This form is a generic Bill of Sale for a Golf Cart from an individual rather than from a dealer. No warranty is being made as to its condition. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

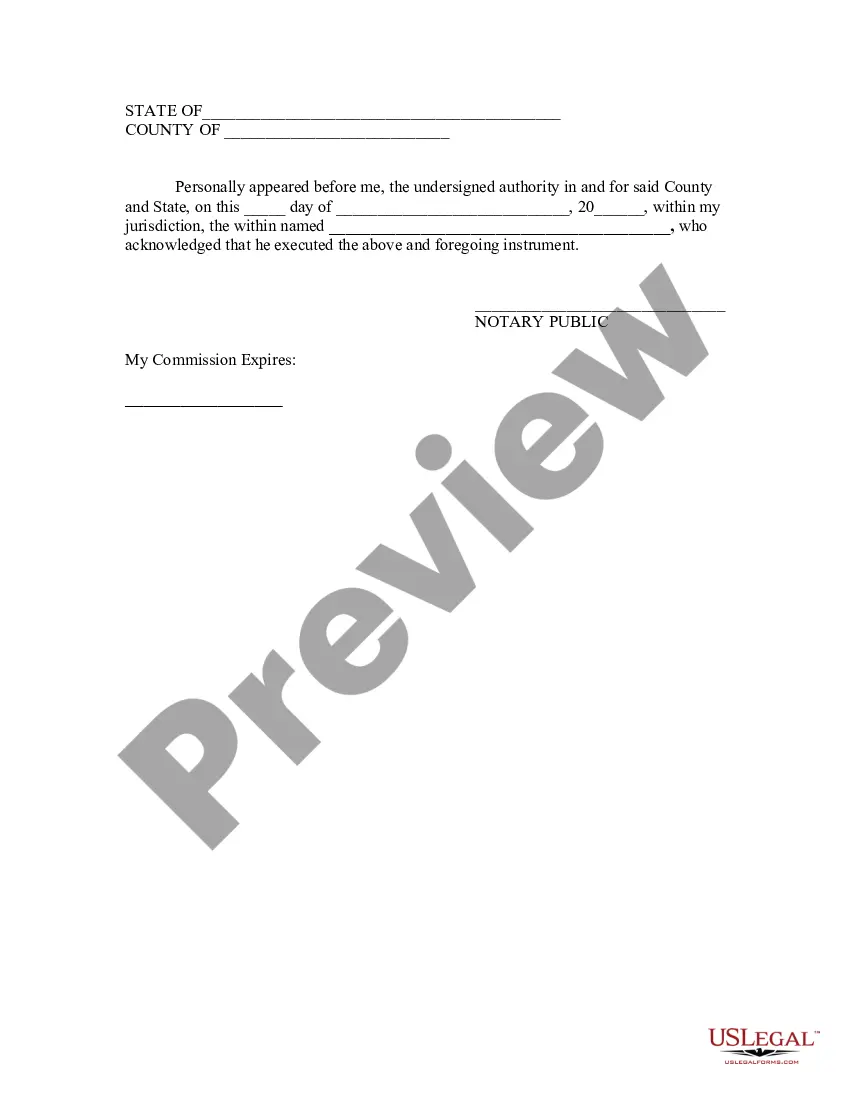

A Michigan Bill of Sale for a Golf Cart is a legal document that serves as proof of ownership transfer for a golf cart in the state of Michigan. It outlines the details of the transaction between the seller and the buyer, including important information about the golf cart being sold. The content of a Michigan Bill of Sale for a Golf Cart typically includes the following details: 1. Parties involved: The bill of sale should clearly state the names, addresses, and contact information of both the seller and the buyer. This information helps establish the identities of the individuals involved in the transaction. 2. Description of the golf cart: A comprehensive description of the golf cart should be included, highlighting distinguishing characteristics such as the make, model, year, color, and vehicle identification number (VIN). This information makes it easier to identify the specific golf cart being sold. 3. Purchase price: The bill of sale should clearly state the agreed-upon purchase price for the golf cart. This amount should be stated in both numerical and written forms to avoid any confusion. 4. Payment details: Any payment terms or conditions should be mentioned in the bill of sale. If the payment is to be made in installments or through alternative methods, such as cash or check, these details should be clearly specified. 5. Date of sale: The exact date when the transaction is taking place should be mentioned on the bill of sale. This helps establish the timeline of the ownership transfer. 6. Seller disclosure: Sellers may include a section in the bill of sale where they can disclose any known defects or issues with the golf cart. This disclosure protects the buyer and ensures transparency in the transaction. 7. Signatures and notarization: Both the seller and the buyer must sign the bill of sale to make it legally binding. In some cases, notarization may be required for enhanced authenticity. In addition to the standard Michigan Bill of Sale for a Golf Cart, there may be different types based on specific requirements or circumstances. Some different types of bill of sale for a golf cart in Michigan may include: 1. As-Is Bill of Sale: This type of bill of sale states that the golf cart is being sold in its present condition, with no warranties or guarantees from the seller. 2. Warranty Bill of Sale: This bill of sale provides a limited warranty from the seller to the buyer, ensuring that the golf cart will be free from defects up to a certain period. 