Michigan Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Employment Contract Of Consultant With Nonprofit Corporation?

If you wish to complete, acquire, or print legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site's straightforward and efficient search feature to obtain the documents you need.

Numerous templates for business and personal purposes are categorized by categories and states, or by keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you wish and provide your information to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Michigan Employment Contract of Consultant with Nonprofit Corporation with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to retrieve the Michigan Employment Contract of Consultant with Nonprofit Corporation.

- You can also view forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

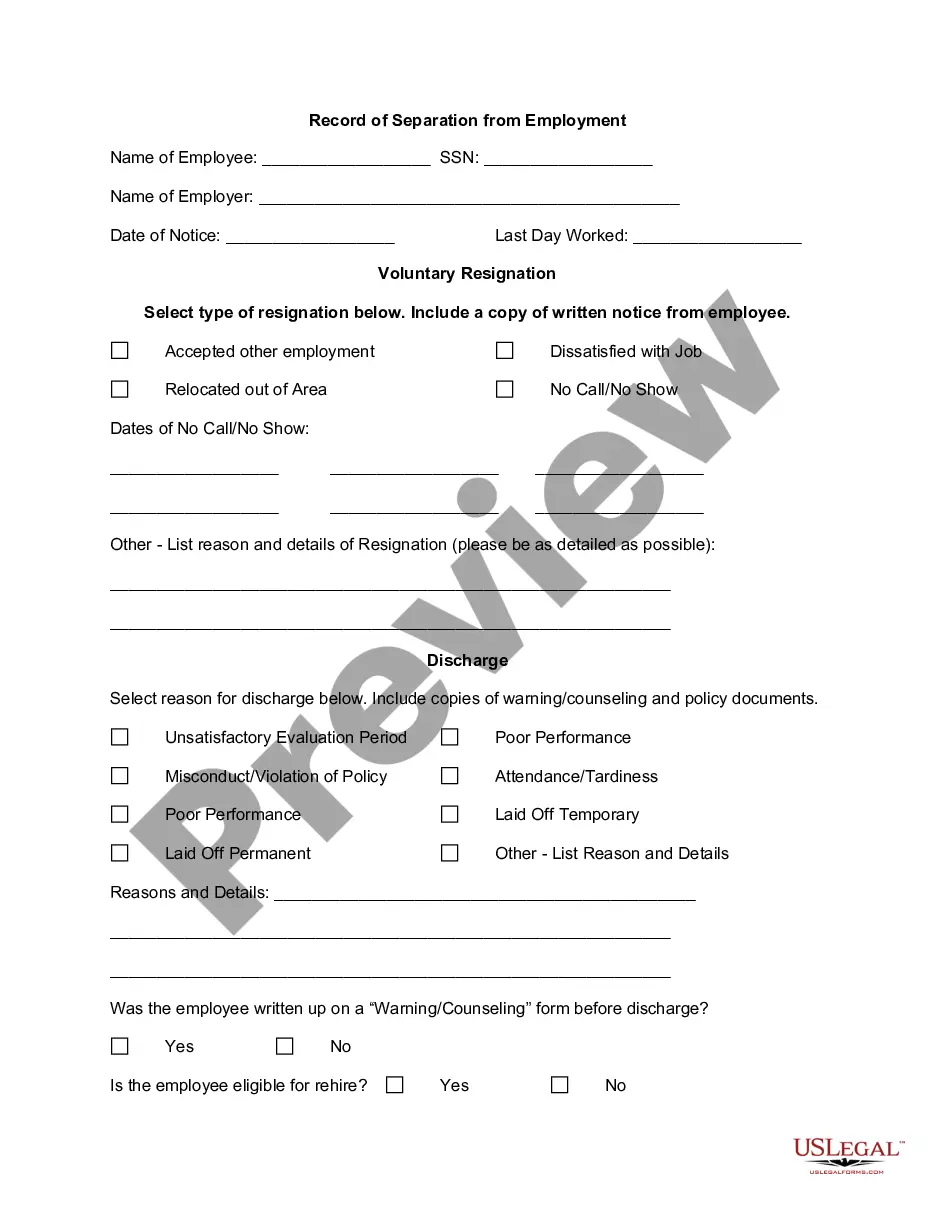

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

In Michigan, nonprofits are primarily regulated by the Michigan Department of Licensing and Regulatory Affairs (LARA). This agency oversees the formation and compliance of nonprofit entities, ensuring they operate within legal guidelines. Understanding these regulations is essential when entering into a Michigan Employment Contract of Consultant with Nonprofit Corporation, as it helps ensure that the organization adheres to state laws.

Yes, Michigan requires 501(c)(3) nonprofit corporations to file Form 990 with the IRS annually. This form provides vital information about the organization’s financial status, activities, and governance. Maintaining compliance with Form 990 is crucial for any nonprofit, especially when drafting a Michigan Employment Contract of Consultant with Nonprofit Corporation, as it reflects the organization's commitment to transparency.

A nonprofit corporation in Michigan must have at least three board members. This requirement promotes transparency and accountability within the organization. When setting up a Michigan Employment Contract of Consultant with Nonprofit Corporation, having a sufficient number of board members aids in decision-making and effective governance.

Yes, employment contracts are generally enforceable in Michigan, provided they meet specific legal requirements. It is vital for both the employer and employee to understand their rights and obligations outlined in the contract. For nonprofits, having a well-drafted Michigan Employment Contract of Consultant with Nonprofit Corporation can help ensure clarity and enforceability in the employment relationship.

An LLC cannot qualify as a nonprofit under Michigan law. Nonprofits typically operate as corporations and must adhere to specific regulations that govern their activities. If you are considering establishing a Michigan Employment Contract of Consultant with Nonprofit Corporation, it is essential to understand the legal distinctions between nonprofit corporations and LLCs.

In Michigan, a 501(c)(3) nonprofit corporation must have at least three directors on its board. Each director should not be related to another director, ensuring diverse perspectives in governance. This structure supports the effective management of the organization, especially when creating a Michigan Employment Contract of Consultant with Nonprofit Corporation, which establishes clear roles and expectations.

For a contract to be legally binding in Michigan, it must contain an offer, acceptance, consideration, and lawful purpose. The Michigan Employment Contract of Consultant with Nonprofit Corporation should clearly outline these elements to ensure enforceability. Additionally, both parties must have the legal capacity to enter into the contract. Understanding these components can greatly enhance the validity of your agreements.

Yes, you can cancel a contract in Michigan under specific circumstances, such as mutual agreement or breach of contract. A Michigan Employment Contract of Consultant with Nonprofit Corporation might include termination clauses that outline these conditions. Being aware of the terms can help you manage your contract more effectively. It's wise to consult a legal professional before taking such actions to understand the implications.

Employment laws in Michigan cover various aspects including wage and hour laws, discrimination protections, and workplace safety regulations. These laws impact how a Michigan Employment Contract of Consultant with Nonprofit Corporation should be structured and adhered to. By familiarizing yourself with these laws, you can ensure that your contracts are compliant and fair. Always consider seeking legal advice for the best practices.

Michigan contract law governs agreements made in the state, requiring mutual consent, consideration, and lawful objectives. When you're preparing a Michigan Employment Contract of Consultant with Nonprofit Corporation, understanding these fundamentals is crucial. This law ensures that both parties have clear expectations and that the agreement upholds state requirements. Consulting a legal expert can provide added assurance.