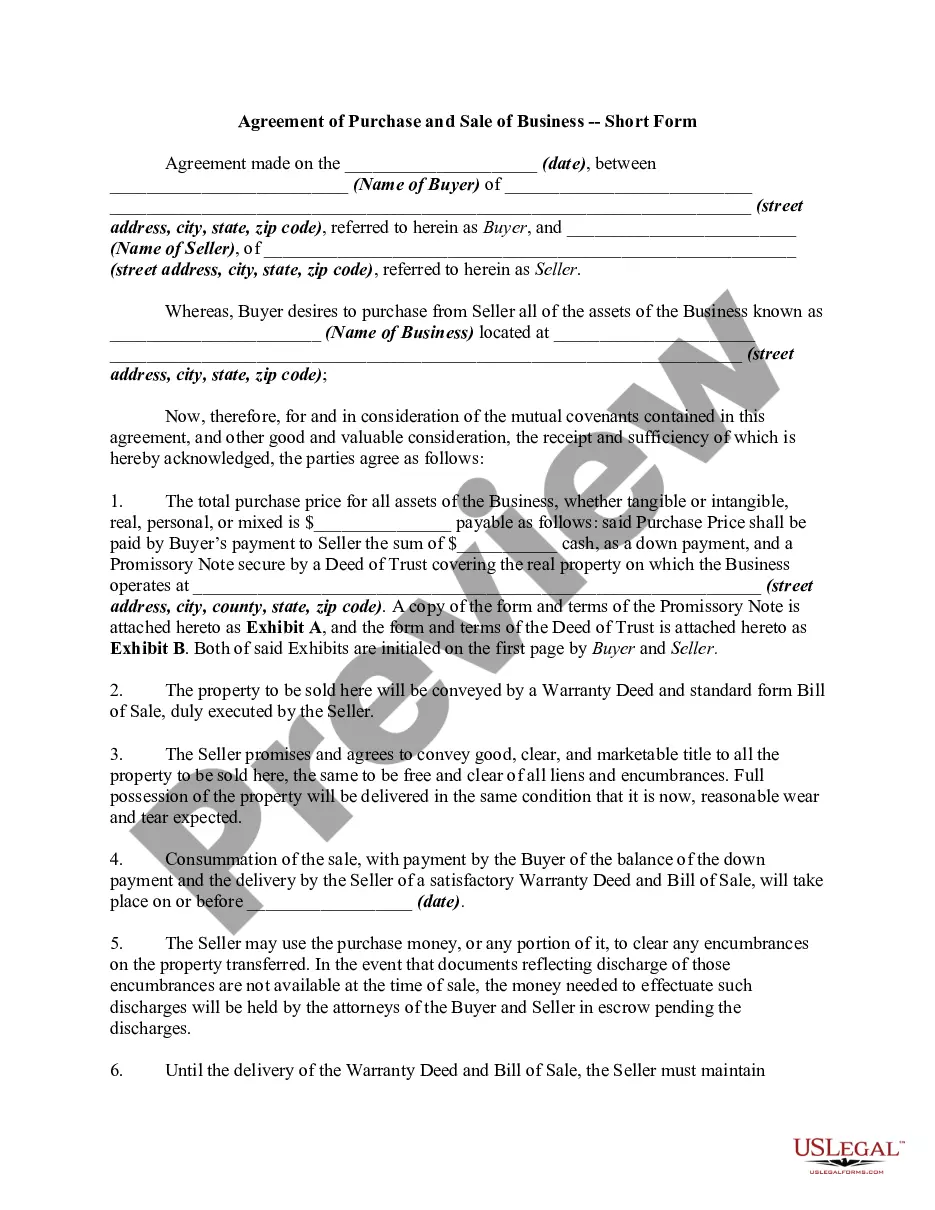

Michigan Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Selecting the optimal legal document template can be quite a challenge.

Undoubtedly, there are numerous designs available on the web, but how do you find the legal form you need.

Make use of the US Legal Forms website. This service offers a vast array of templates, such as the Michigan Agreement for Purchase of Business Assets from a Corporation, which can be utilized for commercial and personal purposes.

You can preview the form using the Review option and read the form description to ensure it is suitable for your needs.

