Michigan Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

It is feasible to spend hours online searching for the valid document template that complies with the state and national requirements you will need.

US Legal Forms offers countless valid forms that are reviewed by experts.

You can download or print the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental from my service.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can complete, modify, print, or endorse the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental.

- Every valid document template you obtain is yours permanently.

- To receive another version of the accessed form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for your county or city of your preference.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

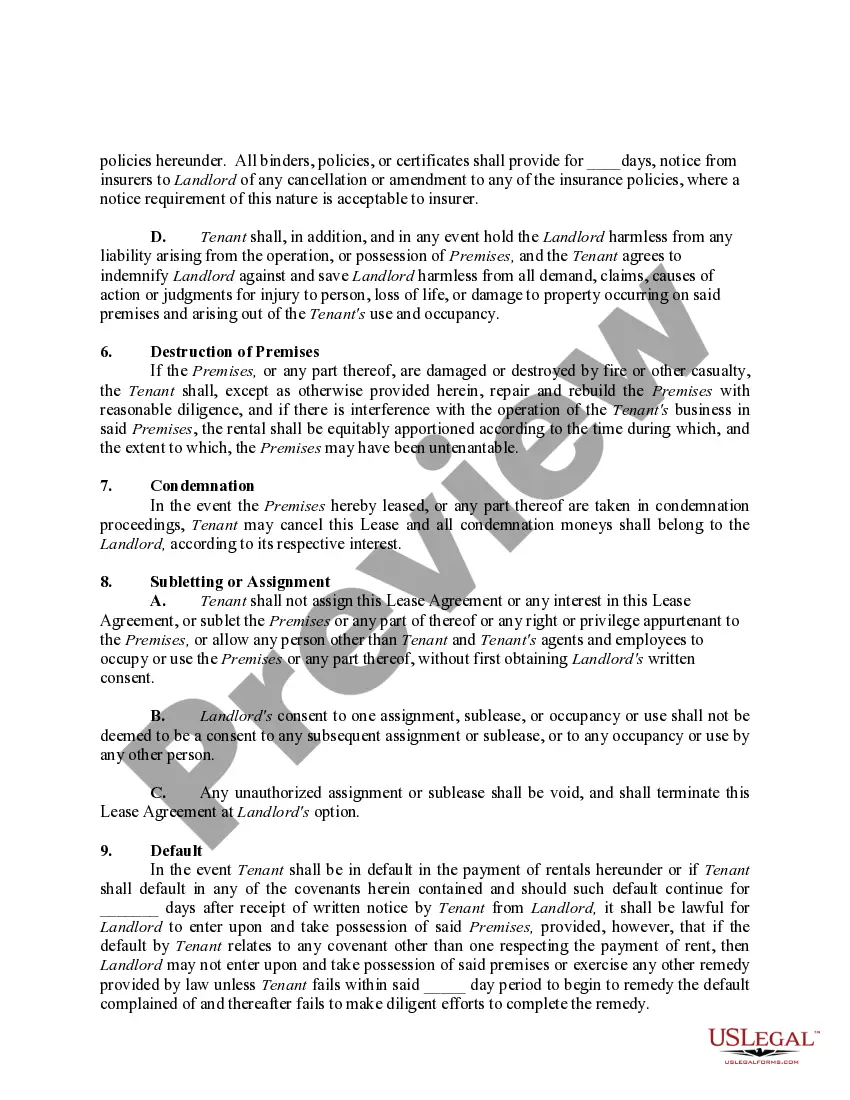

To calculate a triple net lease, total the annual property expenses, including taxes, insurance, and maintenance costs, and divide that figure by the square footage of the property. This gives you the expense per square foot, which you can add to the base rent per square foot. Ensure all calculations are clearly outlined in the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental to avoid any confusion. Using reliable tools or platforms like uslegalforms can simplify this process significantly.

An absolute triple net lease, or absolute NNN lease, offers landlords maximum security as tenants assume all operational costs and liabilities. Even in cases like bankruptcy, the tenant is still responsible for adhering to the lease terms. This structure provides a predictable income stream for landlords. A well-drafted Michigan Triple Net Commercial Lease Agreement - Real Estate Rental should clearly detail such arrangements.

