Michigan Corporate Resolution Authorizing a Charitable Contribution

Description

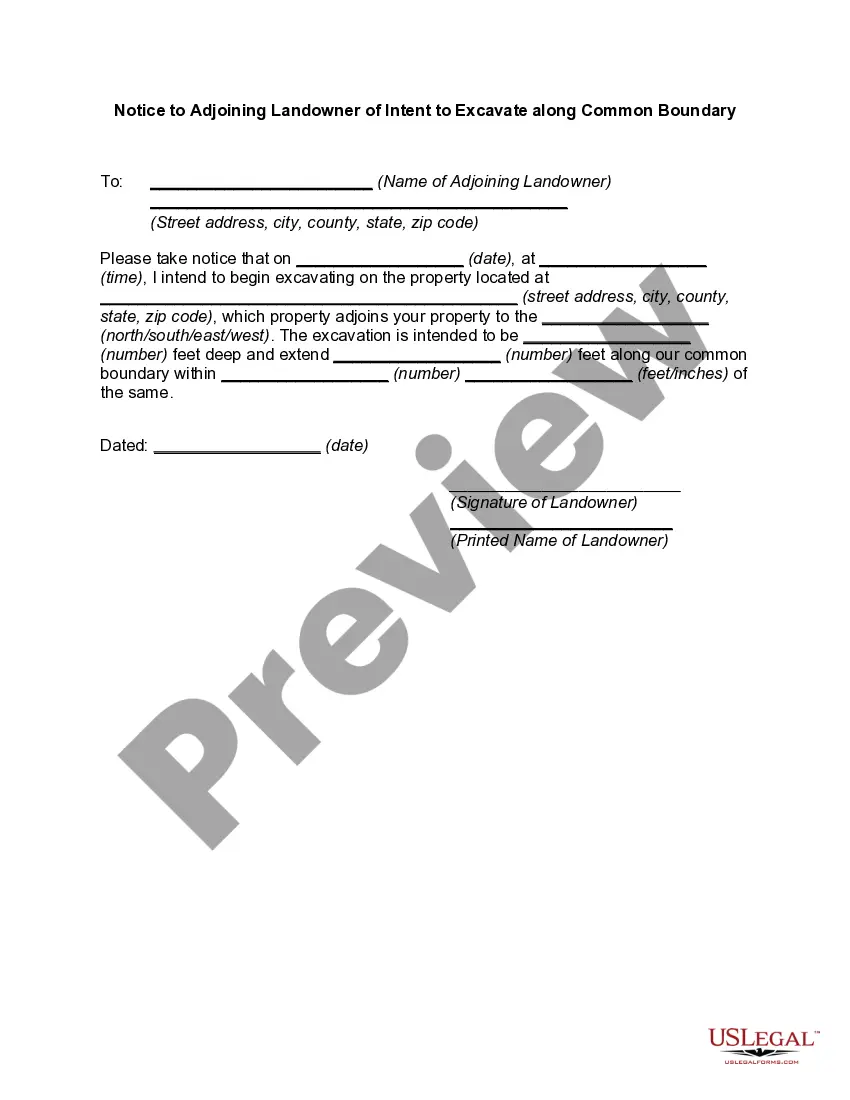

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal paperwork templates that you can download or create.

Using the website, you can access thousands of templates for business and personal needs, categorized by type, state, or keywords. You can find the latest versions of documents like the Michigan Corporate Resolution Authorizing a Charitable Contribution in seconds.

If you already have a subscription, Log In and retrieve the Michigan Corporate Resolution Authorizing a Charitable Contribution from your US Legal Forms collection. The Download button will be visible on every form you access.

When you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, choose the pricing plan you prefer and provide your credentials to create an account.

Process the payment. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make edits. Complete, revise, print, and sign the downloaded Michigan Corporate Resolution Authorizing a Charitable Contribution.

All formats you added to your account do not expire and are yours indefinitely. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Michigan Corporate Resolution Authorizing a Charitable Contribution with US Legal Forms, probably the most comprehensive repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or individual needs and requirements.

- You can view all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are some simple guidelines.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to check the content of the form.

- Refer to the form description to confirm that you have chosen the correct document.

- If the form doesn't meet your requirements, utilize the Search bar at the top of the screen to find the suitable one.

Form popularity

FAQ

The charitable solicitation law in Michigan requires organizations that solicit contributions to register with the Michigan Department of Attorney General. This law ensures transparency and accountability in fundraising. Organizations must comply with this law to avoid penalties and to maintain their credibility with potential donors. Having the necessary documents, including a Michigan Corporate Resolution Authorizing a Charitable Contribution, can support compliance and assure donors of your organization's commitment to charity.

The ideal number of board members for a nonprofit organization typically ranges from five to fifteen. This size allows for a balance between diverse viewpoints and effective communication. It's essential for the board to be large enough to share the workload yet small enough to facilitate discussions. Adopting a Michigan Corporate Resolution Authorizing a Charitable Contribution can help maintain focus on the organization's charitable goals.

For a nonprofit in Michigan, the law mandates a minimum of three board members. These individuals should not be related to ensure proper governance and oversight. Having an adequate number of board members fosters collaboration and strengthens decision-making. Consider creating a Michigan Corporate Resolution Authorizing a Charitable Contribution to document key decisions made by the board.

In Michigan, a non-profit organization must have at least three directors on its board. This requirement ensures diverse perspectives and effective governance within the organization. Each member should be committed to the mission, and their collective experience can significantly enrich the organization's impact. Additionally, having a Michigan Corporate Resolution Authorizing a Charitable Contribution can streamline the decision-making process.

