Title: Understanding and Crafting a Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits Introduction: In Michigan, individuals who have experienced identity theft or imposter scenarios may need to draft a letter to their creditors to accept responsibility for any fraudulent accounts, charges, or debits incurred. This detailed description will guide you through the process of crafting such a letter, ensuring that you include the necessary information and comply with relevant regulations. Additionally, this article will touch upon different variations or situations where such a letter may be required for clarity. Keywords: Michigan, letter, known imposter, creditor, accepting responsibility, accounts, charges, debits, identity theft, fraudulent, letter types. 1. Understanding the Purpose and Importance of a Michigan Letter from Known Imposter to Creditor: Identity theft is a serious and distressing crime that can wreak havoc on an individual's financial well-being. To rectify the situation, victims often need to reach out to their creditors officially, notifying them of the fraudulent transactions and accepting responsibility for resolving the matter. A carefully drafted Michigan Letter from a Known Imposter to a Creditor helps establish a legal document that outlines the victim's commitment to resolving the unauthorized accounts, charges, or debits that have been made in their name. 2. Key Components of a Michigan Letter from Known Imposter to Creditor: To ensure the letter is comprehensive and has the desired impact, it is vital to include the following essential elements: — HeadinAndamanat— - Creditor's Name and Address — Victim's Personal and Account Information — Detailed Explanation of thSituationio— - Declaration of Responsibility for Fraudulent Accounts, Charges, or Debits — SupportinDocumentationio— - Request for Cooperation — ContInformationatio— - Signature 3. Types of Michigan Letters from Known Imposter to Creditor Accepting Responsibility: a) Initial Notification Letter: This letter variant is used when the victim discovers the identity theft or fraudulent activity for the first time. It states the intention to accept responsibility for resolving the unauthorized accounts, charges, or debits, and requests the creditor's cooperation in investigating and rectifying the situation. b) Follow-up Investigation Letter: This type of letter is sent when the victim receives information or updates from the creditor regarding their investigation into the fraud. It serves as a response and reaffirms the victim's commitment to assisting in the investigation and resolving the issue promptly. c) Agreement/Resolution Letter: Once the creditor has concluded the investigation and resolved the fraudulent accounts, charges, or debits, the victim may send this letter to acknowledge the resolution and express gratitude for the creditor's cooperation. It can also include any agreed-upon terms for closing the matter on both ends. Conclusion: Crafting a Michigan Letter from a Known Imposter to a Creditor accepting responsibility for fraudulent accounts, charges, or debits is a crucial step towards resolving the aftermath of identity theft. By ensuring you include the necessary information and adhere to the guidelines, you can increase the chances of a smooth resolution with your creditors and protect your financial well-being. Keywords: Michigan, letter, known imposter, creditor, accepting responsibility, accounts, charges, debits, identity theft, fraudulent, initial notification, follow-up investigation, agreement, resolution.

Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Michigan Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

US Legal Forms - one of many greatest libraries of authorized types in America - gives a variety of authorized document templates you are able to down load or print. Using the internet site, you will get a huge number of types for company and specific purposes, categorized by types, says, or keywords.You can get the newest models of types just like the Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits in seconds.

If you already possess a registration, log in and down load Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits through the US Legal Forms collection. The Down load option can look on each and every type you view. You have access to all formerly delivered electronically types within the My Forms tab of your accounts.

If you wish to use US Legal Forms the very first time, listed below are simple directions to get you started:

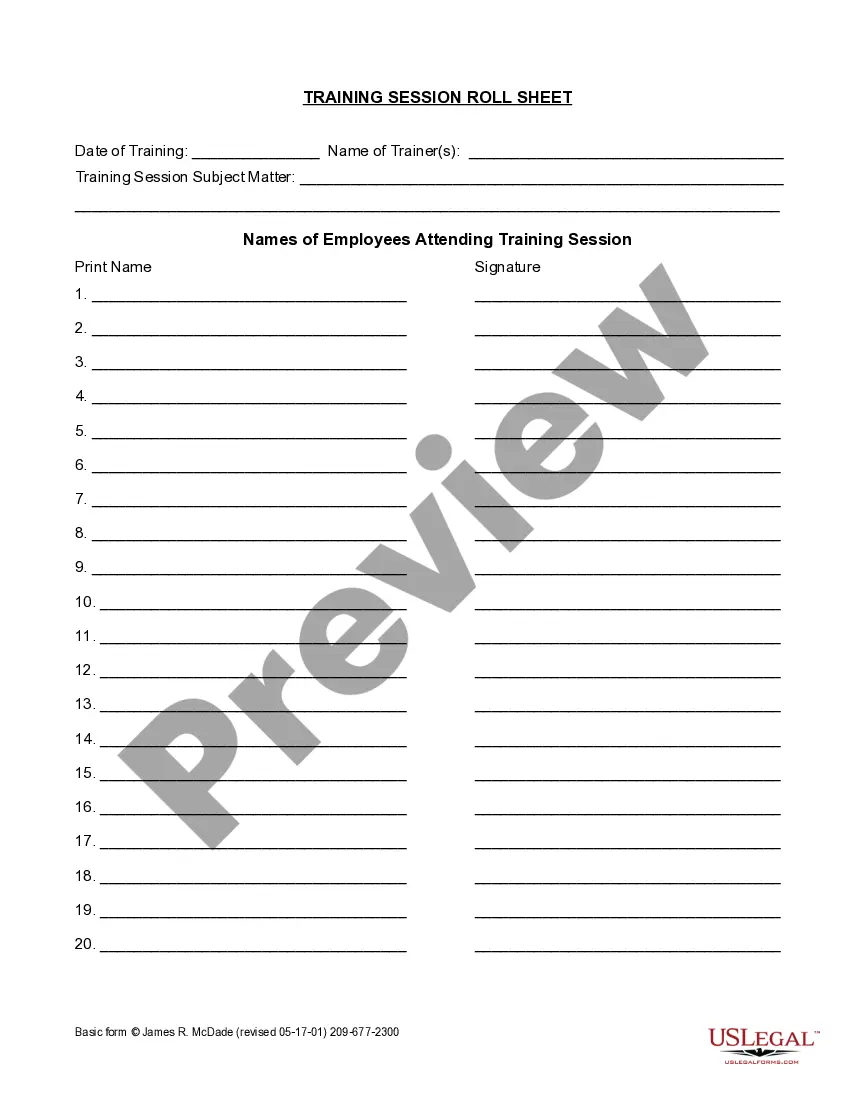

- Ensure you have chosen the proper type to your area/county. Click the Review option to review the form`s content material. Look at the type outline to ensure that you have chosen the proper type.

- In case the type does not satisfy your demands, use the Search field on top of the screen to find the one who does.

- If you are satisfied with the form, confirm your choice by visiting the Purchase now option. Then, pick the prices program you prefer and give your references to sign up on an accounts.

- Approach the deal. Make use of bank card or PayPal accounts to accomplish the deal.

- Find the format and down load the form in your system.

- Make modifications. Fill out, edit and print and signal the delivered electronically Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

Each format you put into your account lacks an expiry particular date which is your own permanently. So, in order to down load or print another version, just proceed to the My Forms portion and click about the type you require.

Gain access to the Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits with US Legal Forms, the most considerable collection of authorized document templates. Use a huge number of specialist and express-certain templates that fulfill your company or specific needs and demands.