Michigan Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

If you need detailed, acquire, or producing valid document templates, utilize US Legal Forms, the leading selection of legal templates, that can be accessed online.

Make the most of the site's straightforward and convenient search to locate the documents you require.

A range of templates for business and personal needs are categorized by types and claims, or keywords.

Step 4. After you have found the form you need, click the Get now option. Choose your preferred pricing plan and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Michigan Personal Monthly Budget Worksheet.

- Utilize US Legal Forms to locate the Michigan Personal Monthly Budget Worksheet with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the Michigan Personal Monthly Budget Worksheet.

- You can also access templates you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the template for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to find alternative versions of the legal form design.

Form popularity

FAQ

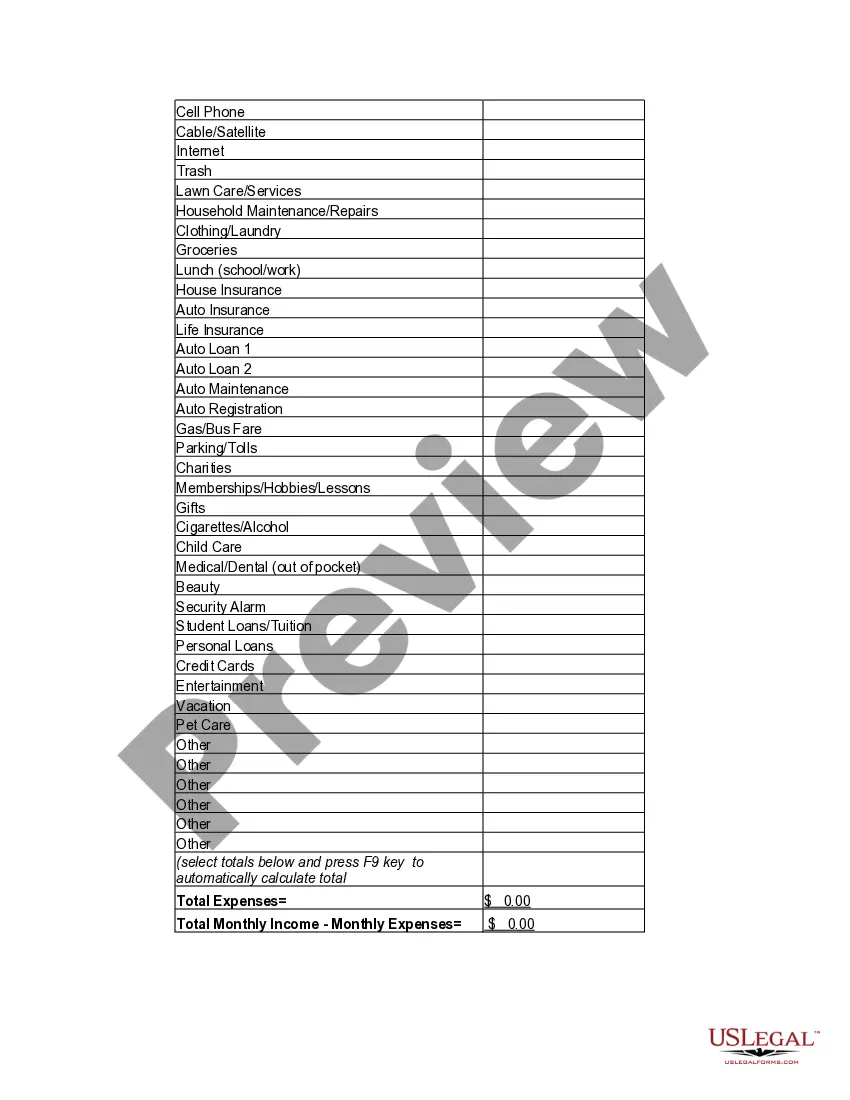

Creating a personal monthly budget begins with understanding your financial situation. Start by gathering your income information and listing your fixed and variable expenses. Next, set realistic spending limits for each category. A Michigan Personal Monthly Budget Worksheet can facilitate this process, enabling you to organize your finances clearly and track your progress throughout the month.

The 50-20-30 budget rule is a simple guideline for managing your finances. According to this rule, allocate 50% of your income to essential expenses, 20% to savings and debt repayment, and 30% to discretionary spending. Incorporating this structure into your planning can help you achieve financial balance. You can use a Michigan Personal Monthly Budget Worksheet to apply this rule effectively and visualize your financial health.

Keeping track of your monthly budget involves regular updates and reviews. Begin by recording all expenses as they occur, whether through an app, a spreadsheet, or a physical notebook. At the end of each month, review your spending against your budget to identify areas for improvement. Using a Michigan Personal Monthly Budget Worksheet can simplify this tracking process, ensuring you stay on course.

To calculate your personal budget, start by listing all your sources of income, including your salary and any side earnings. Next, track your expenses, categorizing them into fixed and variable costs. It’s important to ensure that your expenses do not exceed your income. Consider using the Michigan Personal Monthly Budget Worksheet to simplify this process and help you visualize your finances.

Writing a monthly budget example starts with defining your income and listing each expense category clearly. You can draft an example by outlining your monthly total income, followed by detailed entries for expenses such as rent, groceries, and entertainment. A Michigan Personal Monthly Budget Worksheet can serve as a practical guide, showcasing how to balance your budget effectively.

Filling out a monthly budget sheet involves collecting your income details and expenses data. You will categorize each section accurately and ensure that all figures reflect your actual financial situation. The Michigan Personal Monthly Budget Worksheet provides a straightforward layout to help you input this information effectively, ensuring clarity and organization.

To create a monthly budget, begin by assessing your financial situation. List your income and fixed expenses first, then estimate your variable expenses. Using a Michigan Personal Monthly Budget Worksheet can make this process smoother, allowing you to see the big picture and adjust as necessary for better financial management.

Yes, Excel offers various personal budget templates designed to help individuals manage their finances effectively. These templates often include pre-defined categories for income and expenses, streamlining the budgeting process. Utilizing an Excel template for a Michigan Personal Monthly Budget Worksheet can further enhance your financial planning experience.

To calculate your monthly budget, first list all sources of income and total them. Next, identify all monthly expenses and sum them as well, including both fixed and variable costs. By using the Michigan Personal Monthly Budget Worksheet, you can easily compare your income to your expenses, helping you stay on track financially.

The best spreadsheet to track monthly expenses is one that suits your style and provides clarity. Many individuals find a simple Michigan Personal Monthly Budget Worksheet effective as it includes all necessary fields while remaining easy to manage. You can always customize it according to your specific financial habits for maximum efficiency.