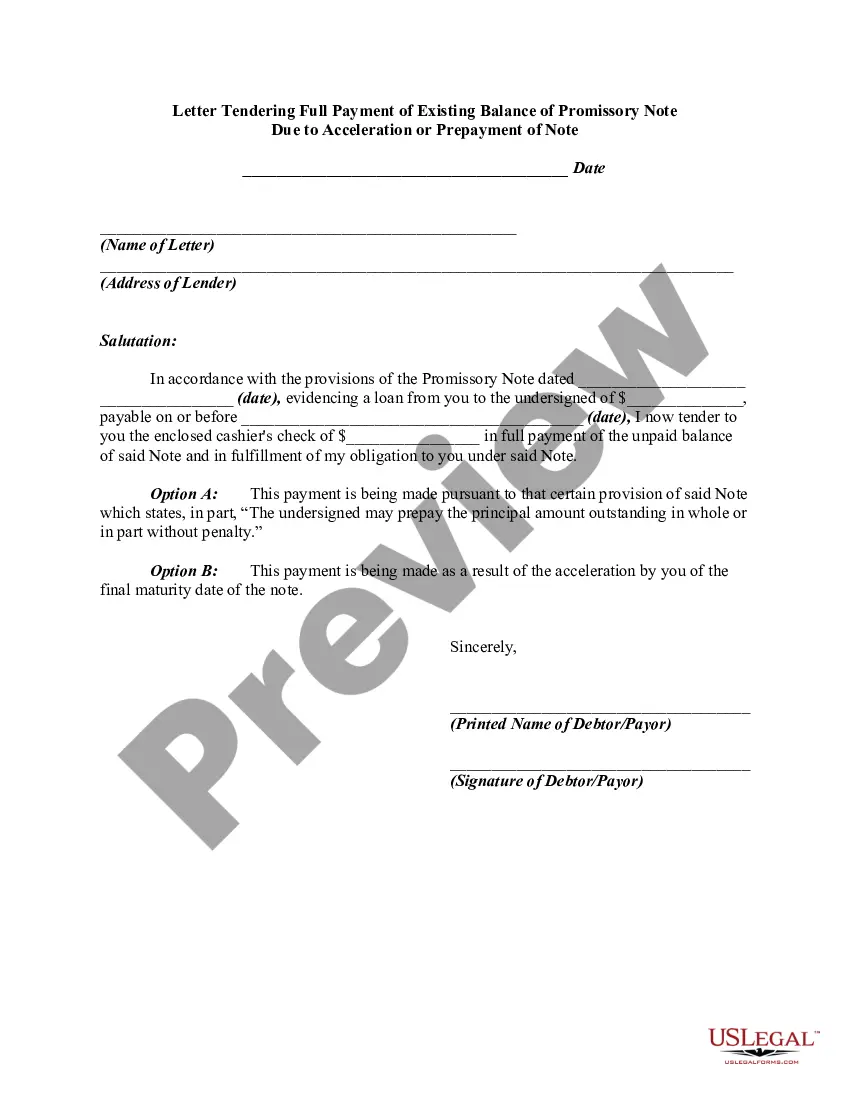

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note

Description

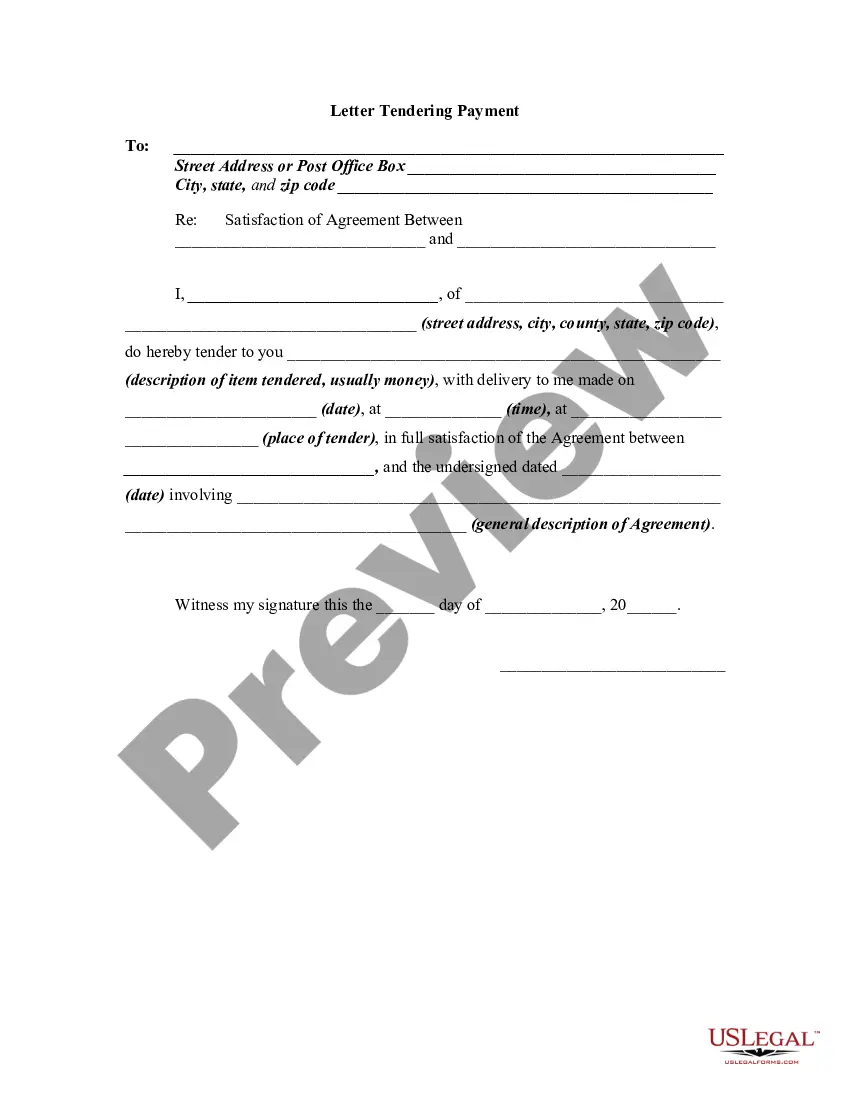

How to fill out Letter Tendering Full Payment Of Existing Balance Of Promissory Note Due To Acceleration Or Prepayment Of Note?

If you need to finalize, acquire, or print legal document web templates, utilize US Legal Forms, the largest assortment of legal forms available online. Leverage the site’s straightforward and user-friendly search feature to find the documents you require. Variety of templates for business and specific purposes are sorted by categories and jurisdictions, or keywords.

Utilize US Legal Forms to access the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note with just a couple of clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to locate the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. You can also retrieve forms you previously stored from the My documents tab in your account.

Every legal document web template you acquire is yours forever. You have access to all forms you saved within your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note with US Legal Forms. There are numerous professional and state-specific forms you may utilize for business or individual needs.

- Step 1. Make sure you have chosen the form for your correct region/country.

- Step 2. Use the Review option to examine the form's details. Remember to read the description.

- Step 3. If you are not pleased with the type, use the Search box at the top of the screen to find other variations of the legal type template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and provide your information to register for an account.

- Step 5. Process the order. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note.

Form popularity

FAQ

Writing a promissory note starts with clearly identifying the parties involved, such as the lender and borrower. Next, you should outline the amount owed, the interest rate, and the payment schedule. It is crucial to include terms related to the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, ensuring clarity on what happens in these circumstances. Finally, both parties must sign the document to make it legally binding.

