Michigan Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Are you currently in a situation where you require documents for either professional or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Michigan Charitable Remainder Inter Vivos Annuity Trust, which are drafted to fulfill state and federal requirements.

When you find the correct form, click Buy now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Michigan Charitable Remainder Inter Vivos Annuity Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/region.

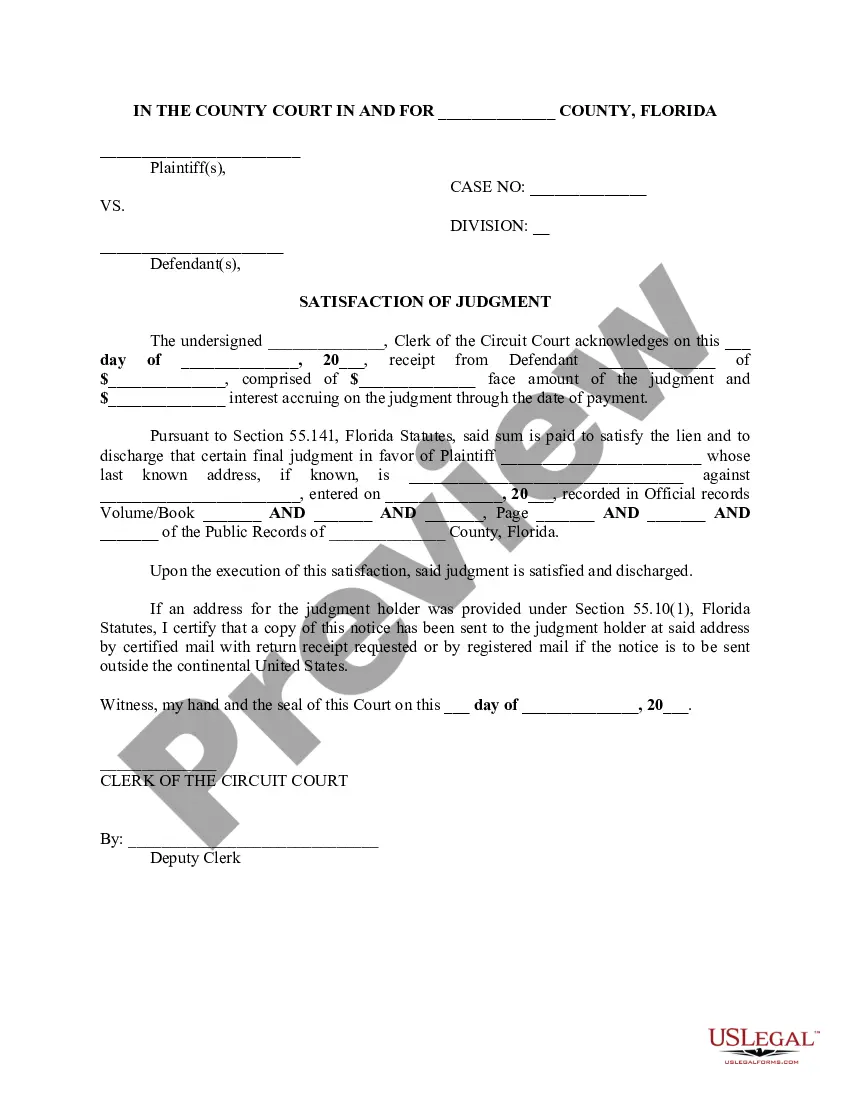

- Utilize the Review button to inspect the form.

- Read the description to make sure you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup area to find the form that meets your needs and requirements.

Form popularity

FAQ

In Michigan, a charitable remainder trust does not need to be recorded with the state. However, maintaining proper documentation is essential for the trust's validity. This includes having a well-prepared trust agreement that defines the terms and conditions clearly. To simplify this process, you can use platforms like uslegalforms, which provide resources for drafting and managing charitable trusts effectively.

A Michigan Charitable Remainder Inter Vivos Annuity Trust typically files Form 5227 with the IRS. This form is used to report information on the trust and its income. It's important to keep accurate records of the trust's income and distributions because this documentation supports your tax filings. You may also want to consult with a tax professional to ensure compliance with state and federal requirements.

Setting up a Michigan Charitable Remainder Inter Vivos Annuity Trust involves several key steps. First, you need to determine the assets you wish to place in the trust. After that, consult with a qualified attorney or financial advisor to create a trust document that complies with Michigan laws. This document will outline the terms of your trust, including the beneficiaries and the distributions they will receive.

A charitable remainder trust functions by allowing you to donate assets while receiving an income stream for a set period or your lifetime. After this time, the remaining assets go to the designated charity. In the case of a Michigan Charitable Remainder Inter Vivos Annuity Trust, this setup can provide strong tax advantages and ensures your philanthropic goals are met effectively.

To create a charitable remainder trust, you first need to decide on the assets you want to contribute and the charity you wish to support. Next, consult with a financial advisor or an attorney specializing in trusts to draft the appropriate legal document. Utilizing platforms like uslegalforms can simplify this process and provide you with the necessary guidance to establish a Michigan Charitable Remainder Inter Vivos Annuity Trust.

Setting up a charitable trust, such as a Michigan Charitable Remainder Inter Vivos Annuity Trust, can be an effective way to manage your estate and provide for charitable causes. Many individuals choose this route for the potential tax benefits and the satisfaction of supporting organizations they care about. Additionally, it allows you to retain an income stream while making a lasting impact.

One disadvantage of a charitable trust is the potential loss of control over assets you contribute. In the case of a Michigan Charitable Remainder Inter Vivos Annuity Trust, you may also face complex tax implications. It’s important to consider that while such a trust can provide regular income, it may limit your financial flexibility in the future.

Setting up a Michigan Charitable Remainder Inter Vivos Annuity Trust involves several steps. First, identify your goals and choose the assets you want to include. Then, seek the guidance of legal and tax professionals to navigate the complexities of the trust setup process. Platforms like uslegalforms can make this journey easier by providing the necessary templates and guidance.

You generally cannot add new assets to a Michigan Charitable Remainder Inter Vivos Annuity Trust once it is established. This limitation emphasizes the importance of careful planning. If you anticipate needing to add assets later, you might consider other options, or consult with a professional to ensure your goals are met.

The key difference lies in their structure and tax implications. A Michigan Charitable Remainder Inter Vivos Annuity Trust allows you to donate assets while retaining income for a specified period. In contrast, a charitable gift annuity typically offers fixed income but does not allow you to manage the trust's assets or control its distribution.