A home equity line of credit is a form of revolving credit in which your home serves as collateral. Because the home is likely to be a consumer's largest asset, many homeowners use their credit lines only for major items such as education, home improvements, or medical bills and not for day-to-day expenses. A home equity line of credit differs from a conventional home equity loan in that the borrower is not advanced the entire sum up front, but uses a line of credit to borrow sums that total no more than the amount, similar to a credit card.

Another important difference from a conventional loan is that the interest rate on a home equity line of credit is variable based on an index such as prime rate. This means that the interest rate can - and almost certainly will - change over time. The margin is the difference between the prime rate and the interest rate the borrower will actually pay.

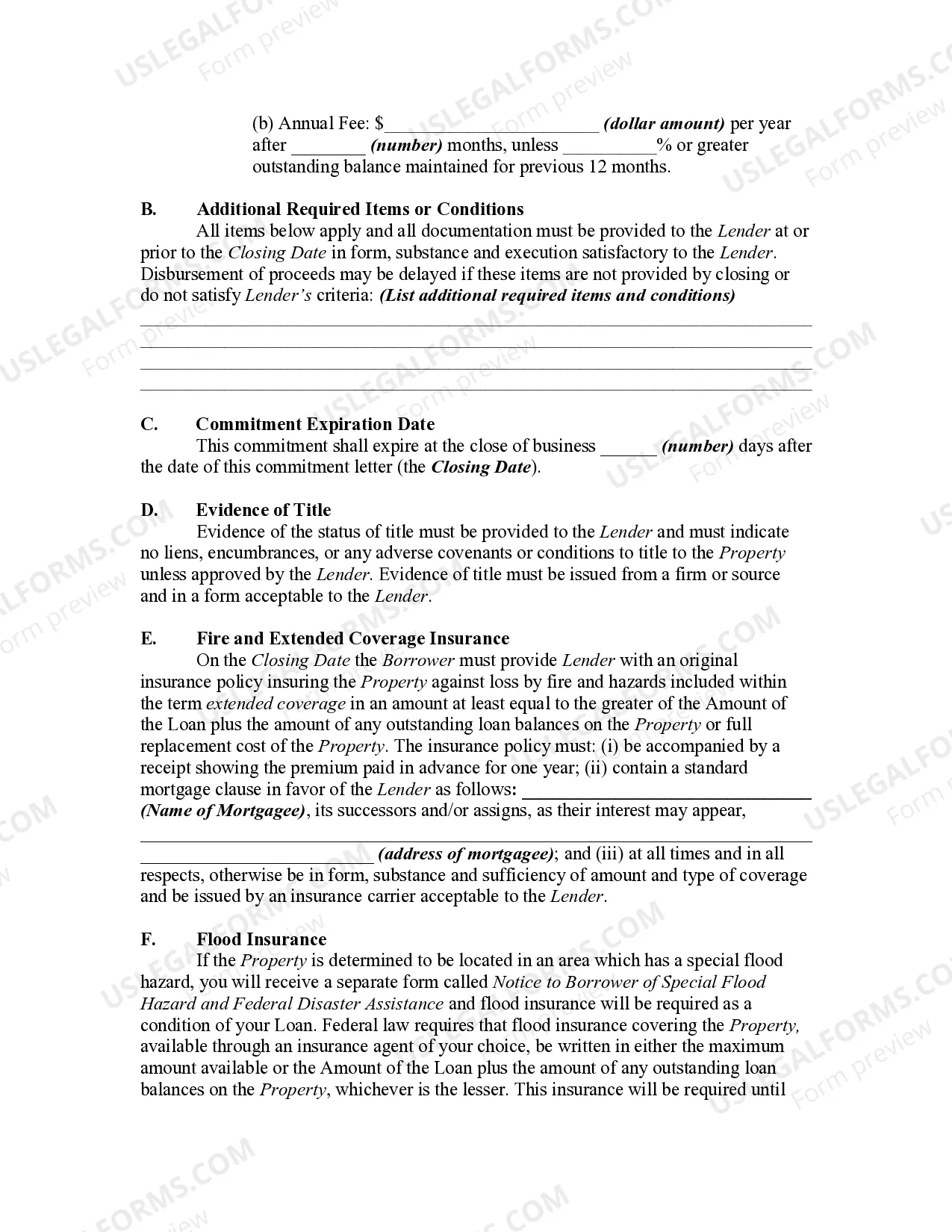

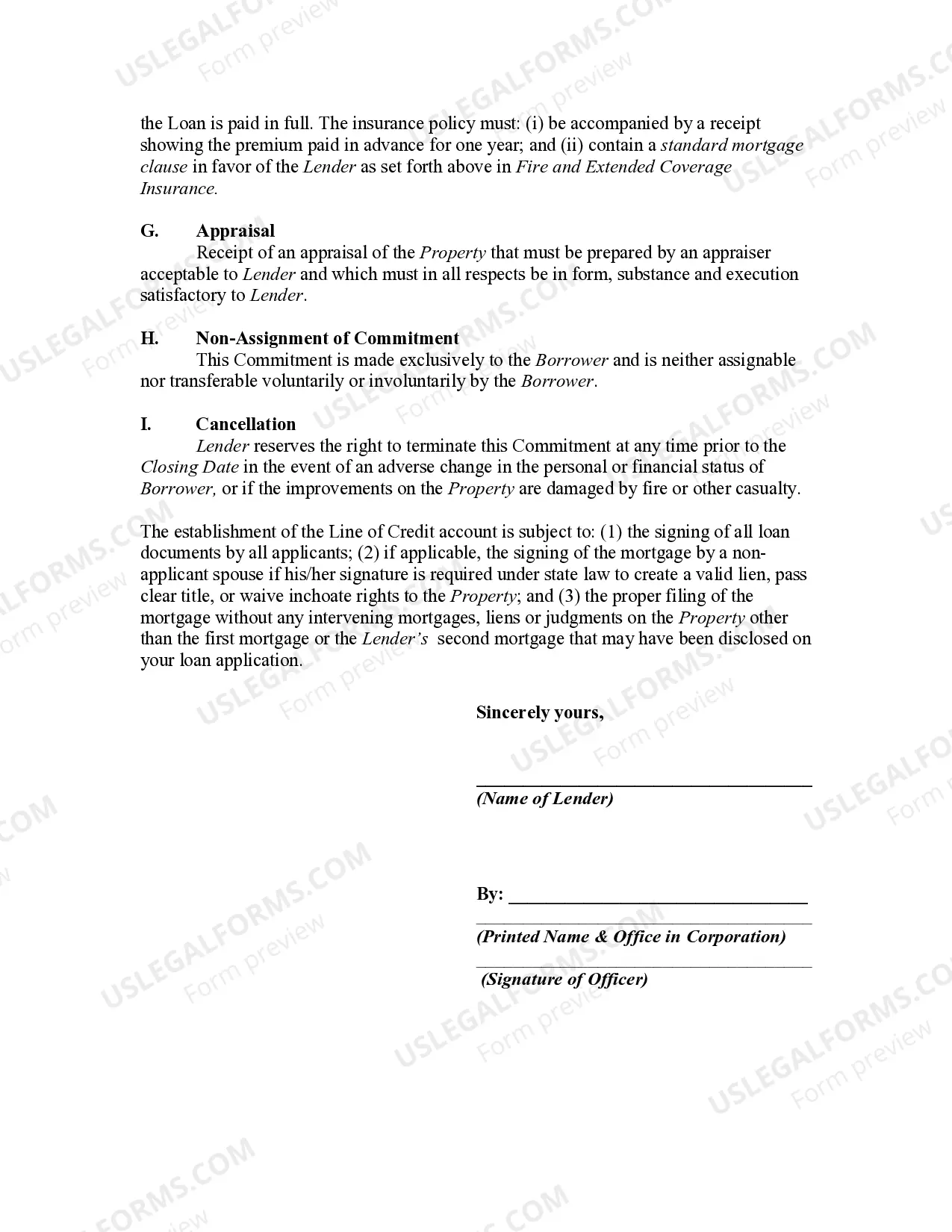

A Home Equity Line of Credit (HELOT) is a type of loan that allows homeowners to borrow against the equity they have built up in their property. In the state of Michigan, a Mortgage Loan Commitment is a vital document for obtaining a HELOT. This commitment is issued by a mortgage lender and signifies their willingness to provide a specific loan amount to the borrower, based on the equity available in their home. Keywords: Michigan, Mortgage Loan Commitment, Home Equity Line of Credit, HELOT, loan amount, equity, borrower, mortgage lender. There are several types of Michigan Mortgage Loan Commitments for Home Equity Line of Credit that borrowers may come across: 1. Fixed-Rate HELOT Commitment: This type of commitment ensures that the interest rate for the entire duration of the loan remains fixed, offering stability and predictable monthly payments. Michigan's homeowners who prefer a fixed interest rate may choose this commitment option. 2. Adjustable-Rate HELOT Commitment: An adjustable-rate commitment allows the interest rate to fluctuate over the loan term. The rate typically follows a market index, and it can increase or decrease based on market conditions. This commitment type may be suitable for borrowers who are open to potential interest rate adjustments. 