A 1031 exchange is a swap of one business or investment asset for another. Although most swaps are taxable as sales, if you come within 1031, you’ll either have no tax or limited tax due at the time of the exchange.

In effect, you can change the form of your investment without (as the IRS sees it) cashing out or recognizing a capital gain. That allows your investment to continue to grow tax deferred. There’s no limit on how many times or how frequently you can do a 1031. You can roll over the gain from one piece of investment real estate to another to another and another. Although you may have a profit on each swap, you avoid tax until you actually sell for cash many years later. Then you’ll hopefully pay only one tax, and that at a long-term capital gain rate .

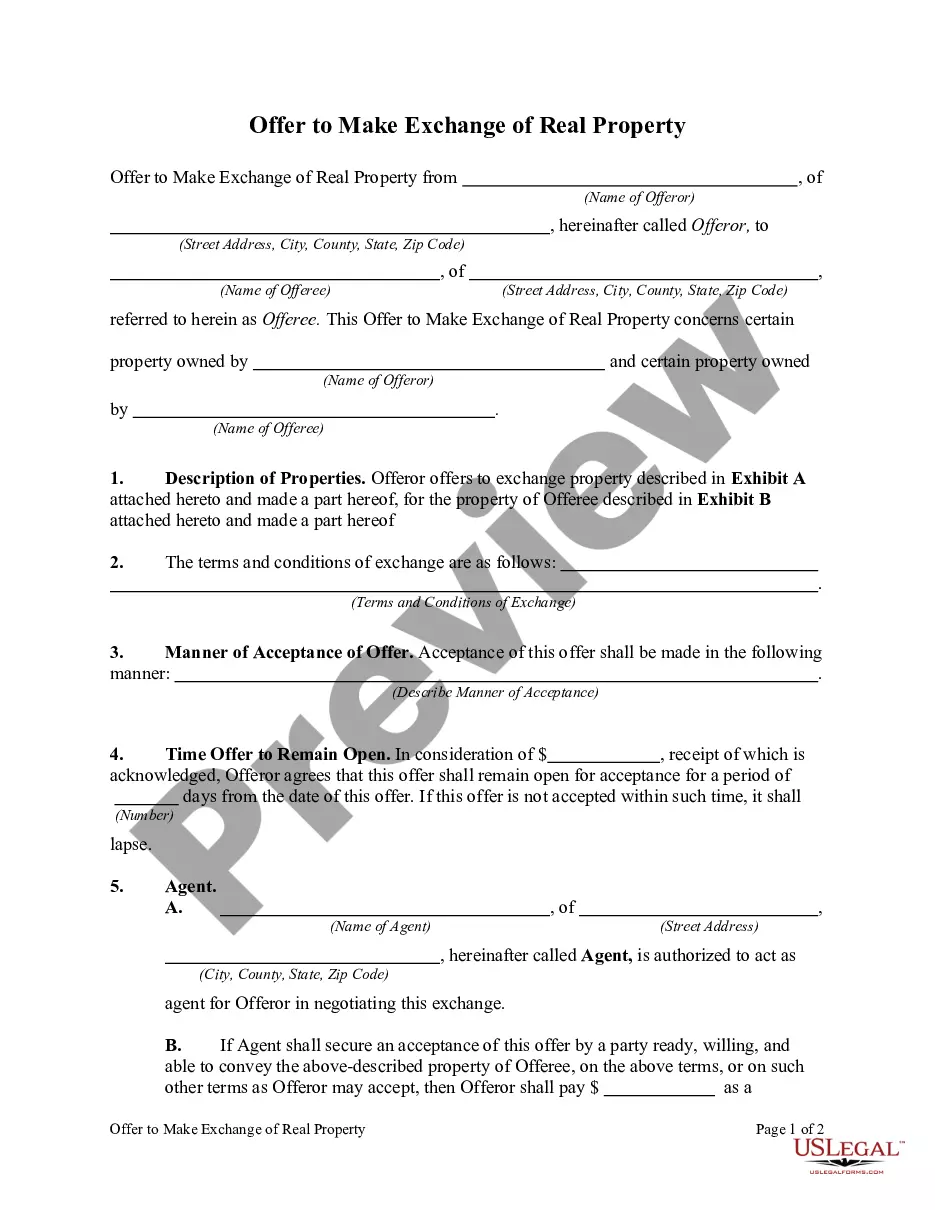

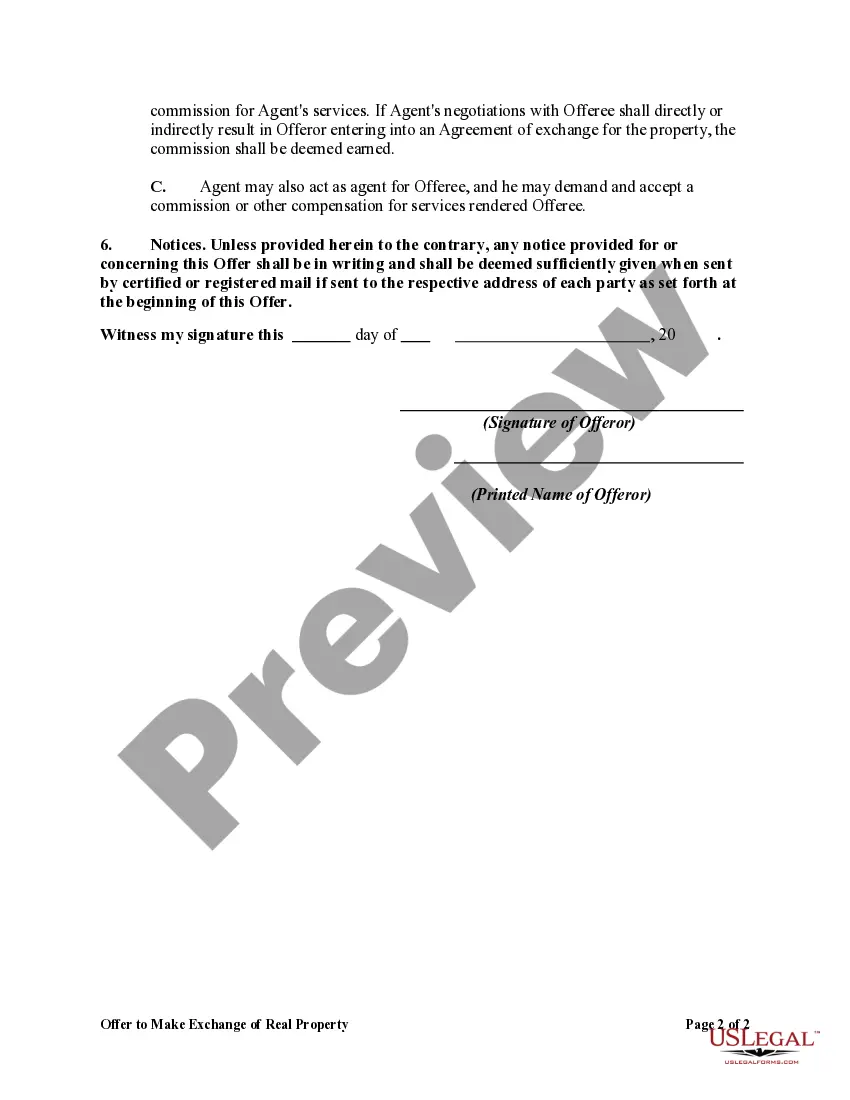

A Michigan Offer to Make Exchange of Real Property is a legally binding document used in the state of Michigan to facilitate the exchange of real estate between two parties. It is commonly utilized when individuals or entities wish to trade properties without involving any monetary transaction. The purpose of a Michigan Offer to Make Exchange of Real Property is to outline the terms and conditions of the exchange agreement, ensuring that both parties understand their rights and obligations. This document typically includes the following elements: 1. Parties Involved: The offer will identify the parties involved in the exchange, including their full legal names, addresses, and contact information. 2. Property Details: Each property involved in the exchange should be described in detail, including its address, legal description, and any important characteristics or amenities. 3. Terms of Exchange: The agreement should clearly state the terms of the exchange, such as the timeline for completion, any contingencies, and the specific requirements for each property being exchanged. 4. Representations and Warranties: Both parties may include representations and warranties that assure the condition and ownership of their respective properties. This ensures that the properties being exchanged are free from any liens, encumbrances, or legal disputes. 5. Responsibilities for Expenses: The offer should outline the responsibilities of each party regarding costs associated with the exchange. This may include property transfer taxes, escrow fees, title insurance costs, or any other expenses related to the transaction. 