Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew

Description

How to fill out Commercial Ground Lease With Lessee To Construct Improvements And Option To Renew?

If you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal templates, which are available online.

Take advantage of the website's effortless and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the payment.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew.

- Use US Legal Forms to find the Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

To record leasehold improvements in accounting, first, you must initially recognize the costs as an asset on your balance sheet. Under the Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, it’s essential to ensure that all related expenses are documented precisely. Subsequently, the improvements should be depreciated annually to reflect their value decrease. Ensure you adhere to accounting principles, and consider using uslegalforms for assistance on proper documentation techniques.

A lessor accounts for leasehold improvements by recording them in their financial statements as either an asset or an expense. Under a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, the lessor needs to track these improvements closely for both depreciation and tax purposes. Proper accounting ensures that the value added to the property is recognized and reflected accurately in financial reports. You can utilize platforms like uslegalforms for guidance on lease agreements and related accounting practices.

To write off leasehold improvements, you will need to calculate their accumulated depreciation according to the terms of your Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew. This involves determining the remaining value of the improvements at the time of disposal or when the lease ends. The recorded loss can then be deducted from your taxable income, providing some financial relief. Consulting a tax advisor can help you understand the specific steps involved.

Yes, leasehold improvements are typically capitalized under a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew. This means they are recorded as an asset on the balance sheet, allowing for depreciation over time. Doing so reflects the investment made in enhancing the leased property. Make sure to follow relevant accounting standards to accurately manage these improvements.

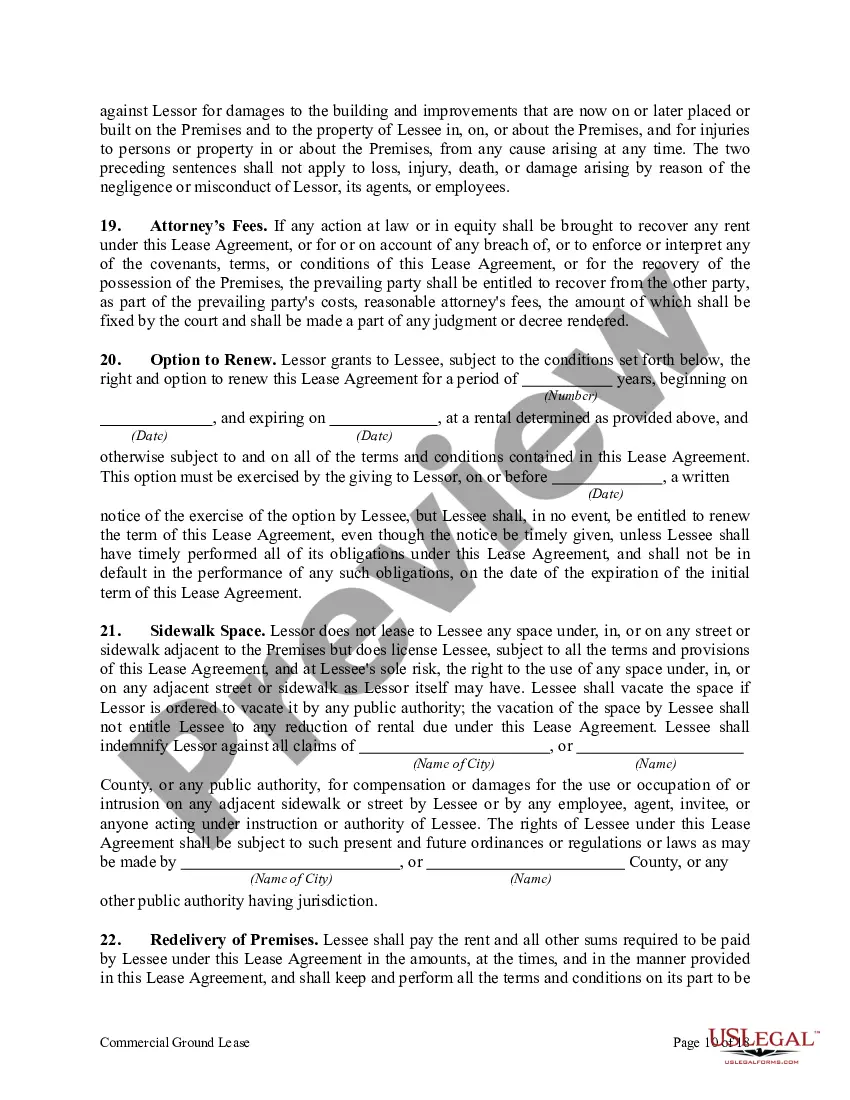

The option to renew a clause is a provision in a lease that grants the lessee the right to continue occupying the property after the initial term. In a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, this clause defines the conditions under which renewal can occur. This creates an opportunity for the lessee to make long-term plans while providing the lessor with continued occupancy. Make sure to read this clause carefully to understand your rights fully.

The clause for renewal of contract outlines the terms under which a lease can be renewed, including the duration and any conditions that must be met. In the context of a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, this clause is essential for lessees planning for future occupancy. Understanding this clause helps prevent misunderstandings and provides clarity for both the lessee and lessor. Always consult a legal expert if needed to ensure accurate comprehension.

The option to renew clause in a lease provides the lessee the right to extend their lease agreement at the end of the initial term. In a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, this clause contains specific terms regarding the notice period and conditions for renewal. This clause is integral for lessees seeking long-term security while allowing lessors to plan for future tenancy. Clear understanding of this clause ensures both parties protect their interests.

To exercise an option to renew a lease, the lessee must follow the procedure outlined in the lease agreement. This generally involves providing written notice to the lessor within the time frame specified in the lease. In a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, this step is critical to secure the lessee’s right to remain on the property. Communicating clearly and timely can help facilitate a smooth renewal process.

Yes, you can renovate a leased commercial property, especially under a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew. However, approval from the lessor is usually necessary, so discussing your renovation plans upfront is important. Renovations can enhance the property's value and functionality, benefiting both the lessee and lessor. Ensure clarity on responsibilities and approval processes to avoid potential disputes.

An option to renew gives the lessee the right to extend the lease term under specific conditions. For a Michigan Commercial Ground Lease with Lessee to Construct Improvements and Option to Renew, it typically requires the lessee to notify the lessor of their intent to renew within a defined timeframe. This right creates stability for tenants and motivates them to invest in the property. Both parties should review these terms carefully to ensure mutual benefits.