Michigan Tax Free Exchange Agreement Section 1031

Description

How to fill out Tax Free Exchange Agreement Section 1031?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by groups, states, or keywords. You can find the latest versions of forms such as the Michigan Tax Free Exchange Agreement Section 1031 in a matter of seconds.

If you already have a membership, Log In and download the Michigan Tax Free Exchange Agreement Section 1031 from the US Legal Forms collection. The Download option will be available on every form you view. You will have access to all previously saved forms within the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill, modify, print, and sign the downloaded Michigan Tax Free Exchange Agreement Section 1031. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you need. Access the Michigan Tax Free Exchange Agreement Section 1031 with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

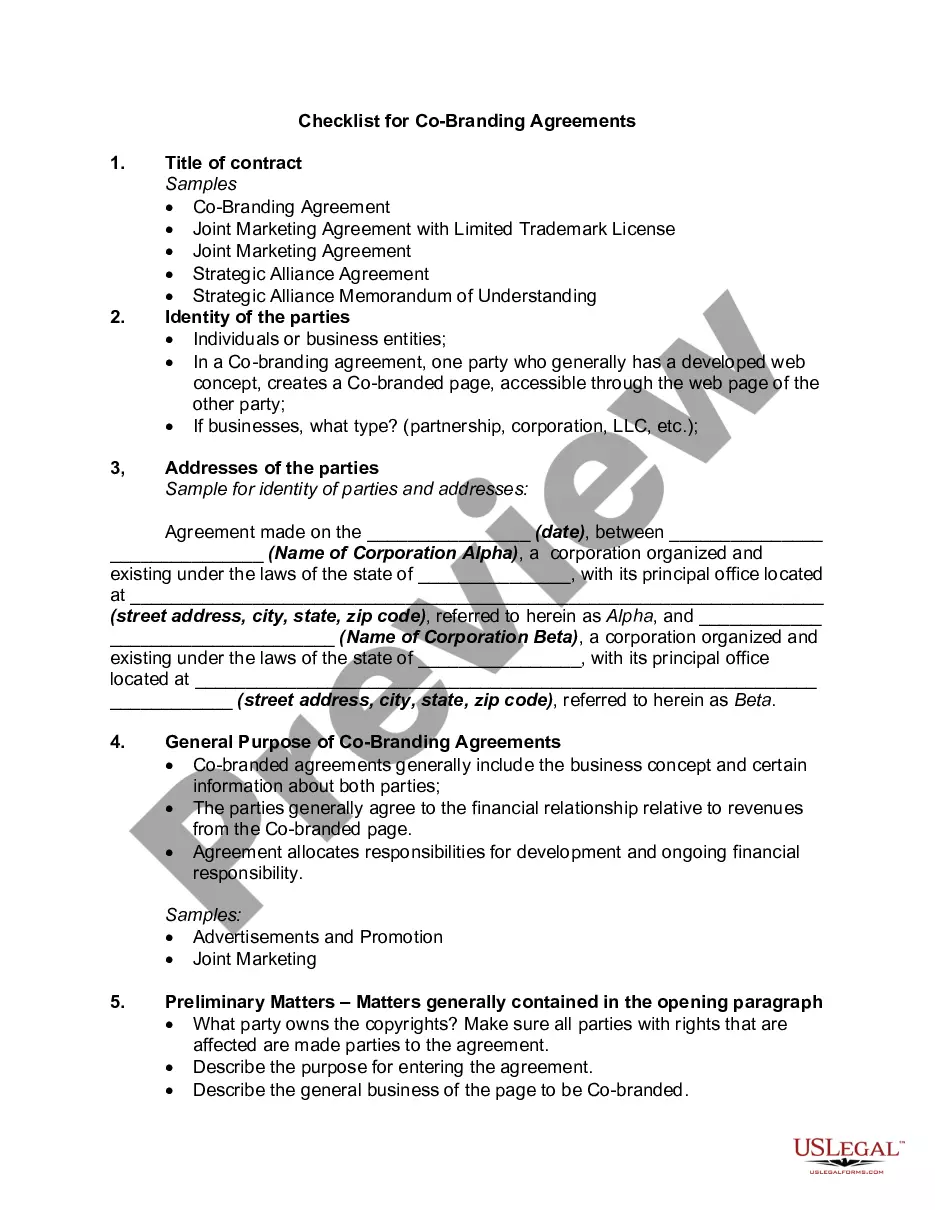

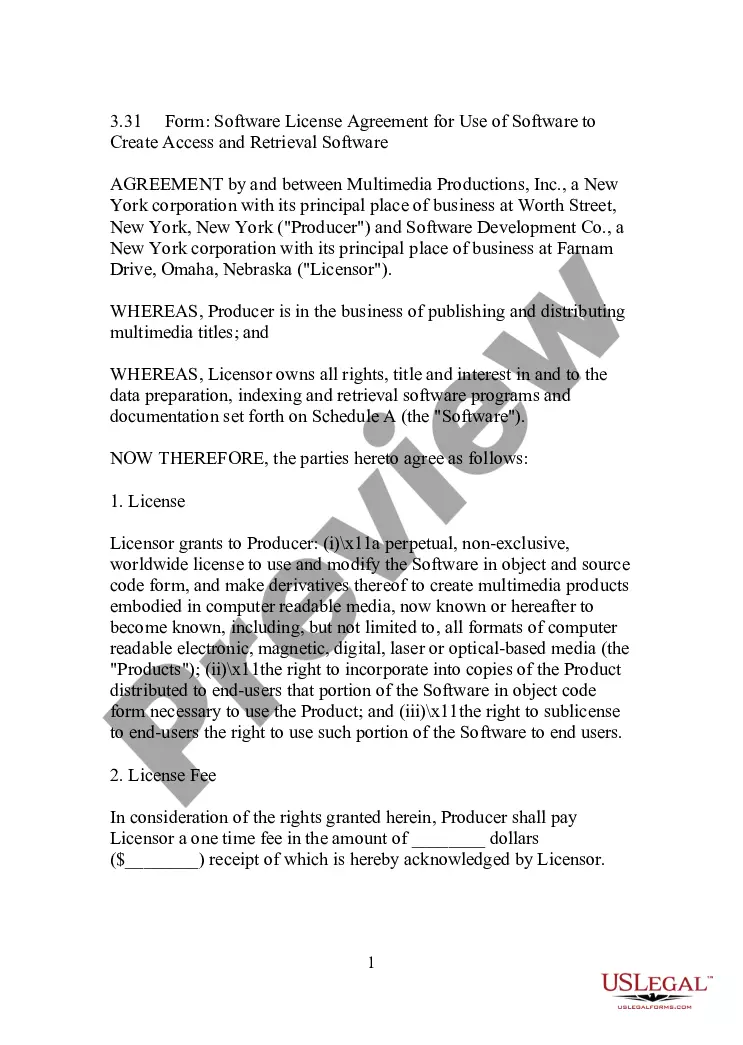

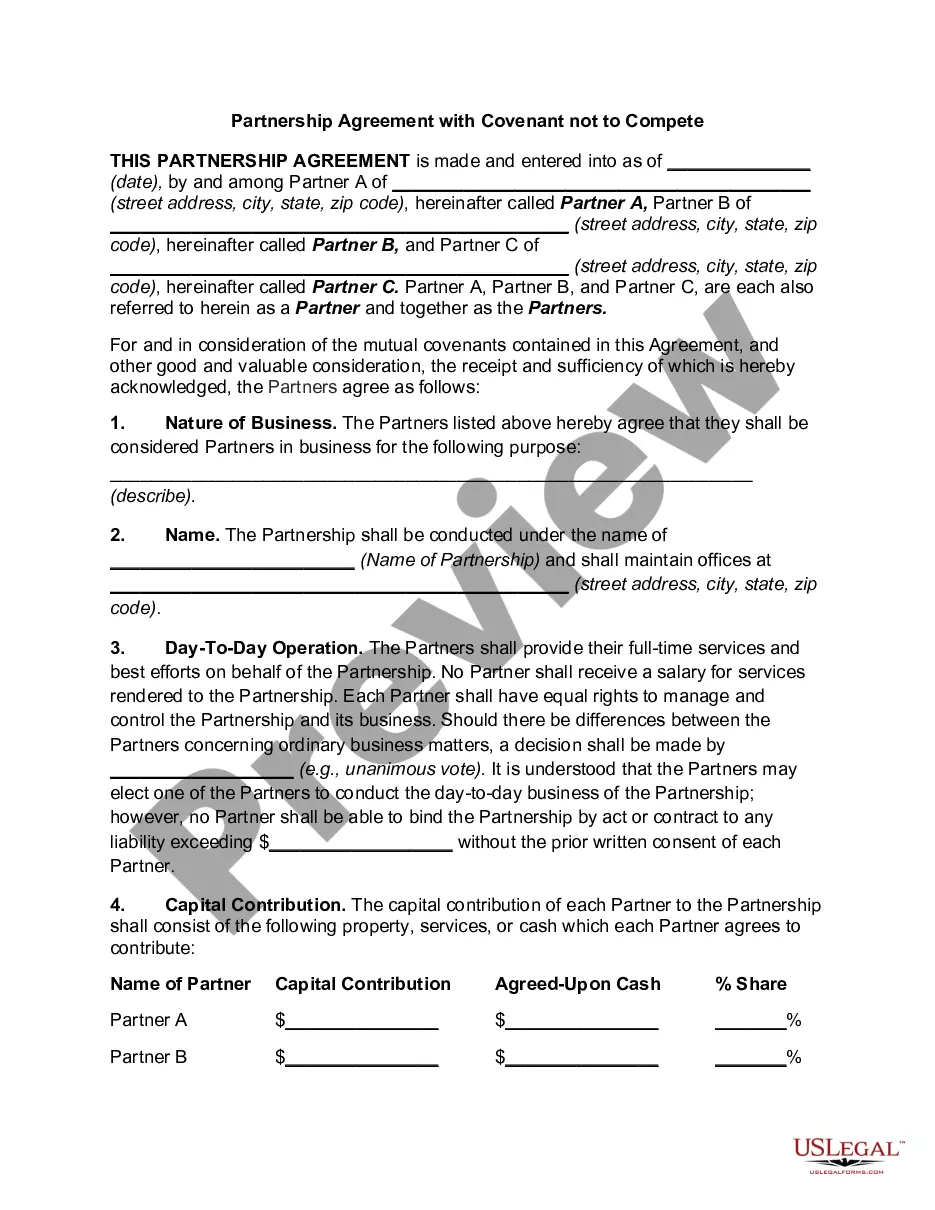

