A Michigan Revocable Living Trust for Married Couple is a legal document that allows a couple in the state of Michigan to efficiently manage and distribute their assets while providing flexibility and control during their lifetime. This type of trust provides various advantages, such as avoiding probate, ensuring privacy, and offering the opportunity to plan for incapacity. A revocable living trust in Michigan is a versatile tool that can be tailored to meet the specific needs and goals of a married couple. There are several types of Michigan Revocable Living Trusts available, including: 1. Joint Revocable Living Trust: This type of trust is created and funded by both spouses together. It provides a comprehensive plan for the management and distribution of their assets as a couple. 2. Individual Revocable Living Trust: Each spouse establishes an individual trust, allowing them to manage their separate assets independently. However, they can still establish joint property agreements to clarify the ownership of marital assets. 3. AB Revocable Living Trust: Also known as an A-B trust or a Marital and Family Trust, this is a popular option for married couples to minimize estate taxes. It involves dividing the trust into two sub-trusts upon the death of the first spouse: the "A" trust (marital trust) and the "B" trust (family trust). 4. Q-TIP Revocable Living Trust: Q-TIP stands for "Qualified Terminable Interest Property." This type of trust allows a spouse to provide for their surviving spouse while simultaneously preserving assets for the ultimate beneficiaries, typically children from a previous marriage. When establishing a Michigan Revocable Living Trust for Married Couple, it is crucial to consider key elements such as who will act as the trustee(s), how assets will be managed and distributed, and the inclusion of any specific provisions or instructions. Consulting with an experienced estate planning attorney can help ensure all legal requirements and goals are met effectively. Keywords: Michigan, Revocable Living Trust, Married Couple, estate planning, probate avoidance, asset management, asset distribution, privacy, incapacity planning, joint trust, individual trust, AB trust, A-B trust, Marital and Family Trust, Q-TIP trust, Qualified Terminable Interest Property, trustee, estate taxes, beneficiaries, estate planning attorney.

Michigan Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

If you need to compile, obtain, or create sanctioned document templates, utilize US Legal Forms, the most extensive selection of legal documents available online.

Leverage the site’s straightforward and user-friendly search feature to find the forms you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely.

You will have access to all forms you have acquired in your account. Click on the My documents section and choose a form to print or download again.

- Use US Legal Forms to acquire the Michigan Revocable Living Trust for Married Couple within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to get the Michigan Revocable Living Trust for Married Couple.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