6. Contingencies: The agreement may include contingencies that allow either party to back out of the exchange under certain circumstances. These contingencies may include satisfactory property inspections, financing availability, or other conditions agreed upon by the parties. 7. Closing Process: The offer should outline the closing process, including the date, time, and location for the final exchange of documents and keys. It may also specify the method of transferring ownership, such as a warranty deed or quitclaim deed. Different types of Michigan Offer to Make Exchange of Real Property may vary based on specific parameters or additional provisions agreed upon by the parties involved. Some common variations include: 1. Simultaneous Exchange: This type of exchange occurs when both properties are transferred at the same time. This is the simplest form of property exchange, where the exchange occurs concurrently. 2. Delayed Exchange: Also known as a "Starker exchange" or "like-kind exchange," this type of exchange involves a third-party intermediary. The property being exchanged is sold to the intermediary, who holds the proceeds in an escrow account until the replacement property is found within a specific timeframe. 3. Reverse Exchange: In a reverse exchange, the replacement property is acquired before the relinquished property is sold. This type of exchange is more complex and requires detailed planning to comply with tax regulations. It is crucial to consult with a qualified real estate attorney or expert to draft a Michigan Offer to Make Exchange of Real Property that adheres to all legal requirements and protects the rights and interests of both parties.A Michigan Offer to Make Exchange of Real Property is a legally binding document used in the state of Michigan to facilitate the exchange of real estate between two parties. It is commonly utilized when individuals or entities wish to trade properties without involving any monetary transaction. The purpose of a Michigan Offer to Make Exchange of Real Property is to outline the terms and conditions of the exchange agreement, ensuring that both parties understand their rights and obligations. This document typically includes the following elements: 1. Parties Involved: The offer will identify the parties involved in the exchange, including their full legal names, addresses, and contact information. 2. Property Details: Each property involved in the exchange should be described in detail, including its address, legal description, and any important characteristics or amenities. 