Michigan Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

How to fill out Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

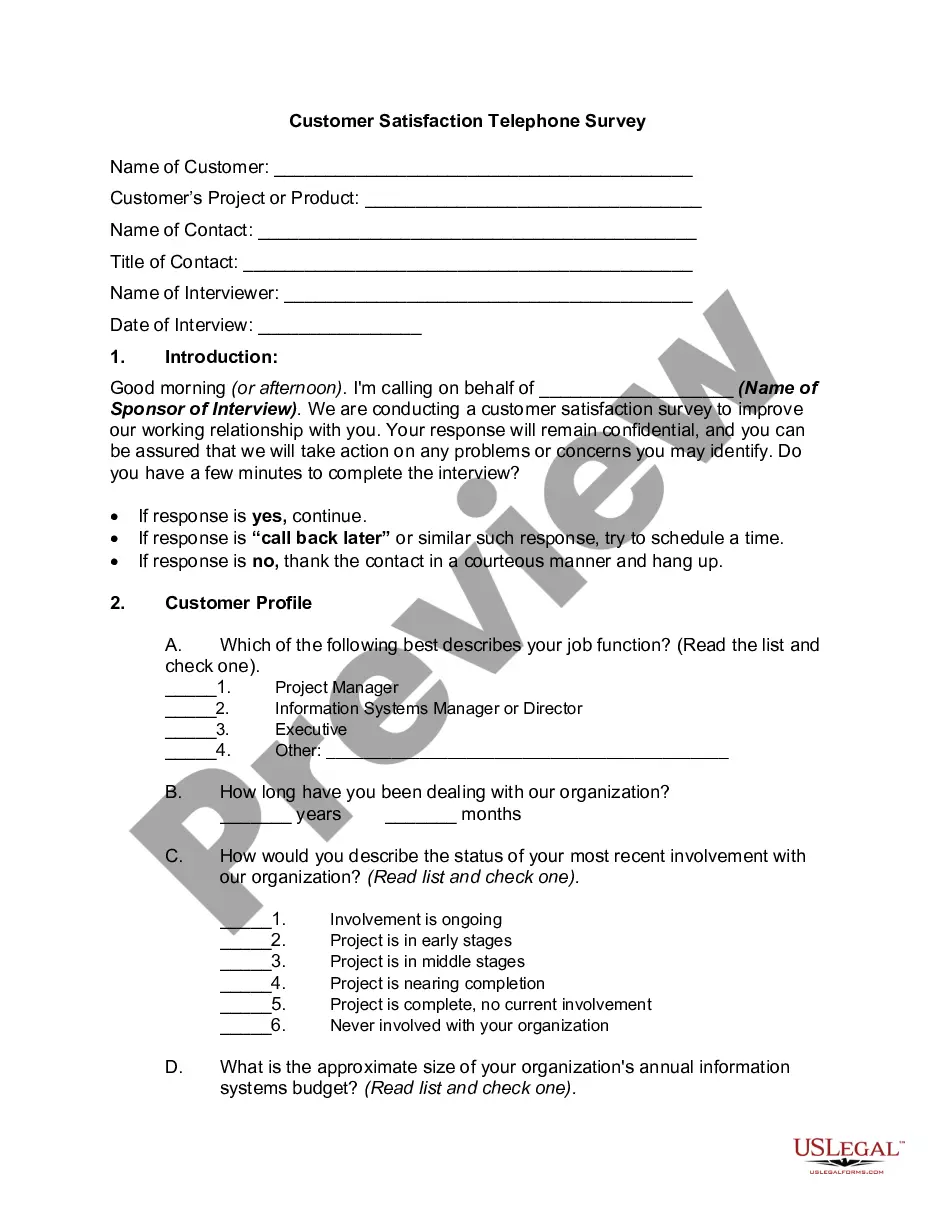

Selecting the appropriate valid document format can be rather challenging. Of course, there are numerous templates accessible online, but how do you find the valid form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Michigan Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Indebtedness, which can be utilized for business and personal needs. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Michigan Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Indebtedness. Use your account to search through the legal documents you have purchased previously. Navigate to the My documents tab in your account and retrieve an additional copy of the document you need.