3. Conditional Bill of Sale: This type of bill of sale includes specific conditions that must be met before the ownership of the golf cart is transferred to the buyer. These conditions may include payment in full or the completion of repairs. It is important to select an appropriate bill of sale type that aligns with the specific circumstances of the golf cart sale to ensure legal compliance and protect the interests of both the seller and the buyer.A Michigan Bill of Sale for a Golf Cart is a legal document that serves as proof of ownership transfer for a golf cart in the state of Michigan. It outlines the details of the transaction between the seller and the buyer, including important information about the golf cart being sold. The content of a Michigan Bill of Sale for a Golf Cart typically includes the following details: 1. Parties involved: The bill of sale should clearly state the names, addresses, and contact information of both the seller and the buyer. This information helps establish the identities of the individuals involved in the transaction. 2. Description of the golf cart: A comprehensive description of the golf cart should be included, highlighting distinguishing characteristics such as the make, model, year, color, and vehicle identification number (VIN). This information makes it easier to identify the specific golf cart being sold. 3. Purchase price: The bill of sale should clearly state the agreed-upon purchase price for the golf cart. This amount should be stated in both numerical and written forms to avoid any confusion. 4. Payment details: Any payment terms or conditions should be mentioned in the bill of sale. If the payment is to be made in installments or through alternative methods, such as cash or check, these details should be clearly specified. 5. Date of sale: The exact date when the transaction is taking place should be mentioned on the bill of sale. This helps establish the timeline of the ownership transfer. 6. Seller disclosure: Sellers may include a section in the bill of sale where they can disclose any known defects or issues with the golf cart. This disclosure protects the buyer and ensures transparency in the transaction. 7. Signatures and notarization: Both the seller and the buyer must sign the bill of sale to make it legally binding. In some cases, notarization may be required for enhanced authenticity. In addition to the standard Michigan Bill of Sale for a Golf Cart, there may be different types based on specific requirements or circumstances. Some different types of bill of sale for a golf cart in Michigan may include: 1. As-Is Bill of Sale: This type of bill of sale states that the golf cart is being sold in its present condition, with no warranties or guarantees from the seller. 2. Warranty Bill of Sale: This bill of sale provides a limited warranty from the seller to the buyer, ensuring that the golf cart will be free from defects up to a certain period. 3. Conditional Bill of Sale: This type of bill of sale includes specific conditions that must be met before the ownership of the golf cart is transferred to the buyer. These conditions may include payment in full or the completion of repairs. It is important to select an appropriate bill of sale type that aligns with the specific circumstances of the golf cart sale to ensure legal compliance and protect the interests of both the seller and the buyer.