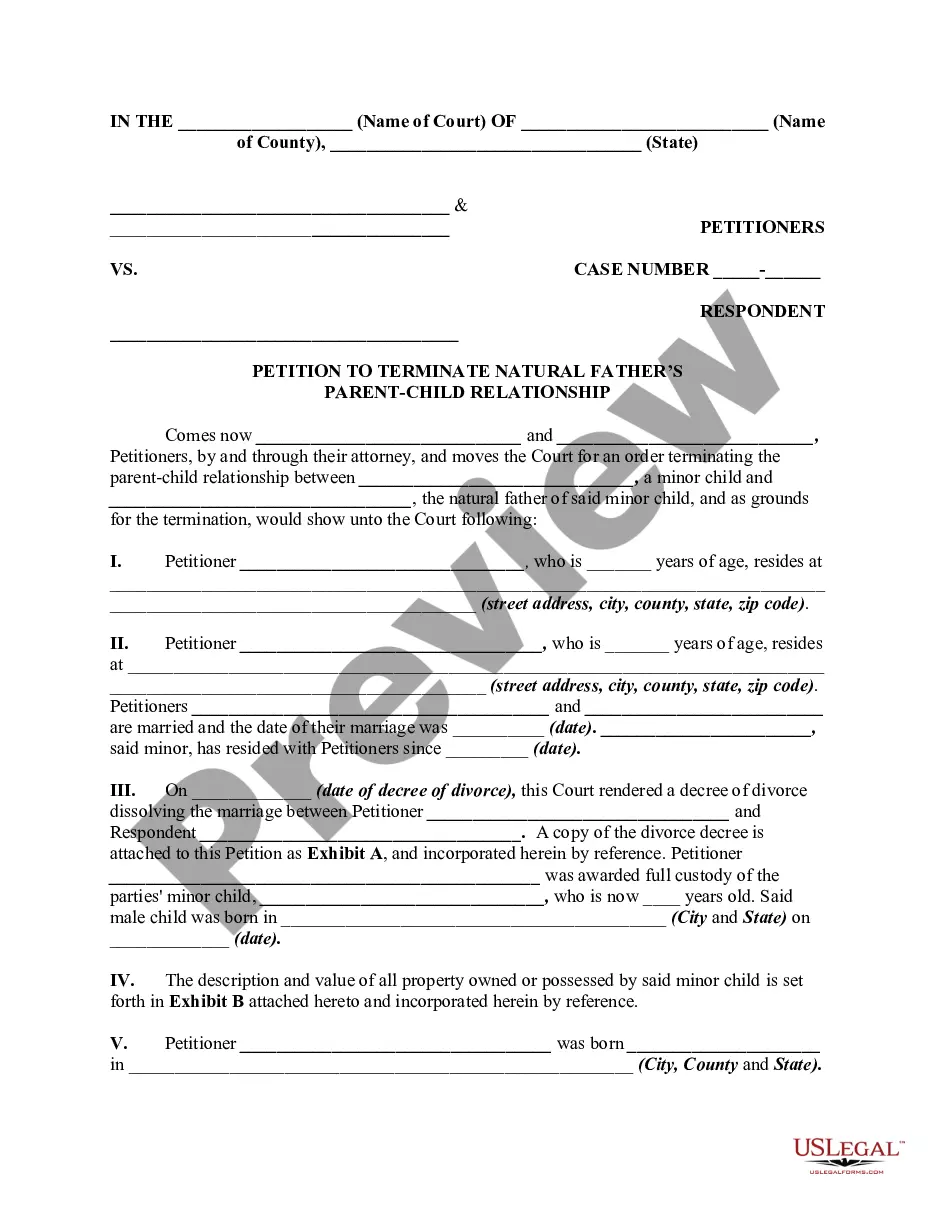

- Step 1. Ensure you have selected the form for the correct jurisdiction/state.

- Step 2. Use the Preview option to review the document’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the payment option you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Michigan Revocable Living Trust for Married Couple.

Form popularity

FAQ

While a Michigan Revocable Living Trust for Married Couples offers many benefits, there are downsides to consider. One downside is that establishing and maintaining the trust might incur legal fees and administrative costs. Additionally, since the trust is revocable, you do not gain asset protection from creditors, which means your assets are still subject to claims. Evaluating these factors against your personal circumstances is crucial, and solutions like uslegalforms can provide guidance in the process.

To set up a Michigan Revocable Living Trust for Married Couples, you should start by deciding on the assets you want to include in the trust. Next, you need to draft the trust document clearly outlining the terms and appointing a trustee. After completing the document, you must transfer ownership of your selected assets to the trust, which can include your home and bank accounts. It’s advisable to consult with a legal expert or use a reliable platform like uslegalforms to ensure your trust meets Michigan’s legal requirements.

In Michigan, marriage does not automatically override a trust; however, it can impact the terms of the trust. If you create a Michigan Revocable Living Trust for Married Couple, it may incorporate provisions that consider your spouse’s needs and rights. Regularly updating your trust after significant life changes, such as marriage, ensures that it aligns with your current circumstances, protecting both spouses' interests. With the right trust agreements, a marriage can work harmoniously with your estate planning.

Yes, a married couple can absolutely have a joint revocable trust, often referred to as a Michigan Revocable Living Trust for Married Couple. This type of trust allows both partners to manage their assets collectively, providing flexibility and ease in the estate planning process. By combining their assets into one trust, they can efficiently manage their wealth and simplify the distribution of their estate after passing. This joint approach can also help minimize probate costs and streamline the transfer of assets.

Generally, a joint trust does not automatically become irrevocable when one spouse dies. Instead, the trust typically continues as a revocable trust solely in the surviving spouse's control. However, certain provisions may shift when it comes to managing the assets. Understanding the dynamics of a Michigan Revocable Living Trust for Married Couple can help you navigate these changes effectively.

Yes, a revocable trust can be changed after one spouse dies. The surviving spouse can modify the trust to reflect their new circumstances and wishes. This flexibility is a key feature of the Michigan Revocable Living Trust for Married Couple, allowing the surviving spouse to adapt the estate plan as needed. Having the right legal support can make this process smoother and more efficient.

While a joint revocable trust offers many benefits, it does have some disadvantages. One concern is that both spouses must agree to any significant changes, which can lead to disputes. Additionally, if one spouse becomes incapacitated, managing the trust assets may require extra steps. It is important to weigh these factors carefully when considering a Michigan Revocable Living Trust for Married Couple.

When one spouse dies, the Michigan Revocable Living Trust for Married Couple typically changes to become a single trust. The surviving spouse maintains control over the trust assets and can manage them as needed. This setup helps avoid probate, ensuring a smoother transition of assets. The trust can still be amended, allowing the surviving spouse to adjust the estate plan as circumstances change.

The most appropriate type of trust for married couples is typically a revocable living trust, such as the Michigan Revocable Living Trust for Married Couple. This form of trust offers flexibility and control, allowing you and your spouse to manage and distribute your assets as desired. It can cater to specific needs, such as providing for children or managing assets for future generations. Moreover, it helps in avoiding probate, saving time and costs.

Yes, a married couple can certainly establish a revocable trust together, such as the Michigan Revocable Living Trust for Married Couple. This arrangement allows both partners to modify the trust as needed while retaining control over the assets within. By setting up this type of trust, you protect your estate and ensure effective management during your lifetime and beyond. It also offers peace of mind knowing your wishes will be honored.

Interesting Questions

More info

(For more financial calculators visit here) Note: You could do this calculation manually through these steps, but we prefer using our free tools. You can use our calculator for income and monthly income and calculate your own results.