Michigan General and Continuing Guaranty and Indemnification Agreement

Description

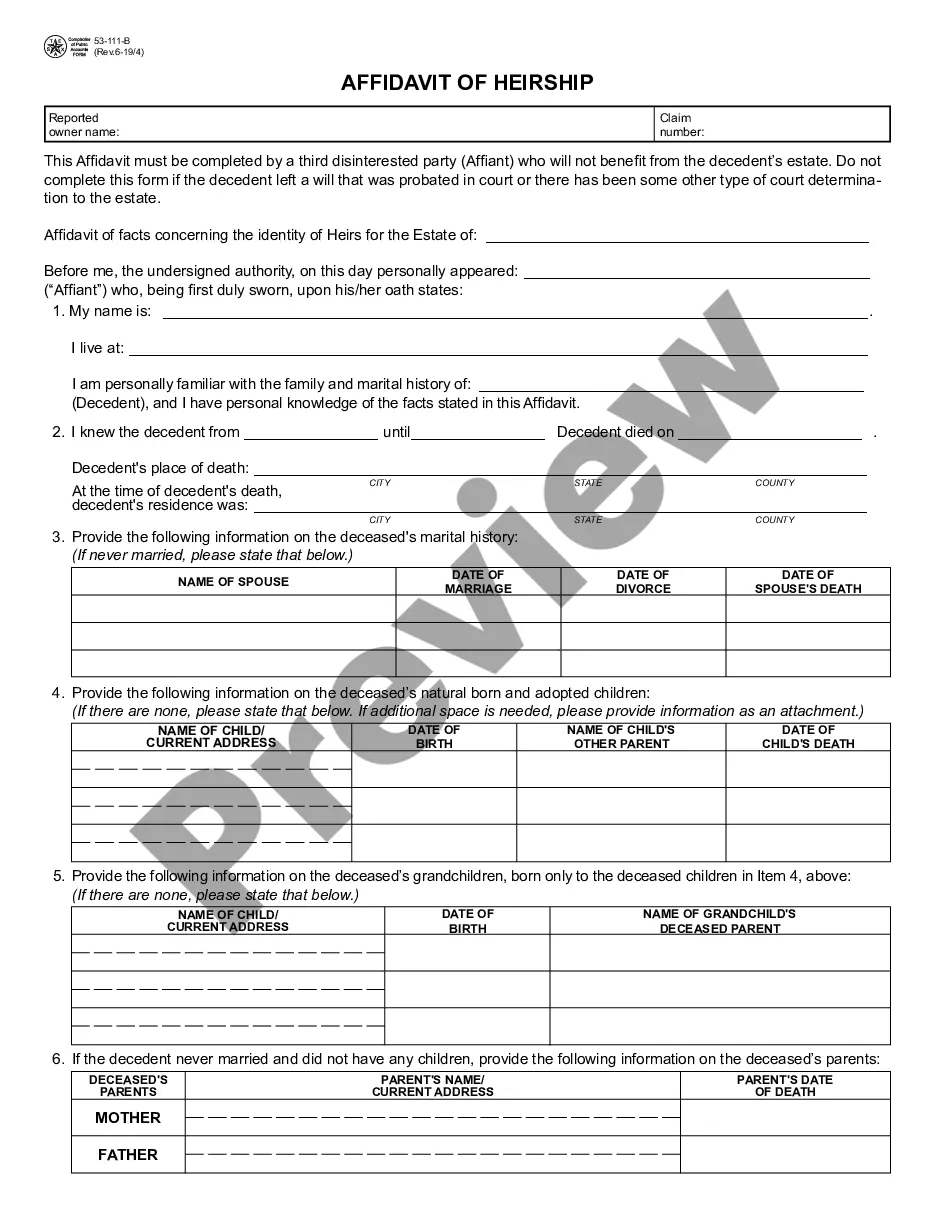

How to fill out General And Continuing Guaranty And Indemnification Agreement?

You might spend hours online looking for the proper document format that meets the state and federal standards you need.

US Legal Forms offers a wide range of legitimate forms that have been reviewed by experts.

You can download or print the Michigan General and Continuing Guaranty and Indemnification Agreement from our service.

If available, make use of the Preview option to examine the document format as well.

- If you possess a US Legal Forms account, you can sign in and select the Obtain option.

- Then, you can fill out, modify, print, or sign the Michigan General and Continuing Guaranty and Indemnification Agreement.

- Every legal document format you acquire is yours permanently.

- To get another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions below.

- First, ensure that you have selected the correct document format for your area/city of preference.

- Review the form details to verify you have chosen the correct document.

Form popularity

FAQ

A continuing guaranty agreement is a contract that remains in effect over time, providing ongoing assurance for credit or obligations. Under a Michigan General and Continuing Guaranty and Indemnification Agreement, this type of agreement allows one party to financially back another in a series of transactions. It is a valuable tool for businesses looking to secure consistent financial support and maintain trust with partners.

No, liability and indemnification serve different purposes in legal agreements. Liability refers to being responsible for potential damages, while indemnification involves compensating another party for losses incurred. In the context of a Michigan General and Continuing Guaranty and Indemnification Agreement, understanding both terms is essential for managing risks effectively in any transaction.

General Liability (GL) insurance typically does not cover breaches of contract, as it is designed for third-party bodily injury and property damage. In situations specified within a Michigan General and Continuing Guaranty and Indemnification Agreement, it is essential to have separate contractual liability coverage. This ensures that all aspects of your obligations are protected and laid out clearly.

General insurance indemnity refers to the obligation of an insurer to restore the insured to their pre-loss financial position after a loss occurs. Within the framework of a Michigan General and Continuing Guaranty and Indemnification Agreement, this type of indemnity provides peace of mind, knowing that financial support is available when needed. Understanding this concept is crucial for safeguarding against unexpected events.

Yes, liability often encompasses indemnity, as it pertains to the responsibility for damage or loss. When a Michigan General and Continuing Guaranty and Indemnification Agreement is in place, indemnity helps protect against the financial aftermath of liabilities. This understanding is vital for anyone entering contractual relationships, ensuring that potential pitfalls are managed effectively.

Indemnification involves one party agreeing to compensate another for specific losses or damages, while a guarantee is a commitment from one party to fulfill an obligation if another party defaults. In the context of a Michigan General and Continuing Guaranty and Indemnification Agreement, these terms are crucial for understanding financial responsibilities. Knowing the distinction helps in determining liability and risks in legal agreements.

Filling an indemnity form starts with entering your information correctly at the specified fields. Clearly outline the reasons for indemnity and the conditions for coverage. Do not forget to provide any necessary signatures. Using a structured platform like USLegalForms can simplify this process, particularly with the Michigan General and Continuing Guaranty and Indemnification Agreement at hand.

To fill out an indemnity, first draft a clear statement outlining what risks or actions are being indemnified. Accurately include details about the person or entity you are indemnifying. Ensure that all parties involved sign the document to reinforce its legal standing, as supported by the Michigan General and Continuing Guaranty and Indemnification Agreement.

Filling out an indemnity bond involves identifying all parties and clearly stating the obligations. You should detail the conditions under which the bond will apply, along with the amount that is secured. Notably, ensuring clarity in these sections helps maintain integrity with the policies in the Michigan General and Continuing Guaranty and Indemnification Agreement.

An example of indemnity could involve a landlord who requires a tenant to sign a contract. If the tenant causes damage, the indemnity clause specifies that the tenant will cover any repair costs. This example mirrors concepts found in the Michigan General and Continuing Guaranty and Indemnification Agreement, emphasizing security in agreements.