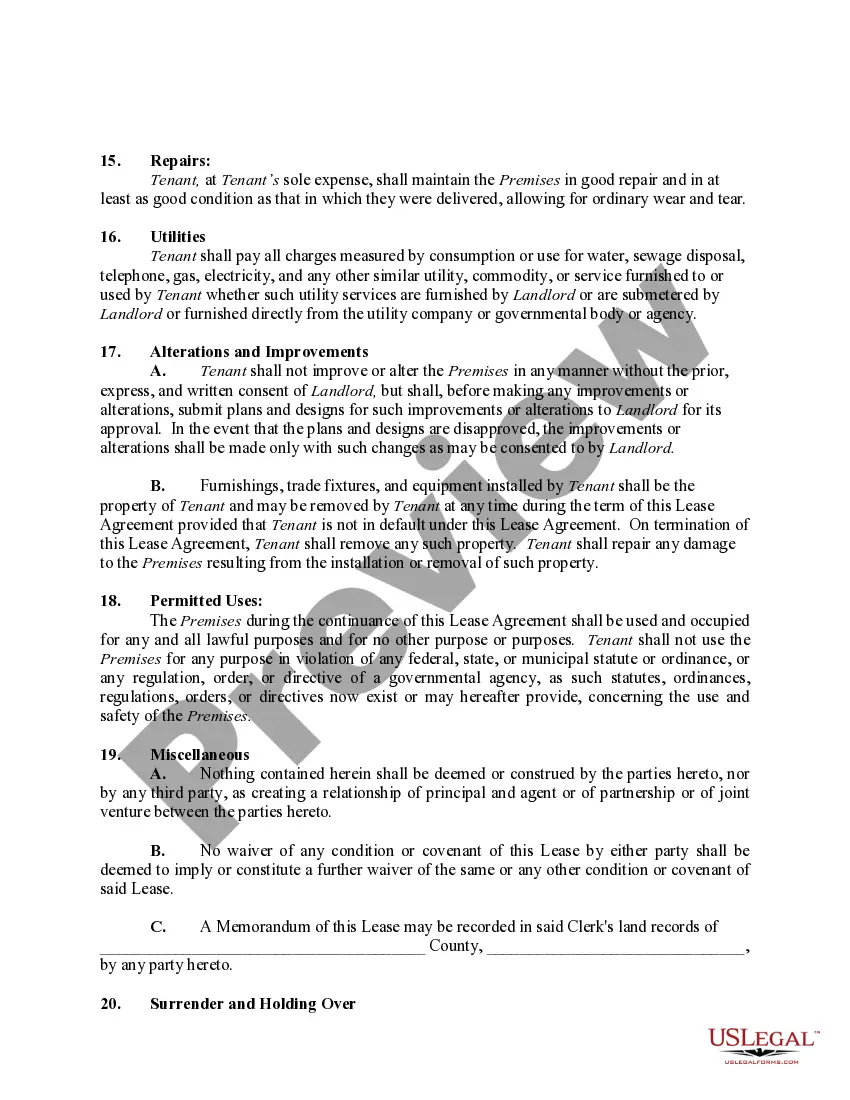

The opposite of a triple net lease is a gross lease. In a gross lease, the landlord covers all property-related expenses such as taxes, insurance, and maintenance. This arrangement creates a straightforward payment structure for tenants. When opting for a Michigan Triple Net Commercial Lease Agreement - Real Estate Rental, it's essential to know the difference to choose the best fit for your financial strategy.

The best triple net lease tenants are generally established businesses with a strong financial history, such as national retailers or service providers. These tenants offer stability and reliability, making them desirable for landlords. Additionally, they often have experience with the obligations tied to a Michigan Triple Net Commercial Lease Agreement - Real Estate Rental. This background can help ensure timely payments and reduce risk for the landlord.