3. Interest-Only HELOT Commitment: With an interest-only commitment, borrowers are required to pay only the interest on the loan amount for a specific period, often five to ten years. After this initial period, the borrower must begin repaying both principal and interest. This commitment type is beneficial for those seeking lower initial monthly payments. 4. Combination HELOT Commitment: Some lenders may offer a combination commitment that allows borrowers to split their HELOT into multiple portions with different terms. For example, a combination commitment might provide one portion with a fixed interest rate and another portion with an adjustable interest rate. This commitment allows borrowers to tailor their loan to their specific needs. 5. Non-Recourse HELOT Commitment: In Michigan, a non-recourse commitment ensures that the borrower is not personally liable for the repayment of the loan if the collateral (the property) is insufficient to cover the debt. This commitment provides additional protection for the borrower in case of foreclosure or default. 6. Secured HELOT Commitment: A secured commitment requires collateral, usually the borrower's primary residence, against which the lender has a legal claim until the loan is fully repaid. Failure to meet repayment obligations may result in the lender foreclosing on the property specified in the commitment. Michigan Mortgage Loan Commitments for Home Equity Line of Credit can be tailored to meet individual borrowers' requirements, providing flexible borrowing options while leveraging the equity in their homes. Note: It is essential to consult with a mortgage lender or professional regarding the specific terms, conditions, and offerings available for a Michigan Mortgage Loan Commitment for Home Equity Line of Credit.A Home Equity Line of Credit (HELOT) is a type of loan that allows homeowners to borrow against the equity they have built up in their property. In the state of Michigan, a Mortgage Loan Commitment is a vital document for obtaining a HELOT. This commitment is issued by a mortgage lender and signifies their willingness to provide a specific loan amount to the borrower, based on the equity available in their home. Keywords: Michigan, Mortgage Loan Commitment, Home Equity Line of Credit, HELOT, loan amount, equity, borrower, mortgage lender. There are several types of Michigan Mortgage Loan Commitments for Home Equity Line of Credit that borrowers may come across: 1. Fixed-Rate HELOT Commitment: This type of commitment ensures that the interest rate for the entire duration of the loan remains fixed, offering stability and predictable monthly payments. Michigan's homeowners who prefer a fixed interest rate may choose this commitment option. 