This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Second Amendment of Trust Agreement

Description

How to fill out Second Amendment Of Trust Agreement?

Selecting the appropriate official document format can be quite challenging.

Certainly, there are numerous templates accessible online, but how would you acquire the official form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your area/state. You can review the form using the Review button and check the form details to confirm it's appropriate for you.

- The service offers a vast array of templates, including the Michigan Second Amendment of Trust Agreement, suitable for both business and personal needs.

- Each of the forms is reviewed by professionals and complies with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to get the Michigan Second Amendment of Trust Agreement.

- Use your account to browse through the official forms you have previously purchased.

- Go to the My documents tab in your account and obtain another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

A trust restatement involves revising the entire trust document to include new provisions while keeping the original trust's intent intact. For instance, when updating beneficiaries or asset distribution due to life changes, you create a new document titled 'Restated Trust Agreement.' This process aligns closely with the Michigan Second Amendment of Trust Agreement, ensuring all changes are clear and legally binding. US Legal Forms can guide you through creating a trust restatement effectively.

Writing a trust amendment involves several steps to ensure clarity and compliance with Michigan laws. First, clearly state that you are amending the trust, referencing the original trust document. Next, specify the changes you wish to make, and conclude with your signature and the date. If you need a user-friendly template, check out US Legal Forms, which provides structured formats and explanations to help you.

A codicil does not have to be notarized in Michigan, but notarization enhances its legitimacy. When you create a codicil to amend your will, following the guidelines of the Michigan Second Amendment of Trust Agreement can help prevent challenges later. Notarizing adds credibility, making it more difficult for others to question its authenticity. For assistance, US Legal Forms has various resources available to help you draft a codicil properly.

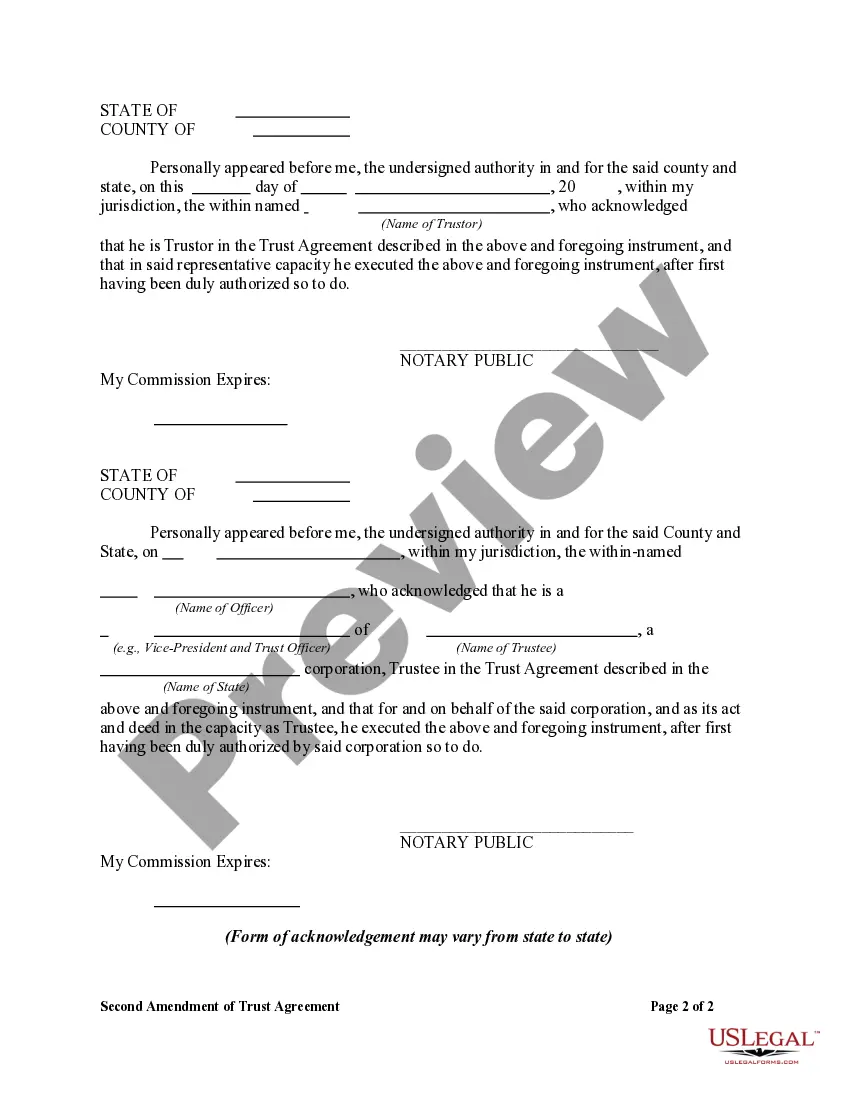

In Michigan, trust documents do not always require notarization to be valid, but certain amendments do. The Michigan Second Amendment of Trust Agreement benefits from having a notary's signature, as it helps reduce disputes among beneficiaries. By notarizing the document, you add an extra layer of authenticity. If you need templates and instructions, US Legal Forms is an easy-to-use resource.

A trust amendment is valid when it meets specific requirements outlined by Michigan law. To ensure its validity, the Michigan Second Amendment of Trust Agreement must be executed in writing and signed by the trustor. Additionally, it should reflect the trustor's intention to modify the original trust document clearly. To simplify this process, consider using platforms like US Legal Forms, which provide templates and guidance.

Trust beneficiaries in Michigan have several rights, including the right to receive information about the trust and its assets as outlined in the Michigan Second Amendment of Trust Agreement. They are entitled to fair treatment and timely distributions according to the trust's terms. Additionally, beneficiaries can request an accounting of the trust's activities and assert their rights against a trustee who fails to uphold their duties. Understanding these rights helps beneficiaries protect their interests.

Yes, one significant advantage of a trust in Michigan is that it typically avoids the probate process. Assets held in a trust, as dictated by the Michigan Second Amendment of Trust Agreement, transfer directly to beneficiaries upon the grantor's death, circumventing probate court entirely. This can save time and costs associated with legal proceedings. Establishing a trust can offer peace of mind and streamline the distribution of your estate.

While not always required, it is advisable to notarize a trust amendment in Michigan for added validity and to enhance its enforceability. The Michigan Second Amendment of Trust Agreement often emphasizes the benefits of having a notarized document to avoid disputes over its authenticity. Notarization ensures that the amendment was made voluntarily and with due diligence. It's prudent to consult with a legal professional to confirm specific requirements.

An amendment to the trust agreement refers to changes made to the original terms of the trust, often through the Michigan Second Amendment of Trust Agreement. This process allows the grantor to update instructions, change beneficiaries, or modify asset allocations without creating an entirely new trust. However, it is essential to follow legal procedures to ensure that amendments are valid and enforceable. Consulting with a legal expert can facilitate this process.

Yes, beneficiaries have the right to see the trust documents in Michigan, ensuring transparency within the Michigan Second Amendment of Trust Agreement. This right helps beneficiaries understand their entitlements and obligations. Trustees are legally required to provide this information, fostering a clear relationship between the trustee and beneficiaries. This openness promotes trust and accountability.