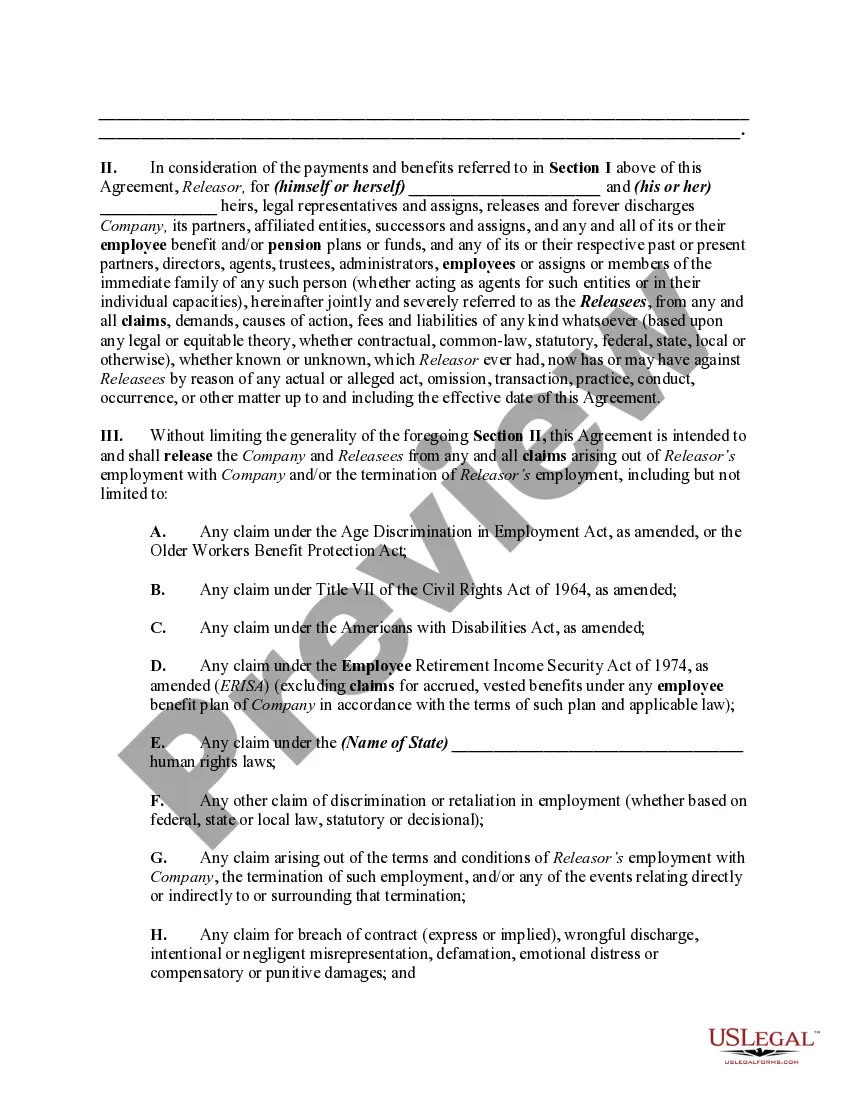

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA); any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended; any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal agreement between an employee and their former employer in the state of Michigan. This release typically occurs when an employee's employment has been terminated, and both parties wish to settle any potential claims the employee may have against the employer. Under Michigan law, there are different types of releases that an employee can enter into with their employer. The first type is a general release, which encompasses all claims the employee may have against the employer, both known and unknown. By signing a general release, the employee agrees to release the employer from any liability related to their terminated employment, including claims for wrongful termination, discrimination, or breach of contract. Another type of release is a limited release. In this case, the employee may choose to release only specific claims against the employer, such as those related to unpaid wages or overtime. By entering into a limited release, the employee retains the right to pursue other claims they may have against the employer. When it comes to the release of employee benefit and pension plans and funds, the employee may be required to sign additional documentation. For instance, if the employee has a 401(k) or pension plan with the employer, they may need to sign a release specifically related to these retirement benefits. This release ensures that the employee agrees to forfeit any future claims to their retirement funds and benefits as part of the termination agreement. It is important for both the employee and the employer to carefully review and understand the terms of the release before signing. Seeking legal advice may be beneficial to ensure that the release adequately protects the employee's rights and interests. Additionally, the employee should be aware that signing a release typically means they can no longer pursue legal action against the employer for the claims covered by the agreement. In conclusion, a Michigan Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal agreement designed to settle any potential claims an employee may have against their former employer. Different types of releases exist, such as general releases or limited releases, each serving a specific purpose in resolving disputes related to terminated employment. Employee benefit and pension plans and funds may also require separate releases to ensure their inclusion in the termination agreement.Michigan Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal agreement between an employee and their former employer in the state of Michigan. This release typically occurs when an employee's employment has been terminated, and both parties wish to settle any potential claims the employee may have against the employer. Under Michigan law, there are different types of releases that an employee can enter into with their employer. The first type is a general release, which encompasses all claims the employee may have against the employer, both known and unknown. By signing a general release, the employee agrees to release the employer from any liability related to their terminated employment, including claims for wrongful termination, discrimination, or breach of contract. Another type of release is a limited release. In this case, the employee may choose to release only specific claims against the employer, such as those related to unpaid wages or overtime. By entering into a limited release, the employee retains the right to pursue other claims they may have against the employer. When it comes to the release of employee benefit and pension plans and funds, the employee may be required to sign additional documentation. For instance, if the employee has a 401(k) or pension plan with the employer, they may need to sign a release specifically related to these retirement benefits. This release ensures that the employee agrees to forfeit any future claims to their retirement funds and benefits as part of the termination agreement. It is important for both the employee and the employer to carefully review and understand the terms of the release before signing. Seeking legal advice may be beneficial to ensure that the release adequately protects the employee's rights and interests. Additionally, the employee should be aware that signing a release typically means they can no longer pursue legal action against the employer for the claims covered by the agreement. In conclusion, a Michigan Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal agreement designed to settle any potential claims an employee may have against their former employer. Different types of releases exist, such as general releases or limited releases, each serving a specific purpose in resolving disputes related to terminated employment. Employee benefit and pension plans and funds may also require separate releases to ensure their inclusion in the termination agreement.