Michigan Shareholder Agreement to Sell Stock to Other Shareholder

Description

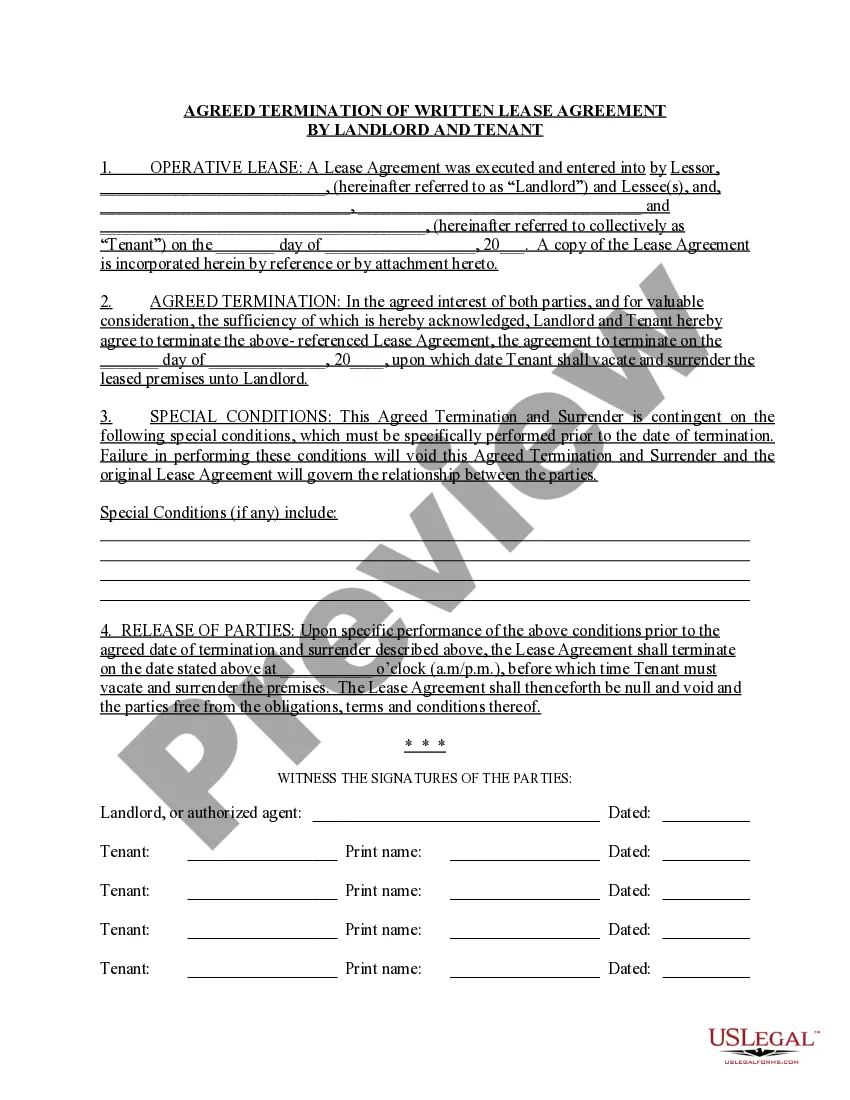

How to fill out Shareholder Agreement To Sell Stock To Other Shareholder?

Selecting the appropriate authorized document format can be challenging. It goes without saying that there are numerous templates accessible online, but how can you find the correct legal template that you require? Utilize the US Legal Forms website. This service offers an extensive collection of templates, including the Michigan Shareholder Agreement to Sell Stock to Other Shareholder, suitable for both business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Michigan Shareholder Agreement to Sell Stock to Other Shareholder. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents tab in your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward steps to follow: First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and review the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search area to find the appropriate document. Once you are confident that the form is suitable, click the Buy now button to obtain the form. Choose the payment plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the authorized file for your device. Complete, edit, and print the acquired Michigan Shareholder Agreement to Sell Stock to Other Shareholder.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to obtain professionally prepared documents that adhere to state regulations.

Form popularity

FAQ

Yes, you can sell shares without a physical certificate, as many companies now issue shares electronically. However, it is still essential to follow the guidelines laid out in your Michigan Shareholder Agreement to Sell Stock to Other Shareholder to handle such transactions properly. This agreement will guide the process, ensuring compliance with relevant laws. When selling shares without certificates, maintaining clear records and communication with fellow shareholders is crucial for a smooth transaction.

Issuing shares usually requires shareholder approval, especially in larger corporations or those with strict bylaws. The Michigan Shareholder Agreement to Sell Stock to Other Shareholder specifies how and when shares can be issued, ensuring that all shareholders agree on the increase in capital. This process plays a crucial role in maintaining equity and protecting existing shareholders' interests. It is wise to consult this agreement to navigate issuing shares smoothly and efficiently.

Yes, you typically need shareholder approval to sell a company, depending on your corporate bylaws and the structure of your organization. The Michigan Shareholder Agreement to Sell Stock to Other Shareholder outlines the process for such transactions and helps ensure all legal requirements are met. This agreement allows shareholders to weigh in on significant decisions, promoting transparency and trust among stakeholders. Using a well-defined agreement can help avoid potential disputes during the sale process.

Yes, a shareholder can transfer shares to another person, provided that the Michigan Shareholder Agreement to Sell Stock to Other Shareholder allows for such transfers. The agreement typically outlines the necessary conditions and processes for a valid transfer. Always ensure the transfer complies with the terms set forth in your agreement.

This depends on the provisions laid out in your Michigan Shareholder Agreement to Sell Stock to Other Shareholder. Often, significant changes, including the sale of shares, may require approval from other shareholders. Consulting your agreement will provide clarity on whether you need such approvals.

A shareholder holding 50% of the shares typically has certain rights, but they may still be bound by the terms of a Michigan Shareholder Agreement to Sell Stock to Other Shareholder. If the agreement imposes restrictions on selling shares to outside parties, those must be followed. It's essential to understand your agreement to know your options.

Yes, a shareholder can sell shares to another shareholder as long as the terms are compliant with the Michigan Shareholder Agreement to Sell Stock to Other Shareholder. This agreement specifies the procedures and rights of shareholders regarding such transactions. Reviewing this document prior to selling is key to ensuring a smooth sale.

You can obtain a shareholder agreement through various platforms, including U.S. Legal Forms, which offers templates for a Michigan Shareholder Agreement to Sell Stock to Other Shareholder. These templates can be customized to suit your company's specific needs. It's also wise to have a legal professional review the agreement to ensure compliance and protection for all parties involved.

Not necessarily. A Michigan Shareholder Agreement to Sell Stock to Other Shareholder may specify that only a certain percentage of shareholders need to agree to a sale. However, it is crucial to check the conditions laid out in your specific agreement to understand what is required for selling shares.

Generally, you cannot force a shareholder to sell their shares without a legal basis specified in a Michigan Shareholder Agreement to Sell Stock to Other Shareholder. Certain circumstances, like a buy-sell provision, may provide for forced sales, but these must be clearly defined in the agreement. Consulting a legal professional can help clarify the specifics of your situation.