Michigan Sample Letter for Tax Deeds

Description

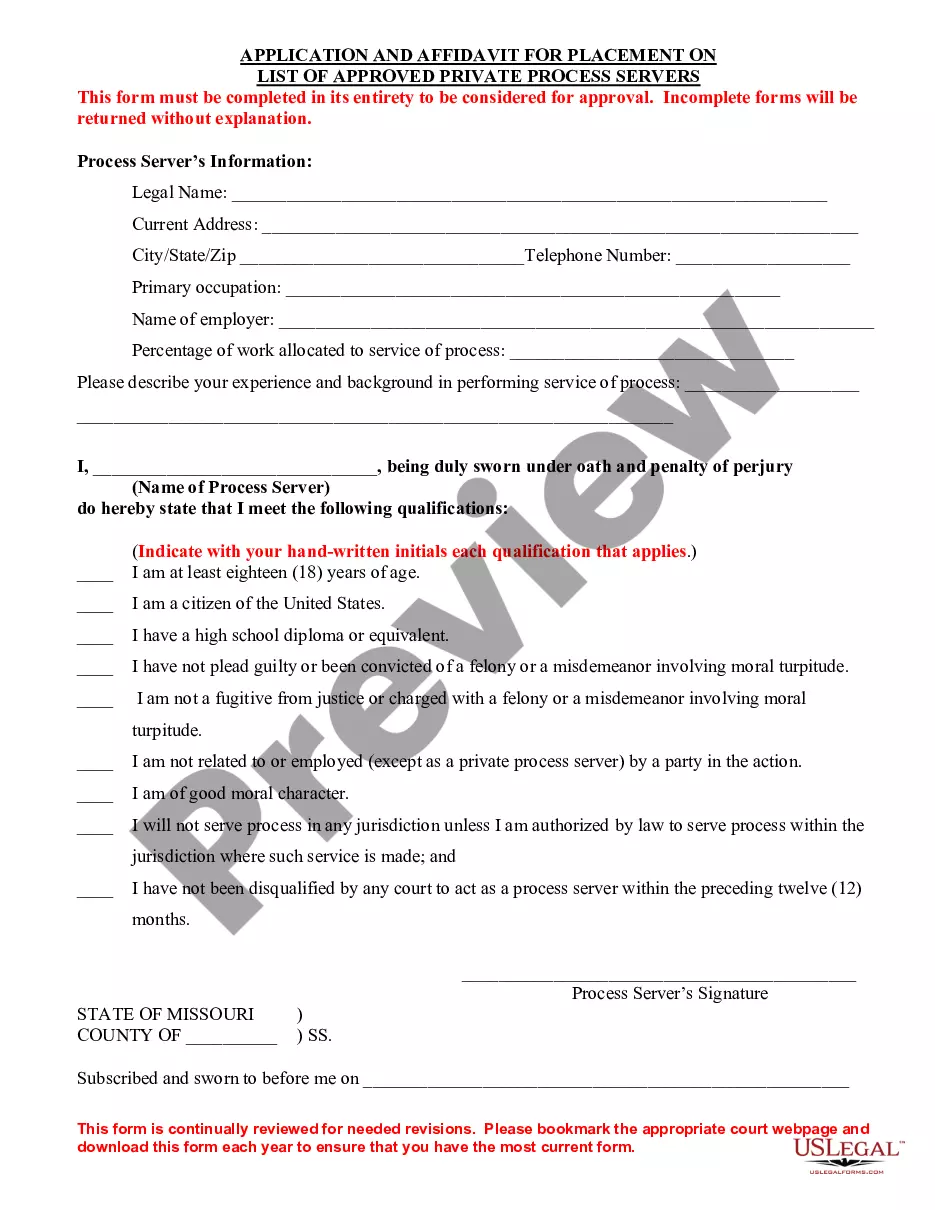

How to fill out Sample Letter For Tax Deeds?

In the event that you need to fully download or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Take advantage of the site's straightforward and user-friendly search function to find the documents you require. Various templates for business and personal purposes are categorized by type and state, or by keywords.

Employ US Legal Forms to acquire the Michigan Sample Letter for Tax Deeds with just a few clicks. If you are already a US Legal Forms customer, Log Into your account and click the Get button to obtain the Michigan Sample Letter for Tax Deeds. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct state/region. Step 2. Utilize the Preview option to review the form's content. Remember to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have found the form you need, click on the Buy now button. Select your preferred pricing plan and enter your details to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Michigan Sample Letter for Tax Deeds.

Avoid altering or deleting any HTML tags. Only synonymize plain text that is outside of the HTML tags.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded with your account.

- Visit the My documents section and select a form to print or download again.

- Complete, download, and print the Michigan Sample Letter for Tax Deeds using US Legal Forms.

- There are millions of professional and state-specific templates available for your business or personal needs.

Form popularity

FAQ

This letter was sent because the Michigan Department of Treasury has increased security to protect Michigan taxpayers and the State from tax related identity theft using a simple Identity Confirmation Quiz. Follow the directions in the letter to take the quiz.

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. In fiscal year 2020, the IRS collected almost $3.5 trillion in revenue and processed more than 240 million tax returns.

MICHIGAN REAL ESTATE TRANSFER TAX If the value of the real estate transferred is $100.00 or more, payment of State and County transfer tax is required. Rate of County tax = . 55c for each $500 or fraction thereof. Rate of State tax = 3.75 for each $500 or fraction thereof.

The Michigan Department of Treasury is responsible for collecting, disbursing, and investing all state monies. The Department advises the Governor on all tax and revenue policy, collects and administers over $20 billion a year in state taxes, and safeguards the credit of the state.

The Bureau of the Fiscal Service in the Department of the Treasury collects overdue (delinquent) nontax debt for other federal agencies. If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt.

We will send a letter/notice if: You are due a larger or smaller refund. We have a question about your tax return.

In ance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including ...