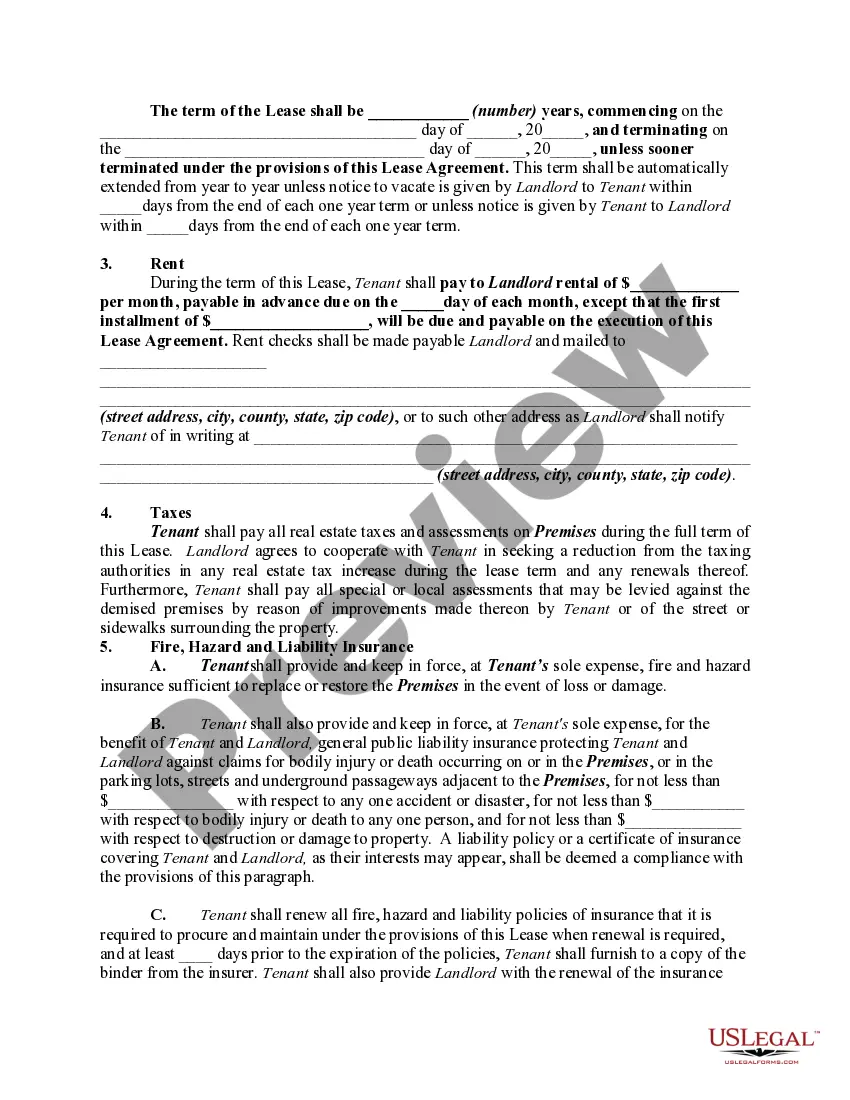

To structure a triple net lease, you should begin with defining the base rent, which the tenant pays, along with the net expenses they are responsible for covering. These expenses typically include property taxes, insurance, and maintenance costs. It's essential to outline each party's responsibilities clearly in the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental. This clarity prevents misunderstandings and protects both the landlord and tenant.