- Click on the Preview option to review the form's content.

- Read the form description to verify that you have chosen the right form.

- If the form doesn't meet your needs, use the Search bar at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

Any rental property sold by those who qualify in accordance with IRS rules as real estate professionals is not considered passive and thus will not be counted as net investment income. The gain deferred in a 1031 exchange is not included in your Adjusted Gross income (AGI) or Net Investment Income (NII).

You may rent your exchange property to a relative provided that you strictly follow three basic rules: 1) the rent you charge has to be fair market value for that property, 2) your rental agreement must be in writing and you must enforce the terms of the agreement (most importantly the clause dealing with the late

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Also, Section 121 has a special rule for 1031 property that states that you have to own the home for at least 5 years (either as 1031 property or principal residence) before you sell it.

Nontaxable Exchanges - A nontaxable exchange is an exchange in which any gain is not taxed and any loss can not be deducted. If you receive property in a nontaxable exchange, its basis is usually the same as the basis of the property you exchanged.

How to Avoid Boot in a 1031 ExchangeTrade up in real estate value with one or more replacement properties.Reinvest all of your 1031 exchange proceeds from the relinquished property into the replacement property.Maintain or increase the amount of debt on the replacement property.More items...?

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Potential Drawbacks of a 1031 DST Exchange1031 DST investors give up control.The 1031 DST properties are illiquid.Costs, fees and charges.You must be an accredited investor.You cannot raise new capital in a 1031 DST.Small offering size.DSTs must adhere to strict prohibitions.

HOW TO REPORT THE EXCHANGE. Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return. If you completed more than one exchange, a different form must be completed for each exchange.