- All the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download option to locate the Michigan Agreement for Purchase of Business Assets from a Corporation.

- Use your account to browse the legal documents you have acquired previously.

- Navigate to the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

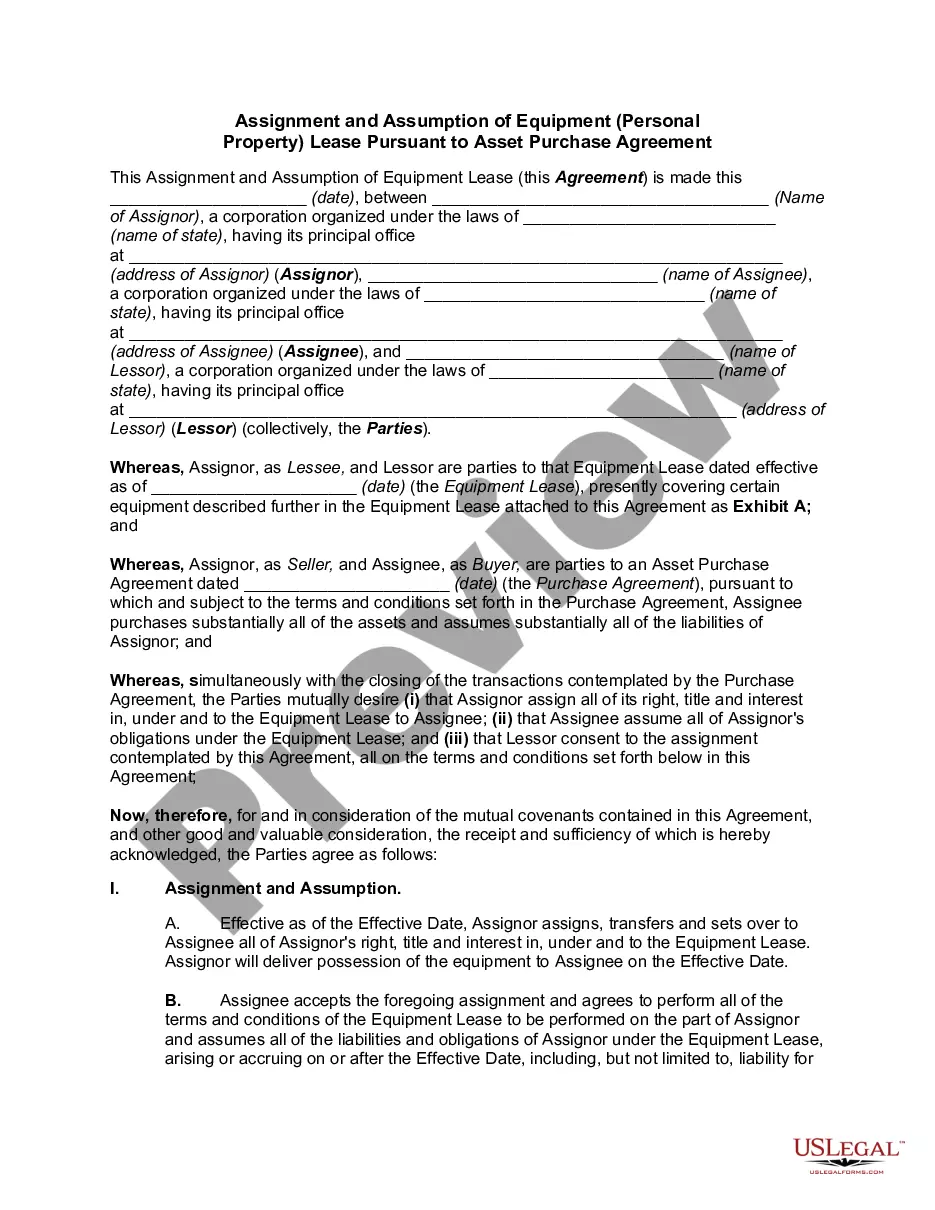

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The Michigan residential purchase and sale agreement is a document through which a seller of residential property agrees to transfer ownership to a buyer. The form can be used by the prospective buyer to make an initial offer to the seller, and if accepted, close the deal and transfer the property title.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership. The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.