Michigan Standard Terms and Conditions for Merchandise Warehouses

Description

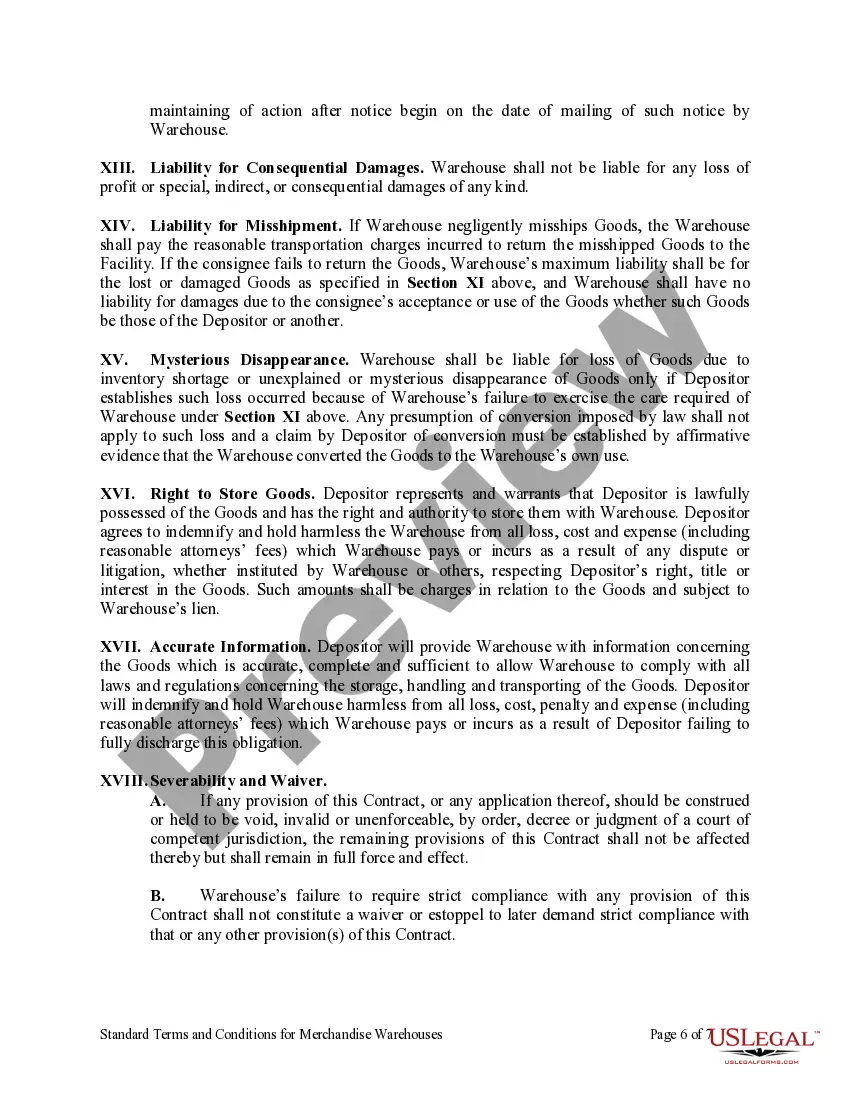

How to fill out Standard Terms And Conditions For Merchandise Warehouses?

Finding the appropriate legal document template can be quite challenging. Certainly, there is a plethora of templates accessible online, but how do you find the specific legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the Michigan Standard Terms and Conditions for Merchandise Warehouses, which can be utilized for both business and personal needs. All templates are evaluated by professionals and comply with federal and state regulations.

If you are already a member, sign in to your account and click on the Download button to obtain the Michigan Standard Terms and Conditions for Merchandise Warehouses. Use your account to review the legal documents you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

Complete, modify, print, and sign the received Michigan Standard Terms and Conditions for Merchandise Warehouses. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally-crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your locality. You can preview the form using the Preview button and review the form details to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search feature to find the appropriate form.

- Once you are confident that the form is correct, click the Purchase now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

The industrial processing exemption in Michigan allows certain businesses to avoid sales tax on equipment and supplies used directly in manufacturing processes. This includes machinery and raw materials that become part of the finished product. Companies operating within the framework of the Michigan Standard Terms and Conditions for Merchandise Warehouses should understand this exemption to maximize their financial efficiency.

To apply for a Michigan sales tax exemption, businesses must complete the appropriate forms, typically available on the Michigan Department of Treasury's website. They may need to provide documentation of their exempt status, such as non-profit status or proof of specific qualifying purchases. Following the guidelines ensures compliance with the Michigan Standard Terms and Conditions for Merchandise Warehouses.

Most tangible personal property is subject to sales tax in Michigan, including general retail goods and certain services. However, there are important exceptions, which businesses need to be aware of to ensure compliance. When developing the Michigan Standard Terms and Conditions for Merchandise Warehouses, clarity on taxable items aids in smooth transactions and better financial planning.

In Michigan, ice cream typically falls under the category of taxable goods unless it is sold in certain exempt contexts, like when sold by certain non-profit organizations. Therefore, it's essential for businesses to understand the nuances of this tax regulation when drafting their Michigan Standard Terms and Conditions for Merchandise Warehouses. This knowledge helps avoid unforeseen tax liabilities.

In Michigan, certain items such as some food products, prescription drugs, and specific medical devices are exempt from sales tax. Additionally, purchases made by non-profit organizations may also qualify for tax exemption. Familiarity with these exemptions is important for anyone dealing with Michigan Standard Terms and Conditions for Merchandise Warehouses to optimize purchasing strategies.

The UCC, or Uniform Commercial Code, provides a comprehensive legal framework for commercial transactions in Michigan. This statute includes provisions on sales, leases, negotiable instruments, and secured transactions. Businesses using the Michigan Standard Terms and Conditions for Merchandise Warehouses must adhere to these rules to ensure legal compliance and smooth operations.