legal proceedings, seizure, repayment.

Michigan Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

You can invest hours online searching for the legal document template that meets the state and federal requirements you require.

US Legal Forms provides an extensive selection of legal forms that have been evaluated by professionals.

It is easy to download or print the Michigan Demand for Collateral by Creditor from my service.

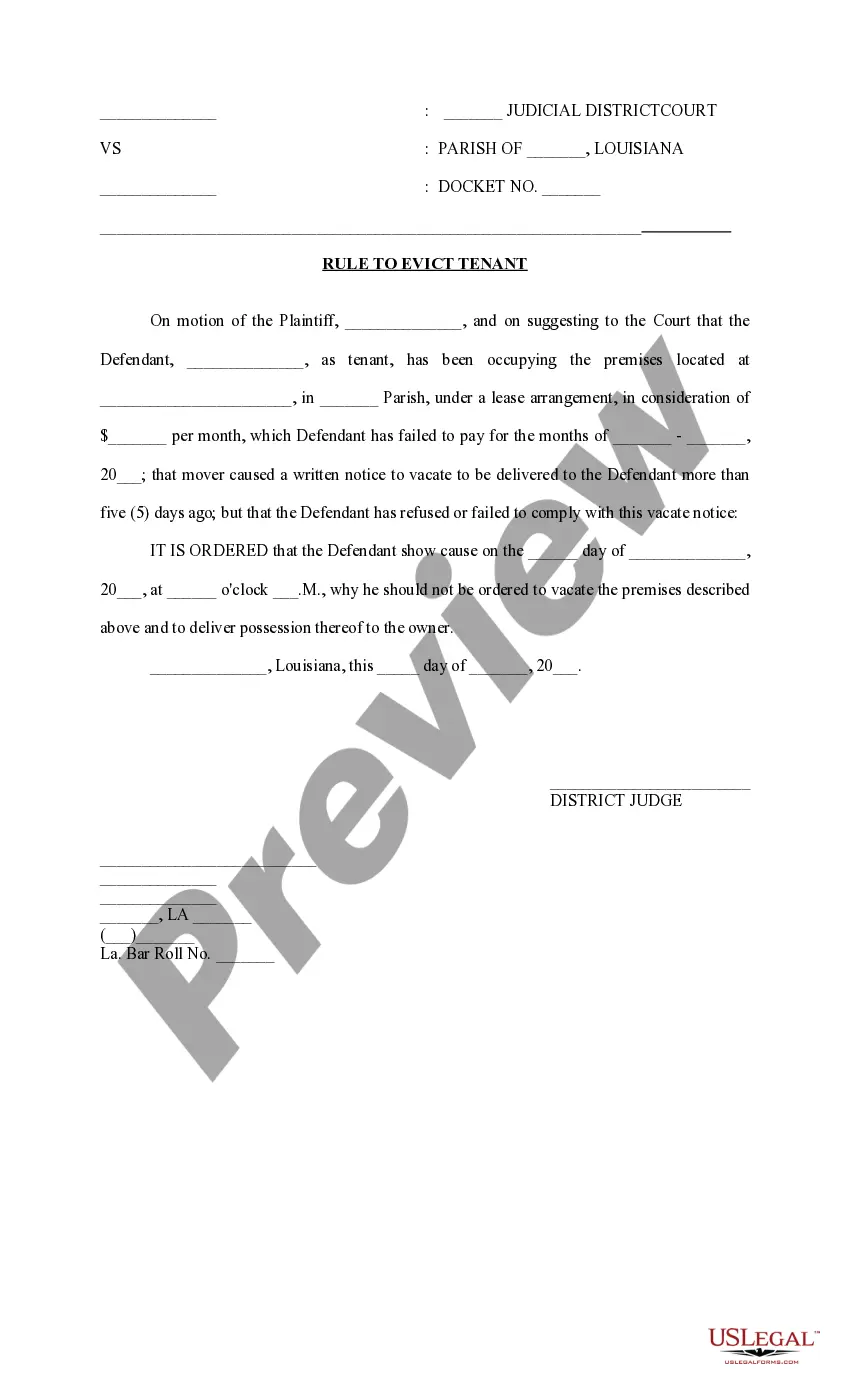

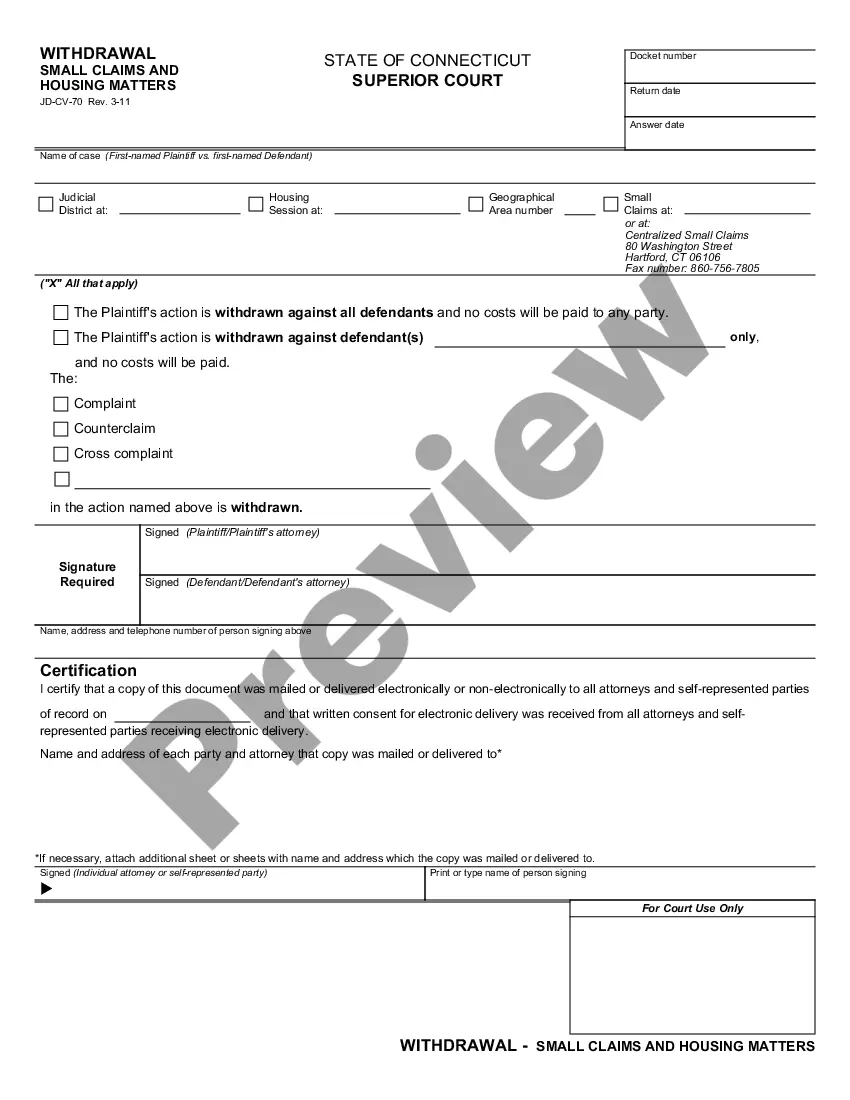

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Michigan Demand for Collateral by Creditor.

- Each legal document template you obtain is yours forever.

- To get another copy of any acquired form, go to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city that you choose.

- Review the form details to make sure you have selected the right form.

Form popularity

FAQ

In Michigan, certain properties are exempt from judgments, which can help protect your assets during debt collection. Exemptions typically include essential household goods, a portion of your equity in your home, and certain retirement accounts. Understanding these exemptions is vital if you receive a Michigan Demand for Collateral by Creditor. Consulting with legal resources like USLegalForms can provide clarity and guidance.

In Michigan, debt collection is governed by both state and federal laws. These rules require creditors to follow specific procedures, including sending a Michigan Demand for Collateral by Creditor under certain conditions. They must also provide you with a fair opportunity to respond to any claims against you. Knowing these rules can empower you during financial challenges.

Creditors may place a lien on your house in Michigan if they have a legal judgment in their favor. This action typically follows a Michigan Demand for Collateral by Creditor. The lien will remain until the debt is satisfied, which can affect your ability to sell or refinance your home. Understanding the implications can help you make informed financial decisions.

Yes, creditors can potentially take your house in Michigan if they obtain a judgment against you. This usually happens after a Michigan Demand for Collateral by Creditor is issued. However, there are protections and exemptions available that may prevent this from occurring. It is wise to explore your options and seek expert advice.

