Michigan Sample Letter for Past Due Balance

Description

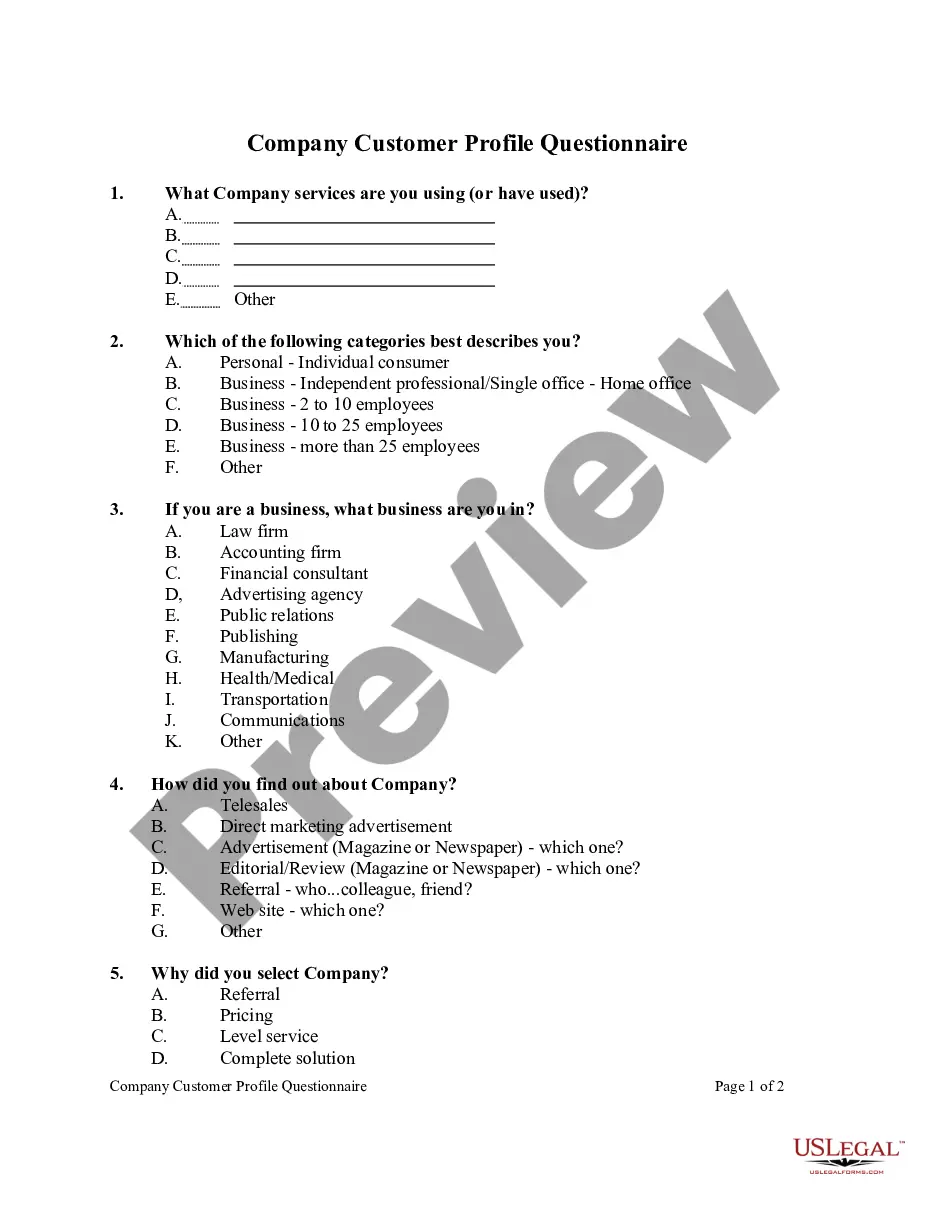

How to fill out Sample Letter For Past Due Balance?

Selecting the finest approved document template can be quite a challenge.

Clearly, there is a range of templates available online, but how can you locate the approved form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Michigan Sample Letter for Past Due Balance, suitable for both business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

Once you are confident that the form is acceptable, click the Purchase now button to acquire the form. Select the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the approved document template to your device. Complete, revise, print, and sign the received Michigan Sample Letter for Past Due Balance. US Legal Forms is indeed the largest repository of legal forms where you will discover various document templates. Utilize the service to download professionally-crafted papers that adhere to state requirements.

- If you are currently registered, Log In to your account and click the Obtain button to retrieve the Michigan Sample Letter for Past Due Balance.

- Use your account to browse through the legal forms you may have acquired earlier.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines for you to follow.

- First, ensure that you have chosen the correct form for your area/county. You can view the form using the Review option and examine the form details to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

I'm writing because our records indicate an outstanding balance of [amount] for invoice [reference number], which was due on [due date]. This payment is now overdue by [amount of time], and we are looking to wrap up this account. The original invoice is attached in case you missed the original notification.

Dear [Name], We require your immediate attention to resolve this issue. Invoice [invoice number] is now overdue by [number of days overdue]. If we do not receive payment within 10 working days, we will refer the matter to a collection agency.

Dear [Client name], I'm writing because our records indicate an outstanding balance of [amount] for invoice [reference number], which was due on [due date]. This payment is now overdue by [amount of time], and we are looking to wrap up this account.

To request payment professionally, it's important to first make sure there was no error or miscommunication about the invoice. Send a polite email to your client explaining that the payment is now past due and ask to make sure they received the initial invoice and there were no problems with it.

Dear [customer name], We are writing to inform you that [invoice #] is now [time] overdue. Our company has reached out to you multiple times requesting payment for the [product/service] that you received on January 15, 2023. However, as of writing, the funds still have not landed in our account.

Look to this example for how to word past due notices on a first attempt: Hello [Customer Name], ing to our records, payment for invoice [Invoice Number] was due on [Due Date] which is now [Number of Days] past due. A copy of the original invoice is attached for easy reference.

Dear [Name], We require your immediate attention to resolve this issue. Invoice [invoice number] is now overdue by [number of days overdue]. If we do not receive payment within 10 working days, we will refer the matter to a collection agency.