Michigan Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

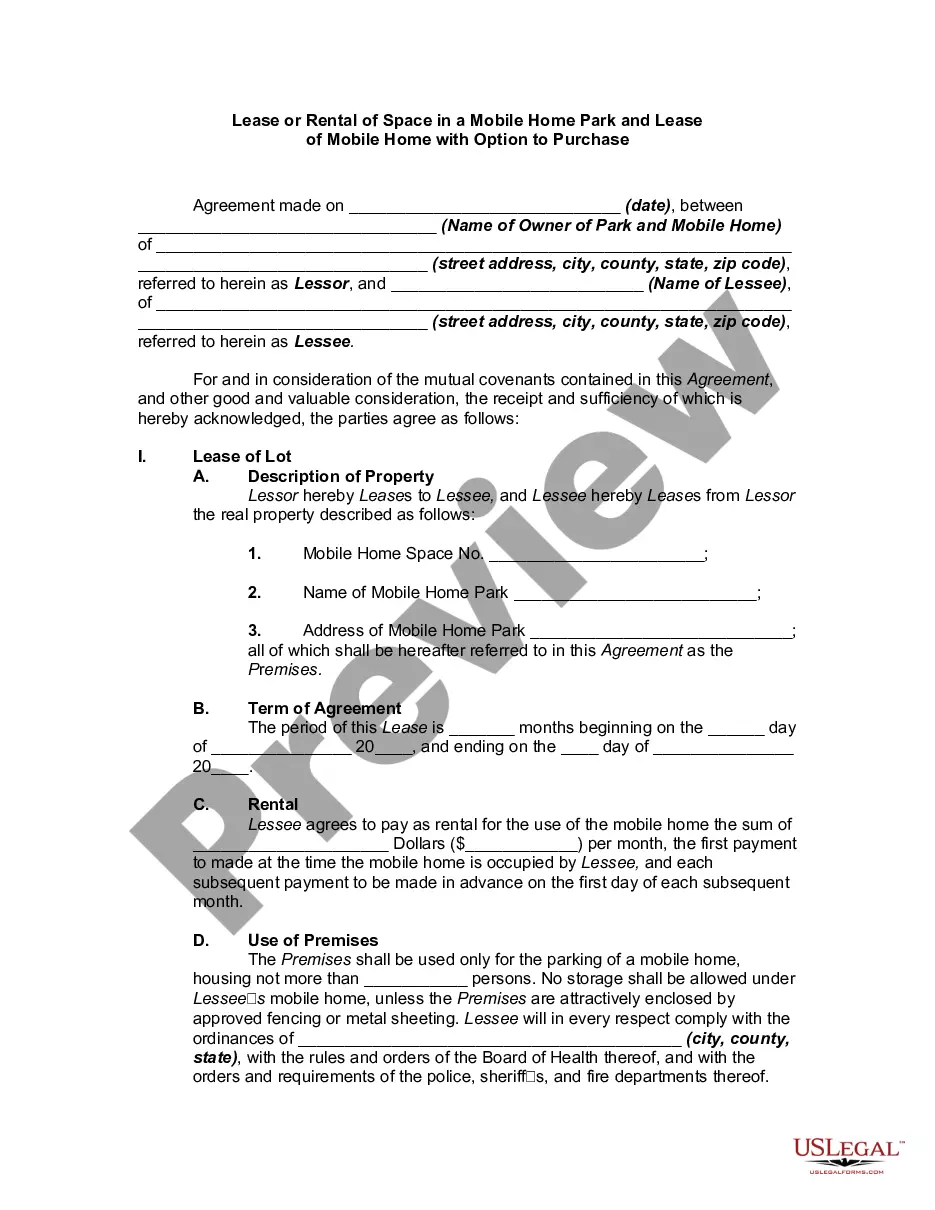

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

If you want to full, acquire, or produce legitimate record templates, use US Legal Forms, the greatest assortment of legitimate varieties, that can be found on the web. Make use of the site`s basic and practical lookup to find the files you want. Various templates for business and person functions are sorted by groups and says, or key phrases. Use US Legal Forms to find the Michigan Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual in a few mouse clicks.

In case you are presently a US Legal Forms buyer, log in to the profile and click the Acquire button to have the Michigan Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual. Also you can gain access to varieties you in the past acquired inside the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct city/region.

- Step 2. Utilize the Preview choice to look over the form`s content material. Never overlook to read through the information.

- Step 3. In case you are not happy with all the form, make use of the Search area near the top of the monitor to find other variations from the legitimate form format.

- Step 4. Upon having identified the shape you want, go through the Get now button. Choose the rates program you choose and put your references to sign up for an profile.

- Step 5. Process the financial transaction. You may use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Pick the format from the legitimate form and acquire it on your own gadget.

- Step 7. Complete, change and produce or indication the Michigan Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual.

Every single legitimate record format you buy is your own property for a long time. You might have acces to every form you acquired with your acccount. Click on the My Forms portion and choose a form to produce or acquire once again.

Contend and acquire, and produce the Michigan Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual with US Legal Forms. There are many skilled and express-particular varieties you may use to your business or person requirements.

Form popularity

FAQ

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Can Severed Mineral Rights be Retained Indefinitely? Under Michigan law (Act 42 of 1963, Termination of Oil or Gas Interests in Land), severed oil or gas rights revert to the surface owner after twenty years unless one of the following actions have occurred within the 20-year period: ? A drilling permit is issued.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

The ownership of the mineral rights in a parcel can usually be determined by examining the deed abstract for the property. Who Can Develop the Minerals in a Parcel? A mineral owner may develop his or her own mineral deposit.