The Michigan Executive Employee Stock Incentive Plan, also known as the Michigan EE SIP, is a compensation program designed to incentivize and retain top-level executives in Michigan-based companies. This stock-based incentive plan is specifically designed to reward executives for their contributions to the company's growth and success. The Michigan EE SIP typically grants executives the opportunity to acquire shares of company stock through various mechanisms. These stock incentives can come in various forms, such as stock options, stock appreciation rights (SARS), restricted stock units (RSS), or performance shares. Stock options, one of the most common types of stock incentives granted under the Michigan EE SIP, allow executives to purchase company stock at a predetermined price, also known as the exercise price, within a specified time frame. Executives stand to benefit from stock option grants if the company's stock price exceeds the exercise price, thus allowing them to purchase shares at a discount. Stock appreciation rights (SARS), another type of incentive under the Michigan EE SIP, entitle executives to receive the appreciation in the company's stock value over a predetermined period. When exercised, executives are typically granted the difference between the stock price at the exercise date and the grant date. SARS provides an incentive for executives to drive the company's stock price higher since they directly benefit from its appreciation. Restricted stock units (RSS) are another type of incentive offered under the Michigan EE SIP. RSS grant executives a specific number of company shares, often subject to a vesting period or performance targets. Once the RSS have vested, meaning the executive has met all the specified requirements, they can convert their RSS to actual company stock. Performance shares, as the name suggests, are stock incentives tied directly to the performance of the executive, team, division, or the entire company. These shares are granted based on predetermined performance goals, such as revenue growth, earnings per share, or market share. Executives receive the allocated shares if the performance targets are met within the defined timeframe. Overall, the Michigan Executive Employee Stock Incentive Plan is an essential tool for attracting, engaging, and motivating top-level executives in Michigan. It offers various stock-based incentives, including stock options, SARS, RSS, and performance shares, to reward executives for their contributions and align their interests with the company's success.

Michigan Executive Employee Stock Incentive Plan

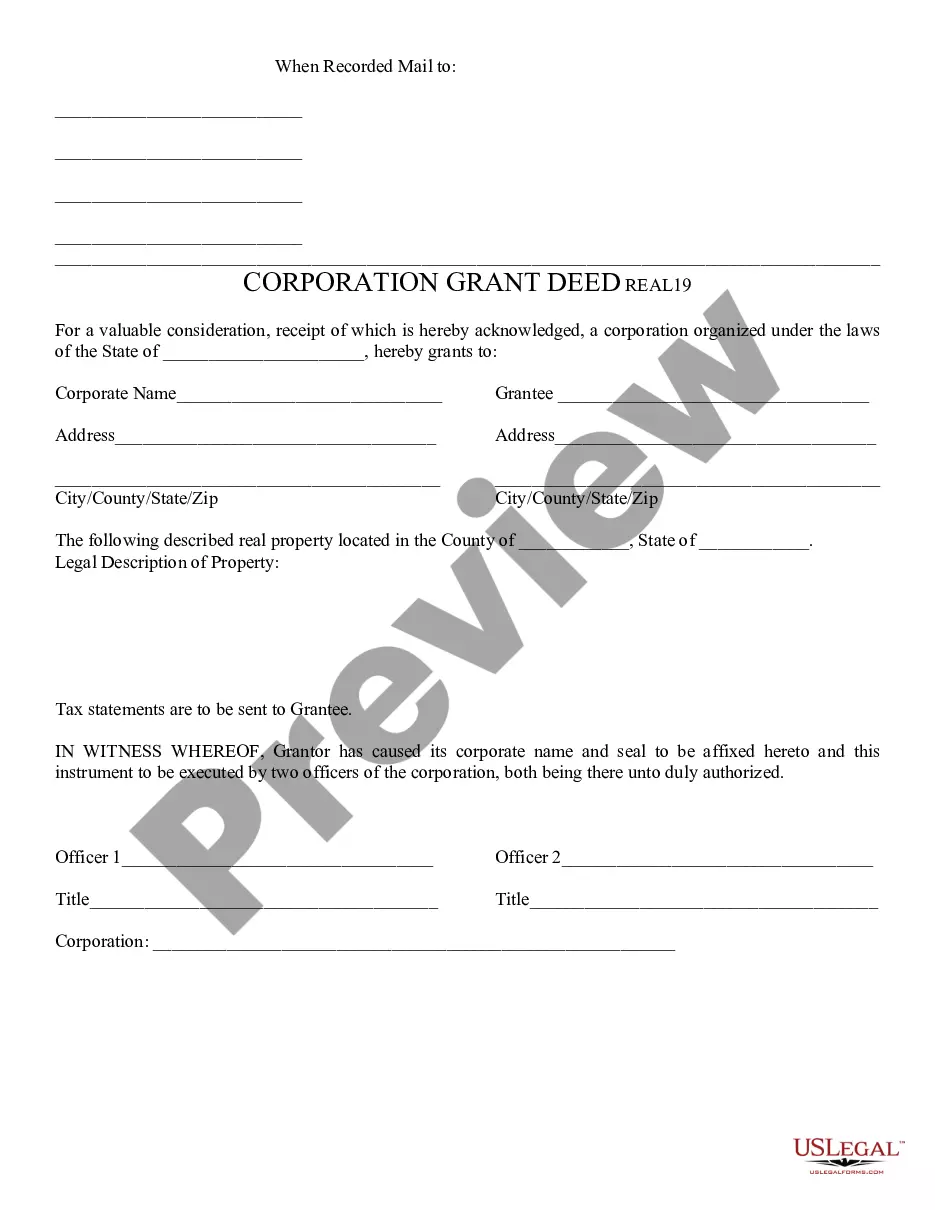

Description

How to fill out Michigan Executive Employee Stock Incentive Plan?

If you wish to comprehensive, down load, or print out lawful record web templates, use US Legal Forms, the greatest variety of lawful kinds, which can be found on the web. Make use of the site`s simple and convenient search to discover the papers you will need. Different web templates for business and individual reasons are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Michigan Executive Employee Stock Incentive Plan with a couple of mouse clicks.

In case you are currently a US Legal Forms consumer, log in in your accounts and click the Acquire key to find the Michigan Executive Employee Stock Incentive Plan. You can even entry kinds you earlier delivered electronically inside the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for the proper city/land.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never forget to read the information.

- Step 3. In case you are unhappy together with the form, make use of the Search discipline on top of the display to get other versions in the lawful form design.

- Step 4. When you have identified the form you will need, go through the Acquire now key. Pick the costs prepare you prefer and include your credentials to sign up to have an accounts.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal accounts to perform the deal.

- Step 6. Select the format in the lawful form and down load it on the gadget.

- Step 7. Total, change and print out or sign the Michigan Executive Employee Stock Incentive Plan.

Each and every lawful record design you buy is the one you have permanently. You may have acces to every form you delivered electronically within your acccount. Click the My Forms segment and choose a form to print out or down load again.

Contend and down load, and print out the Michigan Executive Employee Stock Incentive Plan with US Legal Forms. There are millions of expert and condition-specific kinds you can use for your personal business or individual demands.