Michigan Lease to Own for Commercial Property

Description

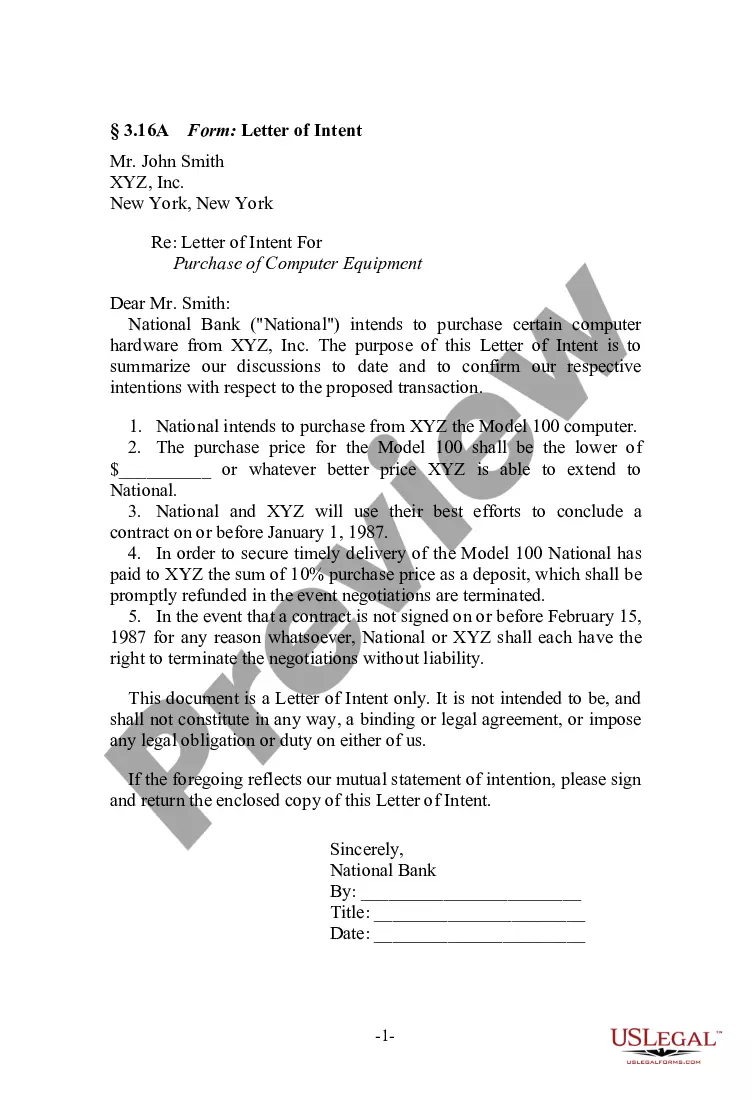

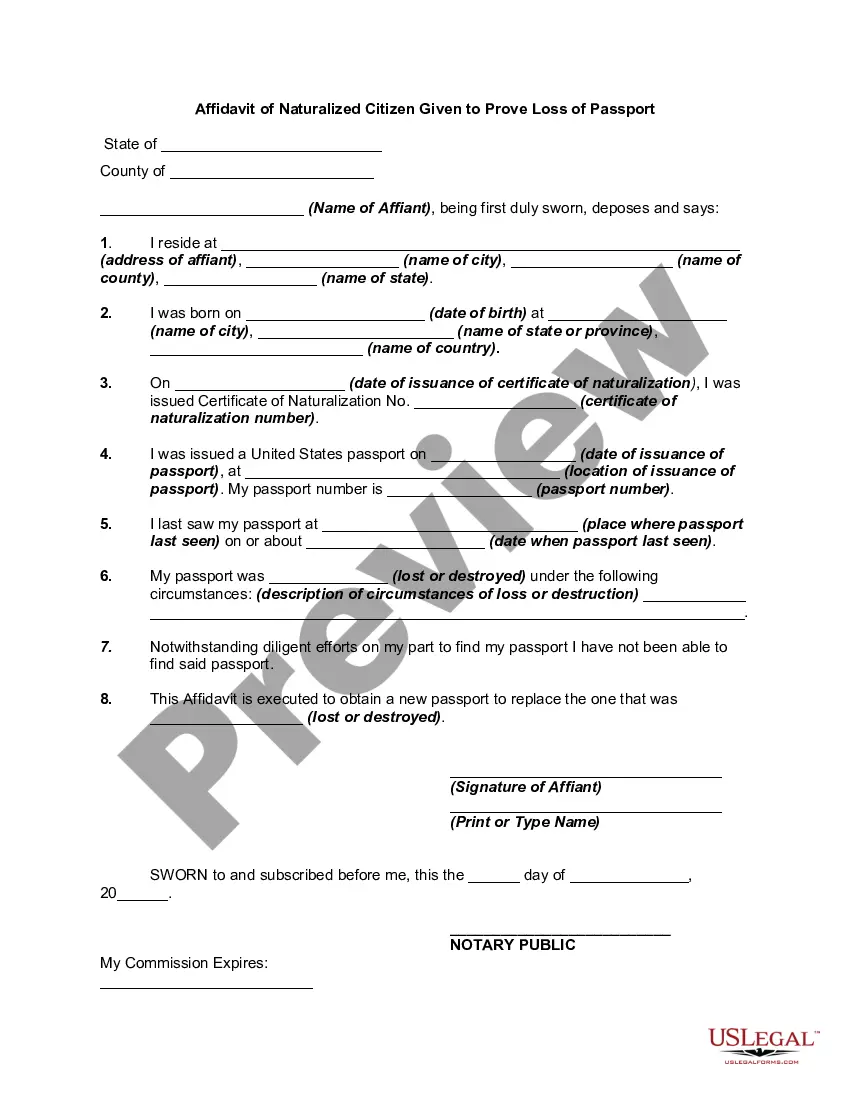

How to fill out Lease To Own For Commercial Property?

It is feasible to spend hours online searching for the valid document template that satisfies the federal and state requirements you require.

US Legal Forms offers thousands of valid forms that have been examined by professionals.

It is easy to download or print the Michigan Lease to Own for Commercial Property from my service.

To obtain an additional version of the template, use the Search area to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can fill out, modify, print, or sign the Michigan Lease to Own for Commercial Property.

- Every valid document template you purchase is yours indefinitely.

- To get another copy of any purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Review the form description to make sure you have selected the appropriate template.

Form popularity

FAQ

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

And, how the most common retail leases are structured: Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes.

Leasing is done for a fixed period mostly for the medium to long term. On the other hand, renting is done for a short period, emphasizing every month. In leasing contracts, the terms and conditions are predetermined, and the contracts are made by taking mutual acceptance.

Triple Net Lease Arguably the favorite among commercial landlords, the triple net lease, or NNN lease makes the tenant responsible for the majority of costs, including the base rent, property taxes, insurance, utilities and maintenance.

Commercial tenants usually remain in a property when a lease has expired because they are still negotiating the terms of a new, renewed lease with the landlord or they have an informal agreement to stay on.

It is not generally advisable to lease a commercial property without a written agreement. Issues typically arise when the landlord is looking to sell or take possession of the property and evict the tenant.

Under a rent to own agreement, a tenant pays a monthly fee. Most of it is rent; the rest goes towards the purchase of the home.