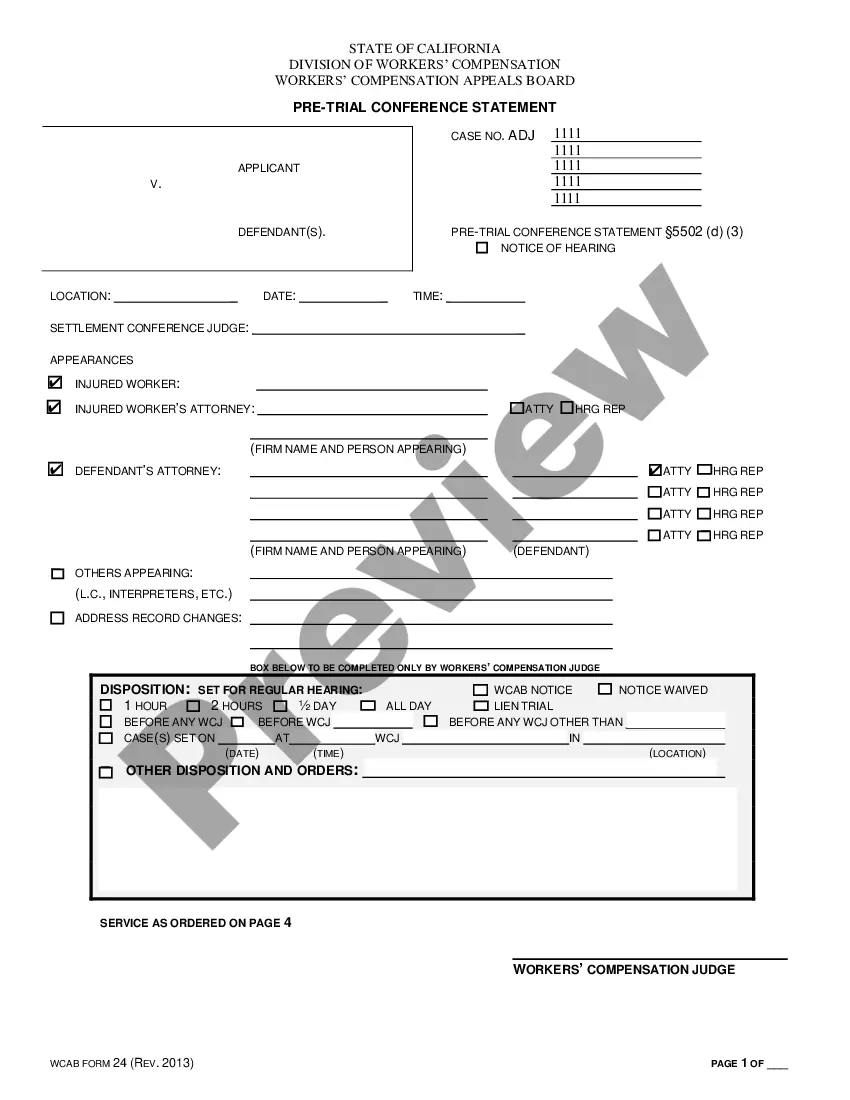

If you are a new user of US Legal Forms, here are some straightforward guidelines you should follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview option and examine the form summary to confirm it is indeed the right one for you. If the form does not meet your requirements, utilize the Search field to find the right document. Once you are certain that the form is accurate, click the Buy now button to acquire the form. Select the payment plan you wish and provide the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document format onto your device. Fill out, edit, print, and sign the obtained Michigan Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Indebtedness.

Make the most of US Legal Forms for obtaining quality legal documents tailored to your requirements.

- US Legal Forms is the largest collection of legal documents available with a variety of document templates.

- Utilize the service to obtain professionally crafted papers that adhere to state regulations.

- Ensure you have chosen the correct document for your specific needs.

- Take advantage of the preview feature to assess the document before purchasing.

- Use the search function to locate the appropriate form if necessary.

- Complete the payment process securely through recognized payment methods.

Form popularity

FAQ

A lien grants a lender the legal right to seize assets or property that have been designated as collateral in order to satisfy a debt if the payment terms are not met. A lien allows the lender to easily obtain legal approval from the courts to seize the property.

A lien refers to a legal claim against property that can be used as collateral to repay a debt. Depending on the type of debt owed, liens can be attached to real property, such as a home, or personal property, such as a car or furniture.

