This form can be used as a guide in preparing an agreement involving a close corporation or a Subchapter S corporation buying all of the stock of one of its shareholders.

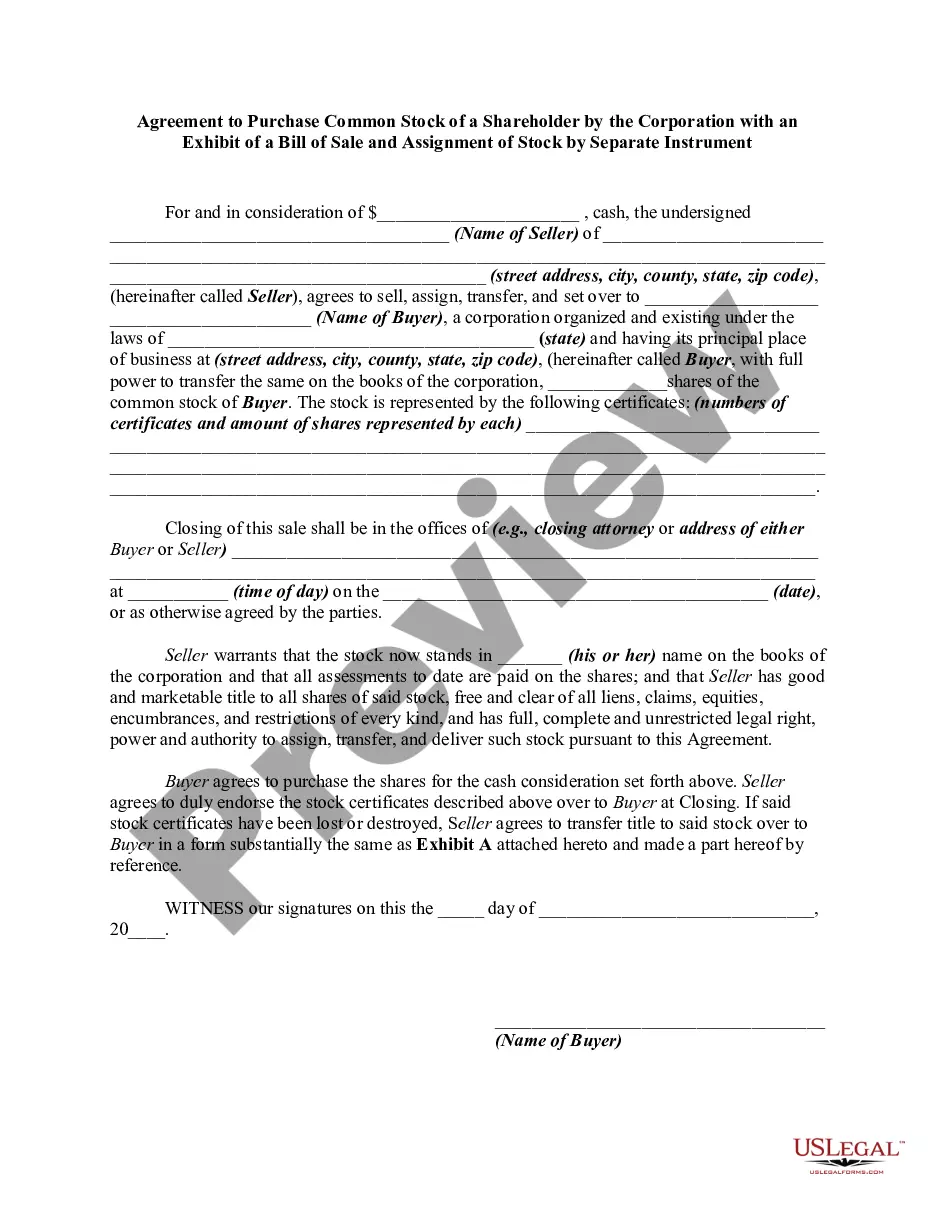

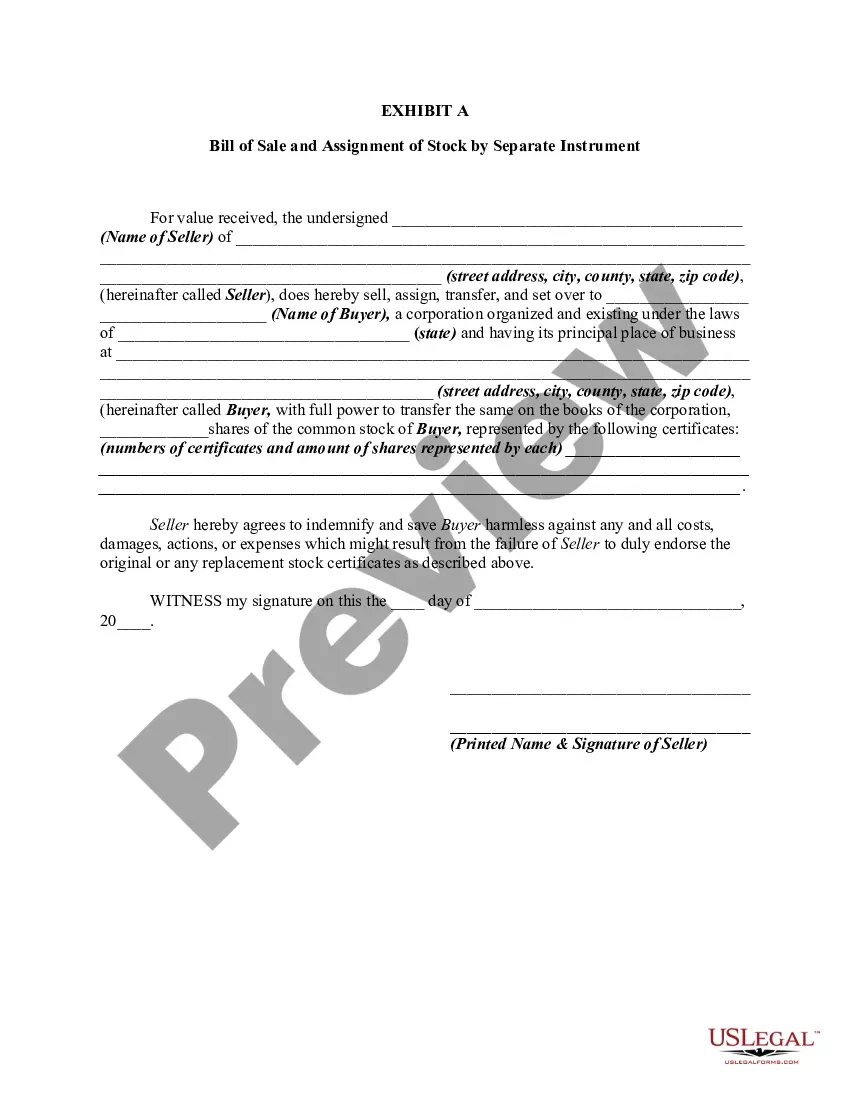

Michigan Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Agreement To Purchase Common Stock Of A Shareholder By The Corporation With An Exhibit Of A Bill Of Sale And Assignment Of Stock By Separate Instrument?

Have you ever found yourself in a situation where you need documents for either business or personal reasons frequently.

There are many legal document templates available online, but finding trustworthy ones isn’t easy.

US Legal Forms offers thousands of template forms, such as the Michigan Agreement to Purchase Common Stock of a Shareholder by the Corporation along with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument, which are designed to comply with federal and state requirements.

Select the payment plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Michigan Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument at any time, if necessary. Click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Michigan Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/county.

- Use the Review button to examine the form.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, simply click Buy now.

