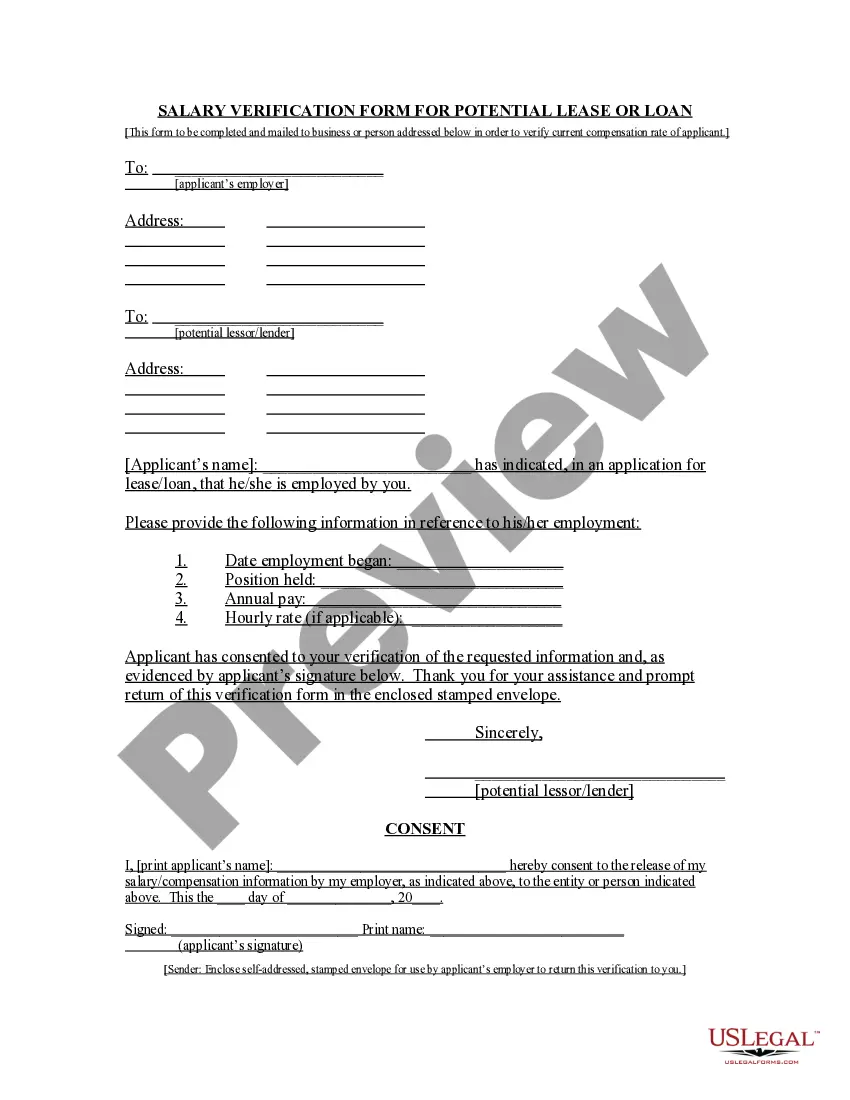

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Michigan Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is a legally binding document that serves to protect the interests of parties involved in an indemnification agreement. This agreement outlines the terms and conditions under which one party agrees to compensate and provide financial security to another party for any losses, damages, or liabilities incurred. The Deed of Trust, a versatile legal instrument, acts as a collateral security for the fulfillment of obligations under the indemnification agreement. It ensures that the party receiving indemnity will be compensated for any losses or damages suffered due to the actions or negligence of the indemnifying party. Keywords: Michigan, Deed of Trust, Securing Obligations, Indemnification Agreement, Collateral Security, Compensation, Financial Security. There may be different types or variations of the Michigan Deed of Trust Securing Obligations Pursuant to Indemnification Agreement, tailored to specific circumstances or industries. Some possible variations include: 1. Real Estate Deed of Trust: This type of Deed of Trust secures obligations pursuant to an indemnification agreement in the context of real estate transactions. It may involve parties such as lenders, borrowers, and title insurance companies. 2. Corporate Deed of Trust: This variation applies to indemnification agreements between corporations, protecting shareholders, directors, officers, or other parties involved in corporate governance. It safeguards against potential legal and financial risks associated with business operations. 3. Employment Deed of Trust: Specifically designed for indemnification agreements related to employee-employer relationships, this variation protects employers from liability arising from employee actions while acting within the scope of their employment. It may also cover legal costs associated with defending and indemnifying employees. 4. Construction Deed of Trust: Aimed at securing obligations pursuant to indemnification agreements in the construction industry, this variation provides financial security to contractors or subcontractors by granting a claim on the property or assets involved in the construction project. These are just a few examples, and the types and variations of Michigan Deed of Trust Securing Obligations Pursuant to Indemnification Agreements can vary based on the specific nature of the agreement and the parties involved.