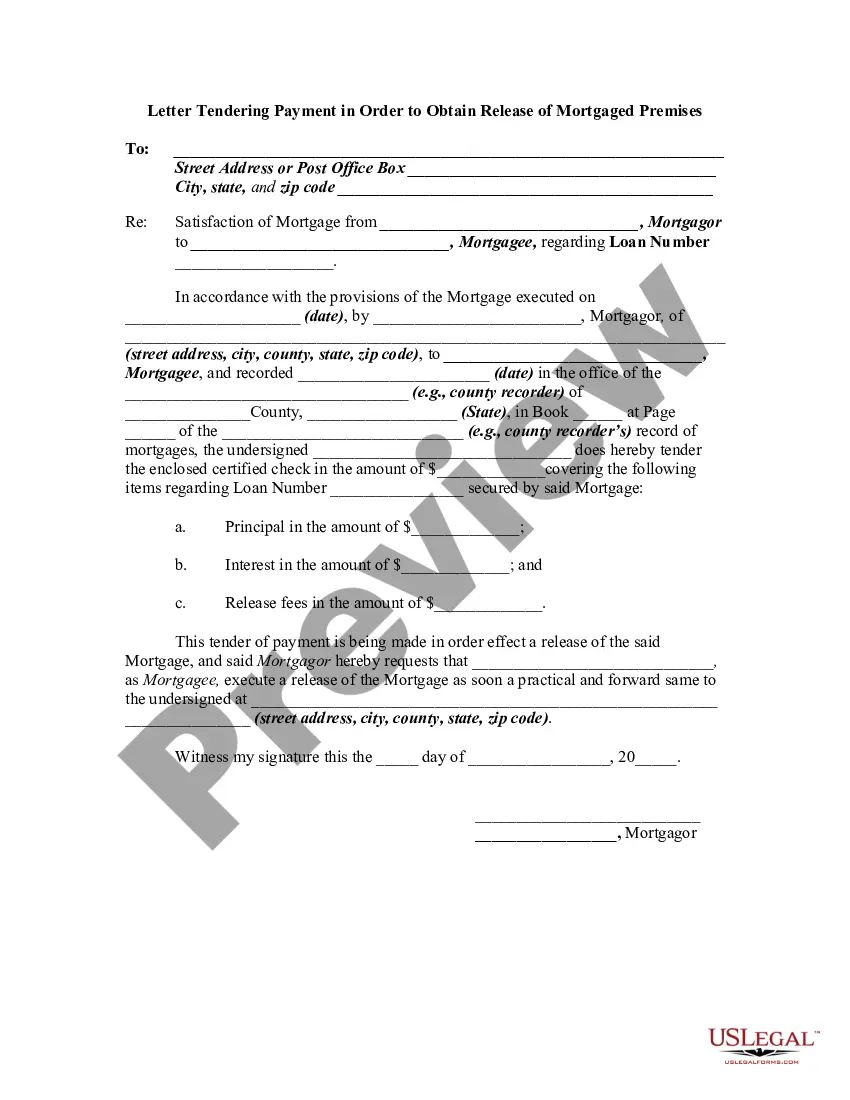

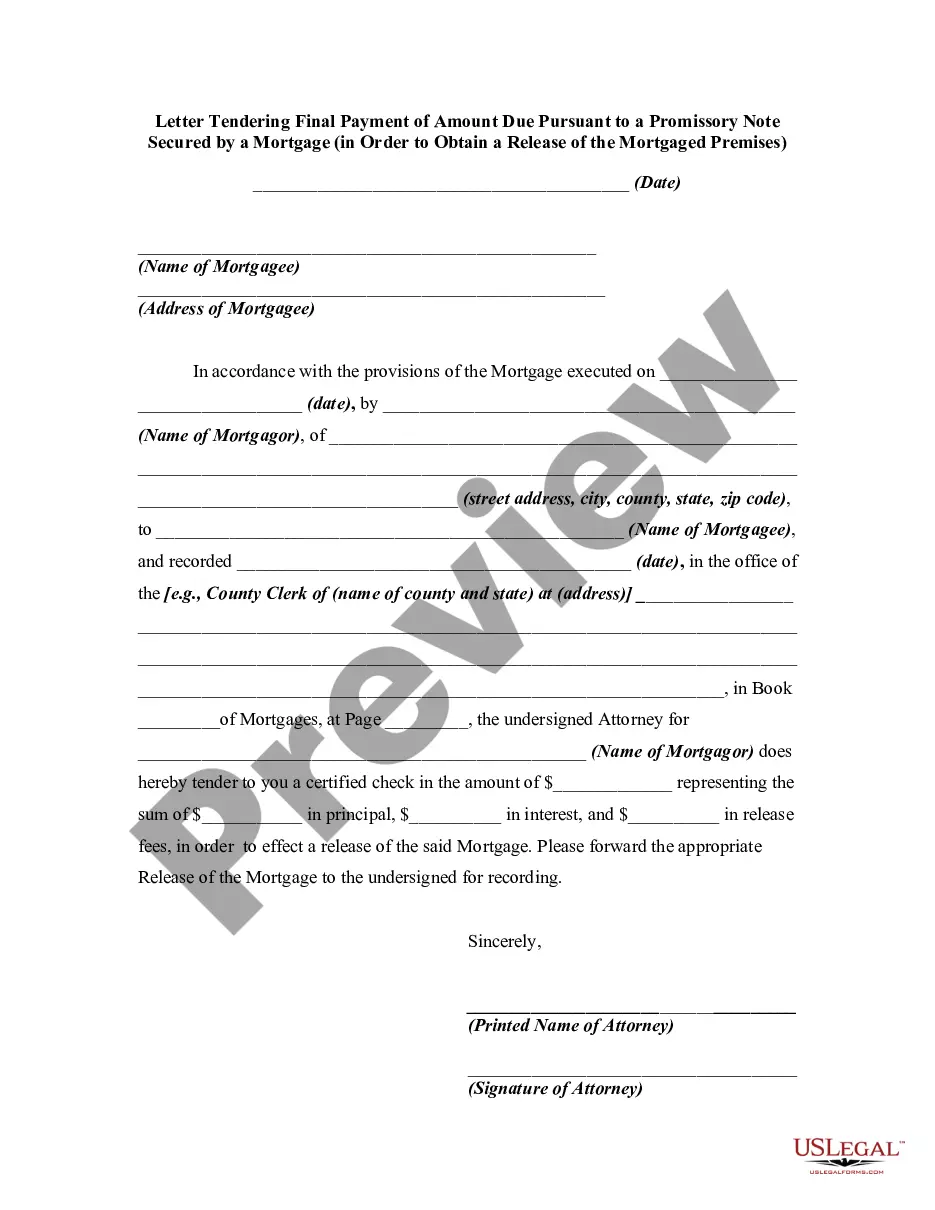

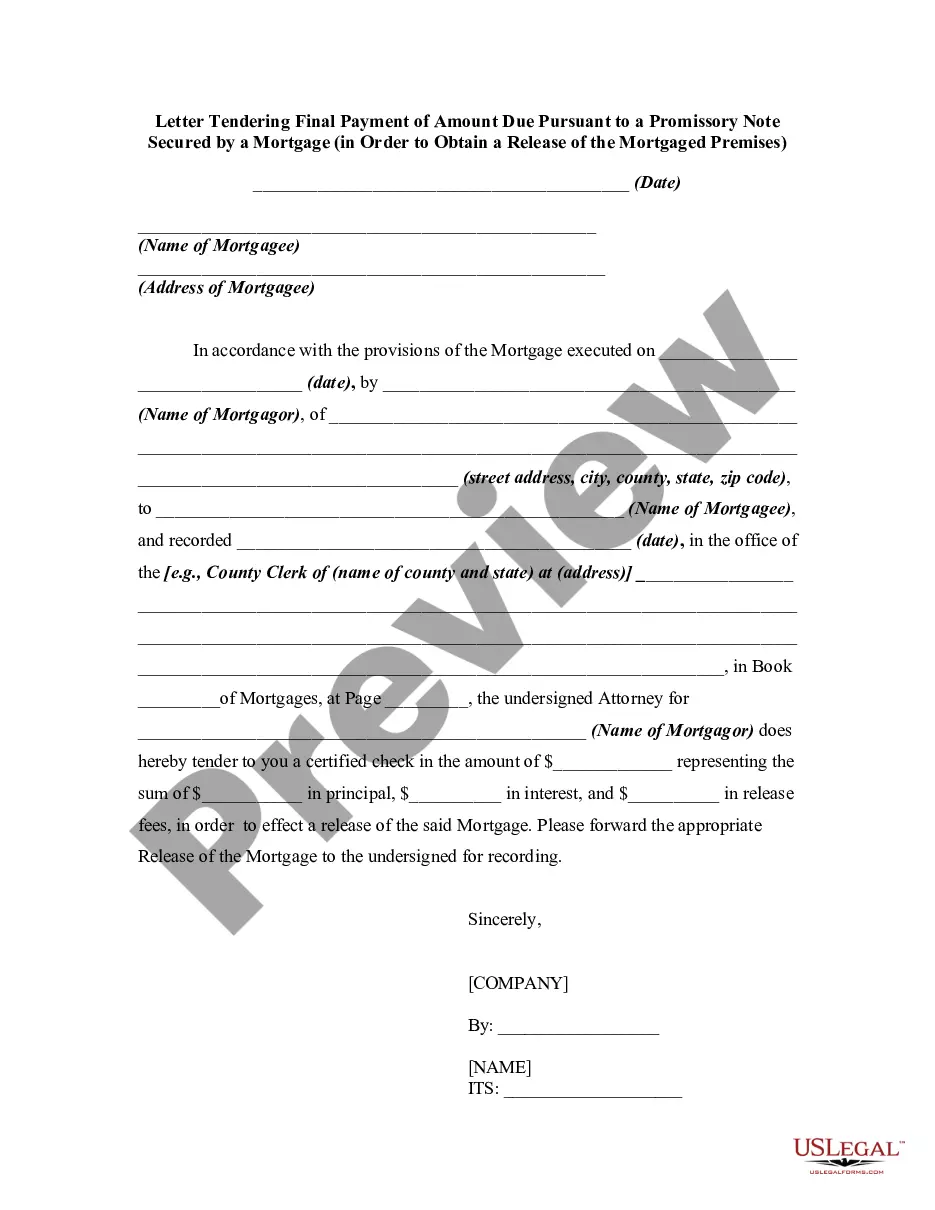

Accelerating a promissory note requires following the specific terms outlined in the note itself. Generally, this involves providing written notice to the borrower and specifying the outstanding balance due. For those looking to formalize this process, a Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note can help clearly convey the intent to accelerate the debt and facilitate prompt payment.

A notarized promissory note typically provides stronger legal standing in court, as it includes the signature verification by a notary public. This means that the document has been properly executed and is more likely to be upheld in legal disputes. However, the effectiveness also relies on compliance with state laws, which means you should ensure that your Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note meets all legal requirements.

Recording a promissory note payment involves documenting each payment made towards the balance in a ledger or payment record. It's essential to note the date, amount, and any remaining balance after the payment. Using a Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note ensures clarity and accountability, providing both parties with a transparent record of transactions.

To accelerate a promissory note, you typically need to invoke an acceleration clause included in the document. This clause allows the lender to demand full repayment if specific conditions arise, such as missed payments. Knowing how to execute a Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note can streamline this process and ensure clear communication with the borrower.

When a promissory note matures, the borrower is obligated to repay the remaining balance in full to the lender. If the borrower cannot make the full payment, options such as renegotiating the terms or executing a Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note may be explored. Understanding these steps ensures that both parties are adequately informed and prepared.

Yes, promissory notes are legally enforceable documents, provided they meet specific legal criteria. In Michigan, they must include essential details such as the amount owed, payment terms, and signatures of the parties involved. When these elements are present, you can rely on the Michigan Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note to ensure legal recourse if needed.