3. Terms of Exchange: The agreement should clearly state the terms of the exchange, such as the timeline for completion, any contingencies, and the specific requirements for each property being exchanged. 4. Representations and Warranties: Both parties may include representations and warranties that assure the condition and ownership of their respective properties. This ensures that the properties being exchanged are free from any liens, encumbrances, or legal disputes. 5. Responsibilities for Expenses: The offer should outline the responsibilities of each party regarding costs associated with the exchange. This may include property transfer taxes, escrow fees, title insurance costs, or any other expenses related to the transaction. 6. Contingencies: The agreement may include contingencies that allow either party to back out of the exchange under certain circumstances. These contingencies may include satisfactory property inspections, financing availability, or other conditions agreed upon by the parties. 7. Closing Process: The offer should outline the closing process, including the date, time, and location for the final exchange of documents and keys. It may also specify the method of transferring ownership, such as a warranty deed or quitclaim deed. Different types of Michigan Offer to Make Exchange of Real Property may vary based on specific parameters or additional provisions agreed upon by the parties involved. Some common variations include: 1. Simultaneous Exchange: This type of exchange occurs when both properties are transferred at the same time. This is the simplest form of property exchange, where the exchange occurs concurrently. 2. Delayed Exchange: Also known as a "Starker exchange" or "like-kind exchange," this type of exchange involves a third-party intermediary. The property being exchanged is sold to the intermediary, who holds the proceeds in an escrow account until the replacement property is found within a specific timeframe. 3. Reverse Exchange: In a reverse exchange, the replacement property is acquired before the relinquished property is sold. This type of exchange is more complex and requires detailed planning to comply with tax regulations. It is crucial to consult with a qualified real estate attorney or expert to draft a Michigan Offer to Make Exchange of Real Property that adheres to all legal requirements and protects the rights and interests of both parties.