Definitions of general lien. a lien on all the property owned by a debtor and not just a specific property. type of: lien. the right to take another's property if an obligation is not discharged.

A pledge arises where there is a delivery of goods to a creditor for the purpose of securing a debt due to him by their owner. A lien is a right to retain goods to secure payment. Both a pledge and lien involve a bailment. The pledgee and lienee are bailees and have the obligations of a bailee.

A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

Either way, if you or the business can't pay back the debt, a secured creditor can repossess or foreclose on the secured property, or order it to be sold, to satisfy the debt.

Secured partyThe creditor who has a security interest in a debtor's collateral. is ?a person in whose favor a security interest is created or provided for under a security agreement,? and it includes people to whom accounts, chattel paper, payment intangibles, or promissory notes have been sold; consignors; and others ...

A lien created by operation of law not requiring the consent of, or a security agreement with, the debtor.

Default is the failure to make required interest or principal repayments on debt.

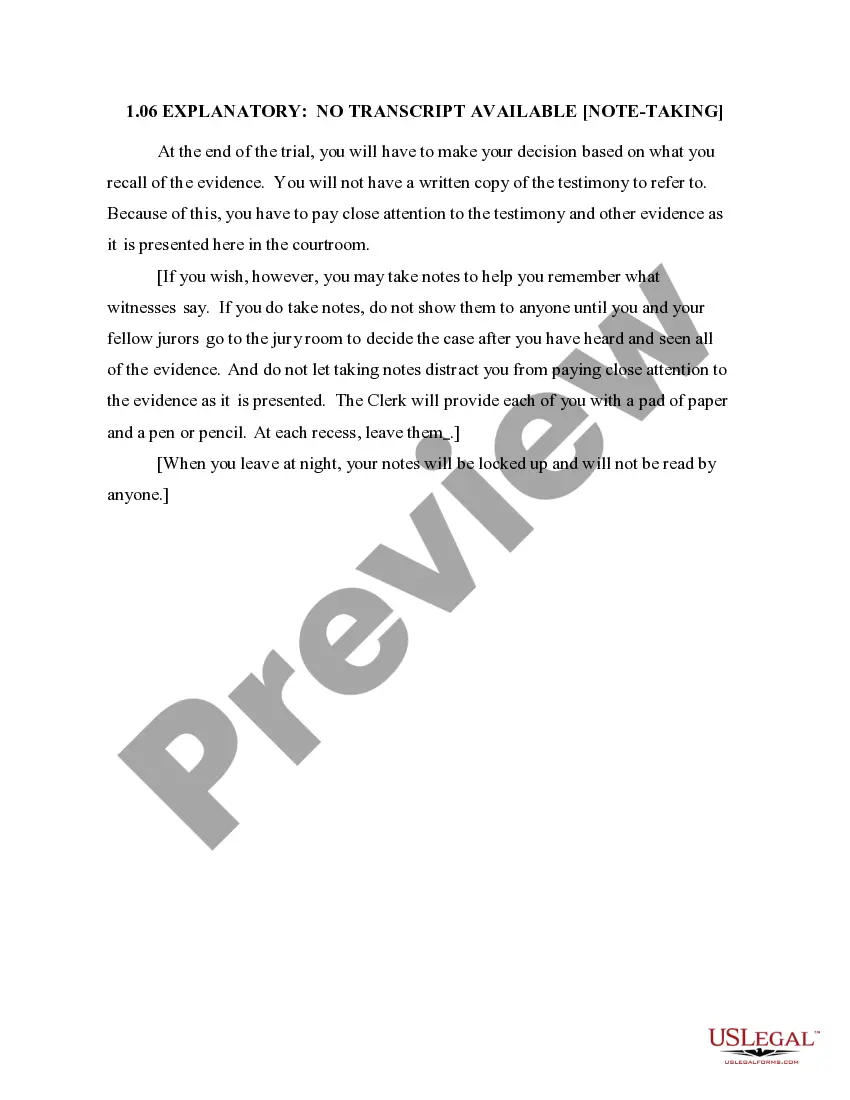

Default occurs when the debtor either fails to make a payment when due or violates his or her security agreement. After a debtor defaults, the secured party may obtain possession or control of the collateral by written consent of the debtor or by obtaining an order from the tribal court.