To open a non-profit organization in Michigan, you must begin by choosing a unique name for your organization. Then, file articles of incorporation with the Michigan Department of Licensing and Regulatory Affairs. After that, you should apply for tax-exempt status at both the state and federal levels. Don’t forget to create a Michigan Corporate Resolution Authorizing a Charitable Contribution to formalize decisions made by the board.

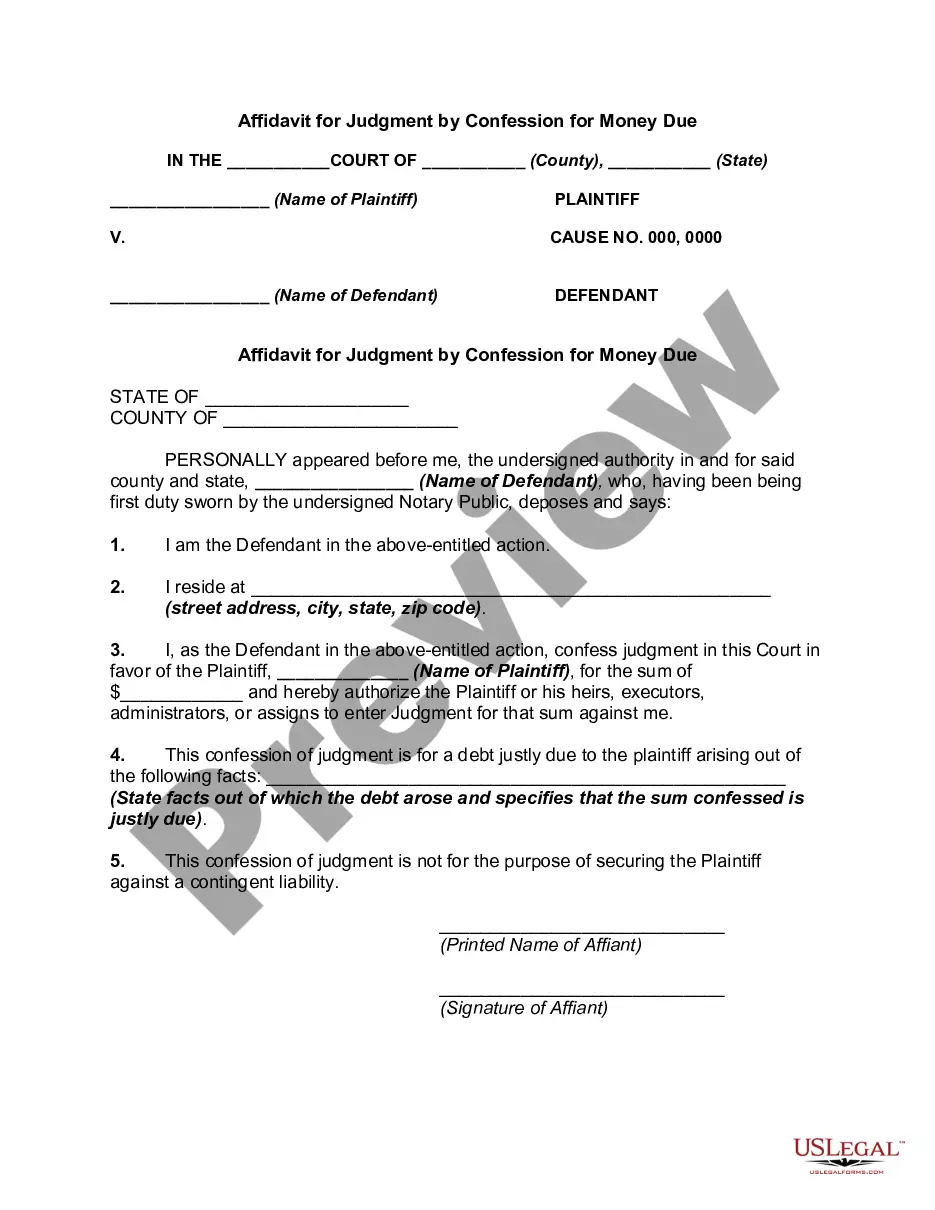

Filling out a corporate resolution form requires careful attention to detail. Start with the name of the corporation and the date it is being passed. Clearly articulate the decisions being made, such as in a Michigan Corporate Resolution Authorizing a Charitable Contribution, specifying what the contribution entails. Ensure that there is adequate space for signatures from the authorized board members to finalize the document.

An example of a corporate resolution might include a decision to approve a merger, authorize a bank transaction, or grant authority for charitable contributions. For example, a Michigan Corporate Resolution Authorizing a Charitable Contribution to a local charity could explicitly detail the amount being donated and the purpose behind the gift. This resolution would then be recorded in the corporate minutes for future reference.

To fill out a resolution form, begin by writing the title of the resolution at the top. Include a preamble that states the purpose of the document and outlines any relevant background information. Then, detail the specific resolutions being made, ensuring they clearly reflect intentions, such as those found in the Michigan Corporate Resolution Authorizing a Charitable Contribution. Finally, provide space for the necessary signatures of board members.

Filling out a corporate authorization resolution form involves several key steps. Start by entering the corporation's name and the date of the resolution. Next, clearly define the authority being granted, including the name of the authorized person and the scope of their powers. Be sure to include a statement indicating that the resolution conforms to the goals of the Michigan Corporate Resolution Authorizing a Charitable Contribution.

A corporate authorization resolution is a formal document that grants specific powers to an individual or a group within the company. It serves to legitimize actions taken by authorized personnel on behalf of the corporation. This document is crucial for activities like signing contracts or making financial transactions. For instance, a Michigan Corporate Resolution Authorizing a Charitable Contribution formalizes the decision to donate to a charity.