The Michigan Certificate of Trust for Mortgage is a legal document designed to facilitate the use of a trust in mortgage transactions within the state of Michigan. It serves as evidence of the trust's existence and the authority of the trustee to enter into a mortgage agreement on behalf of the trust. The Certificate of Trust for Mortgage outlines important information about the trust, including the name of the trust, the date it was established, and the identity of the trustee(s) responsible for managing the trust. It also includes the powers and limitations of the trustee(s) in relation to mortgage matters, and any provisions for the appointment of successor trustees. By using a Certificate of Trust for Mortgage, lenders and borrowers can ensure that the trust and its trustee(s) have the legal capacity to enter into a mortgage transaction. This document provides reassurance to all parties involved that the trust is properly managed and that its assets can be used to secure the mortgage loan. It is essential to understand that there are no specific types of Michigan Certificate of Trust for Mortgage. However, it is common for different types of trusts to be used in mortgage transactions, such as revocable trusts, irrevocable trusts, living trusts, and testamentary trusts. The specific type of trust will depend on the individual's estate planning goals, asset protection needs, and beneficiaries' requirements. In conclusion, the Michigan Certificate of Trust for Mortgage is a crucial legal document that provides evidence of a trust's existence and the trustee's authority to enter into a mortgage agreement. By utilizing this certificate, lenders, borrowers, and trustees can ensure a smooth and legally binding mortgage transaction within the state of Michigan, offering peace of mind to all involved parties.

Michigan Certificate of Trust for Mortgage

Description

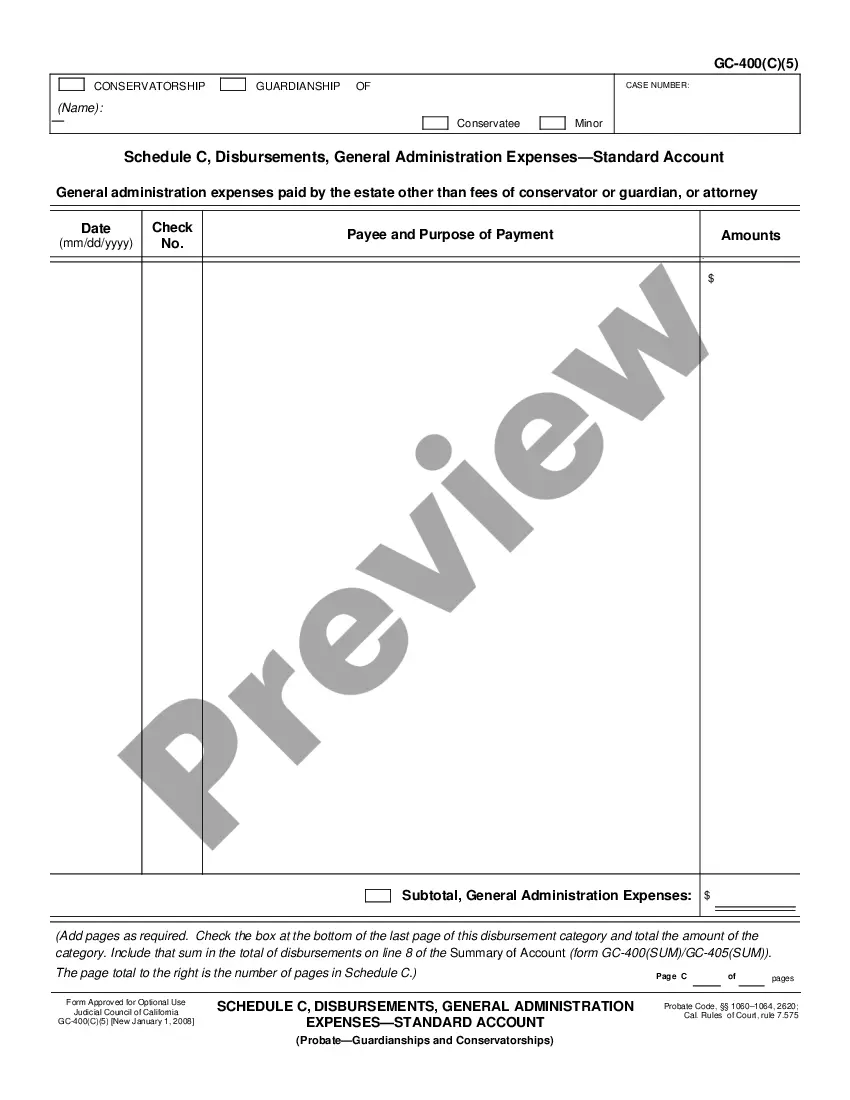

How to fill out Michigan Certificate Of Trust For Mortgage?

If you wish to full, acquire, or print out lawful record themes, use US Legal Forms, the largest assortment of lawful kinds, that can be found on the web. Use the site`s easy and hassle-free search to discover the files you want. Various themes for company and personal functions are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the Michigan Certificate of Trust for Mortgage in a few clicks.

If you are presently a US Legal Forms client, log in to your account and then click the Down load key to find the Michigan Certificate of Trust for Mortgage. You can also entry kinds you earlier acquired from the My Forms tab of the account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for your correct city/land.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Do not forget to read through the description.

- Step 3. If you are not satisfied together with the form, take advantage of the Research discipline at the top of the monitor to find other variations in the lawful form design.

- Step 4. Upon having identified the shape you want, click on the Acquire now key. Opt for the rates program you favor and add your references to register for an account.

- Step 5. Process the purchase. You may use your bank card or PayPal account to accomplish the purchase.

- Step 6. Choose the formatting in the lawful form and acquire it on your own product.

- Step 7. Comprehensive, edit and print out or indication the Michigan Certificate of Trust for Mortgage.

Every lawful record design you purchase is yours permanently. You might have acces to each form you acquired inside your acccount. Click the My Forms portion and pick a form to print out or acquire once more.

Compete and acquire, and print out the Michigan Certificate of Trust for Mortgage with US Legal Forms. There are many professional and status-distinct kinds you may use for your personal company or personal requirements.

Form popularity

FAQ

Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

Here's your step-by-step guide: Decide what type of trust you want. For single people, a single trust is the only available choice. ... Next you'll need to take stock of your property. ... Pick a trustee. ... Create the trust document. ... Sign the trust document in front of a notary public. Fund the trust by placing property into it.

To create a living trust in Michigan, you prepare the trust document and then sign it in the presence of a notary. The final step is to transfer assets into the trust, funding it. Living trusts are a popular estate planning tool.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

The estate attorney will typically write a demand letter and advising the Trustee that if the Trustee does not provide the Trust, that the attorney will have no choice but to compel the Trustee, pursuant to Surrogate's Court Procedures Act 2102 for a copy of the Trust.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act.

TRUST REGISTRATION If an individual has created a Trust, he or she may want to register it with the Probate Court. To do so, the individual must complete the Trust Registration form, PC 610 and submit it to the Probate Court along with a $25 filing fee.