Form popularity

FAQ

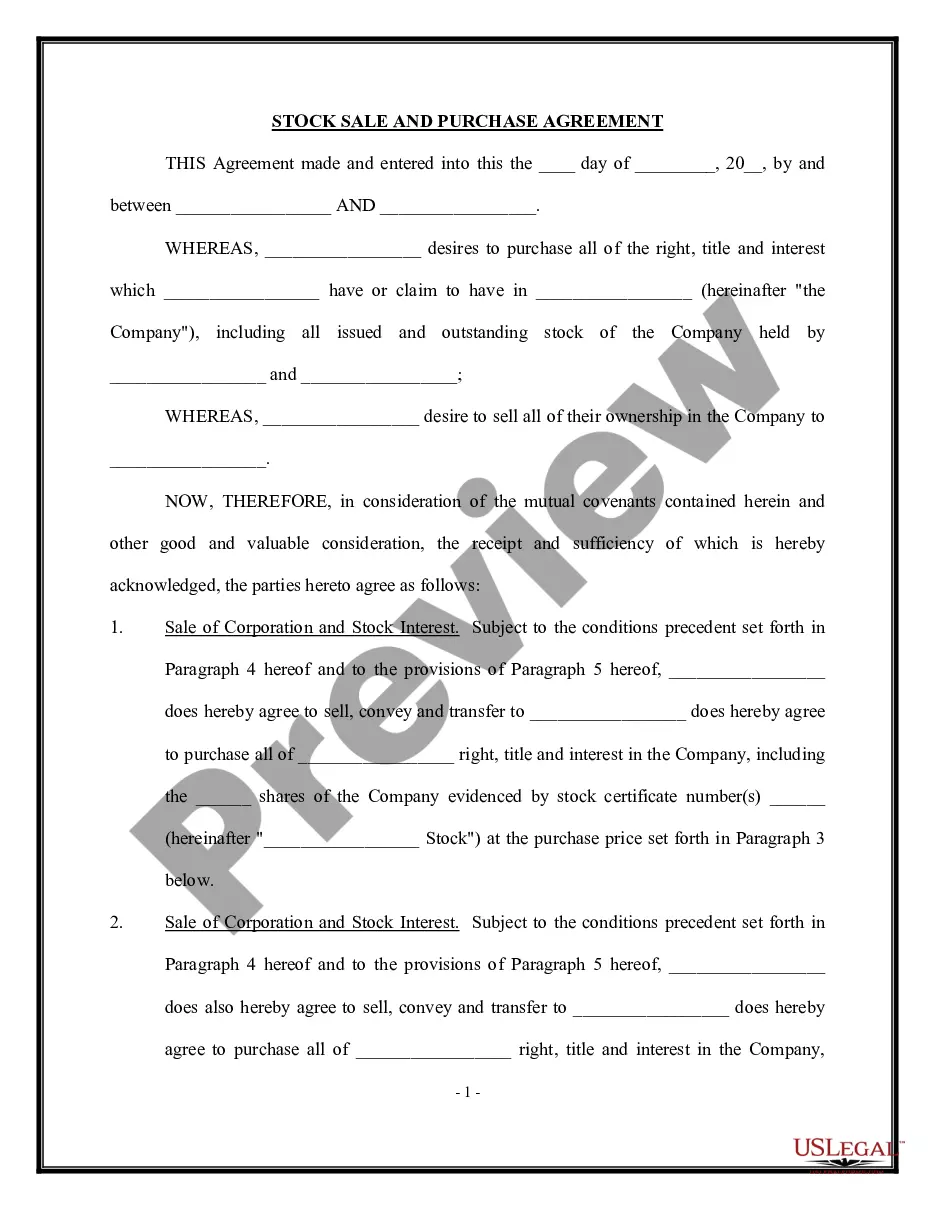

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

A restricted stock purchase agreement is a type of written agreement that places restrictions on the stockholder's rights with respect to the shares being issued. The restrictions generally restrict selling, transferring, etc.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

Another common type of buy-sell agreement is the stock redemption agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.