2. Adjustable-Rate HELOT Commitment: An adjustable-rate commitment allows the interest rate to fluctuate over the loan term. The rate typically follows a market index, and it can increase or decrease based on market conditions. This commitment type may be suitable for borrowers who are open to potential interest rate adjustments. 3. Interest-Only HELOT Commitment: With an interest-only commitment, borrowers are required to pay only the interest on the loan amount for a specific period, often five to ten years. After this initial period, the borrower must begin repaying both principal and interest. This commitment type is beneficial for those seeking lower initial monthly payments. 4. Combination HELOT Commitment: Some lenders may offer a combination commitment that allows borrowers to split their HELOT into multiple portions with different terms. For example, a combination commitment might provide one portion with a fixed interest rate and another portion with an adjustable interest rate. This commitment allows borrowers to tailor their loan to their specific needs. 5. Non-Recourse HELOT Commitment: In Michigan, a non-recourse commitment ensures that the borrower is not personally liable for the repayment of the loan if the collateral (the property) is insufficient to cover the debt. This commitment provides additional protection for the borrower in case of foreclosure or default. 6. Secured HELOT Commitment: A secured commitment requires collateral, usually the borrower's primary residence, against which the lender has a legal claim until the loan is fully repaid. Failure to meet repayment obligations may result in the lender foreclosing on the property specified in the commitment. Michigan Mortgage Loan Commitments for Home Equity Line of Credit can be tailored to meet individual borrowers' requirements, providing flexible borrowing options while leveraging the equity in their homes. Note: It is essential to consult with a mortgage lender or professional regarding the specific terms, conditions, and offerings available for a Michigan Mortgage Loan Commitment for Home Equity Line of Credit.