The UCC applies to a wide range of commercial transactions, particularly those involving sales of goods, leases, and secured transactions. This code governs the relationship between creditors and debtors, helping to enforce security interests. Understanding these applications is vital for managing a Michigan Demand for Collateral by Creditor effectively, as it provides you with legal frameworks to support your claims.

To conduct a UCC lien search in Michigan, you can access the public records maintained by the Department of Licensing and Regulatory Affairs or use commercial search services. This search will inform you if there are existing claims against a debtor's assets. A UCC lien search is an essential step in understanding the landscape of Michigan Demand for Collateral by Creditor before entering any financial agreement.

In Michigan, the UCC statute is codified in the Michigan Compiled Laws, specifically under the Act 174 of 1962. This act governs transactions involving secured interests in personal property. Familiarity with this statute helps you navigate the requirements for a Michigan Demand for Collateral by Creditor, ensuring you meet all legal obligations.

The Uniform Commercial Code (UCC) aims to create consistency in commercial transactions across states, including Michigan. It standardizes laws related to sales, leases, and secured transactions, which simplifies the legal landscape for businesses and creditors. Understanding the UCC is crucial for ensuring compliance, particularly when dealing with Michigan Demand for Collateral by Creditor situations.

The primary purpose of a UCC filing is to publicly declare a creditor's interest in a debtor's collateral. This filing protects the creditor's rights, especially when pursuing claims for repayment. By filing correctly, you contribute to a clear record of your Michigan Demand for Collateral by Creditor, thereby enhancing your legal standing in debt recovery.

To file a UCC statement in Michigan, you must complete the necessary forms with accurate details about the collateral involved. You can submit the completed forms to the Michigan Department of Licensing and Regulatory Affairs, or use online platforms like US Legal Forms for guidance. This streamlined process ensures that your Michigan Demand for Collateral by Creditor is properly recorded.