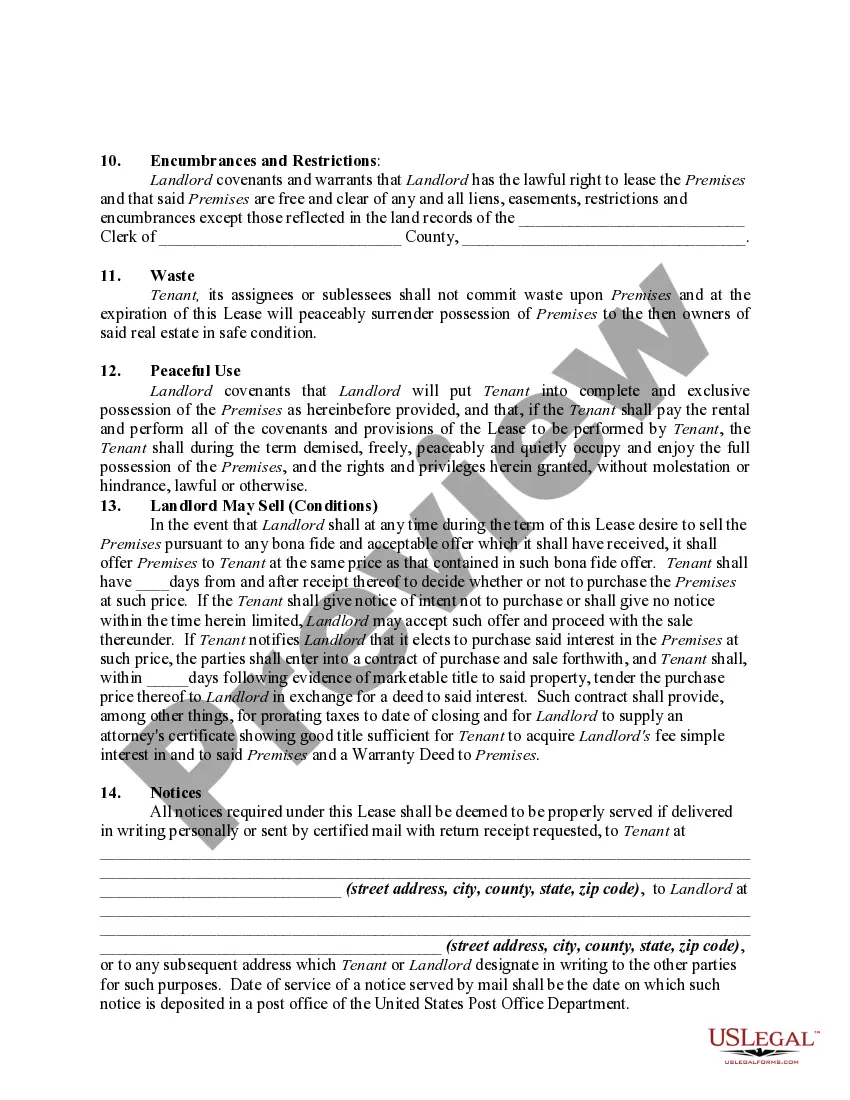

In Michigan, notarization of a lease agreement is not a requirement for it to be legally enforceable. However, having a notarized Michigan Triple Net Commercial Lease Agreement - Real Estate Rental can add an extra layer of protection for both parties. It verifies the identities of those involved and adds credibility. It's always a good idea to discuss options with a legal expert.

In a Michigan Triple Net Commercial Lease Agreement - Real Estate Rental, a landlord typically has several responsibilities. They must maintain the property in good condition, ensure utilities are functional, and comply with zoning laws. Moreover, landlords must provide a safe environment for tenants. Specifically for triple net leases, landlords may pass on additional expenses such as property taxes, insurance, and maintenance to tenants.

A commercial tenant has significant responsibilities under the lease agreement, including maintaining the property and adhering to the terms of the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental. Tenants must also ensure timely payments and mitigate any damages to the property. Understanding these responsibilities is vital for a successful landlord-tenant relationship and can help avoid potential disputes down the line.

The most common commercial lease agreement in Michigan is the Triple Net Lease, often referred to in discussions about the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental. This agreement allows landlords to pass on property expenses, such as taxes, insurance, and maintenance, directly to the tenant. This type of lease offers benefits for both parties, promoting clarity in financial responsibilities.

In Michigan, landlords have specific responsibilities under the law, which include maintaining the property in a safe and habitable condition. They must ensure adherence to local building codes and handle necessary repairs promptly. For those using the Michigan Triple Net Commercial Lease Agreement - Real Estate Rental, understanding these responsibilities is crucial, as it helps clarify obligations and enhances tenant satisfaction.