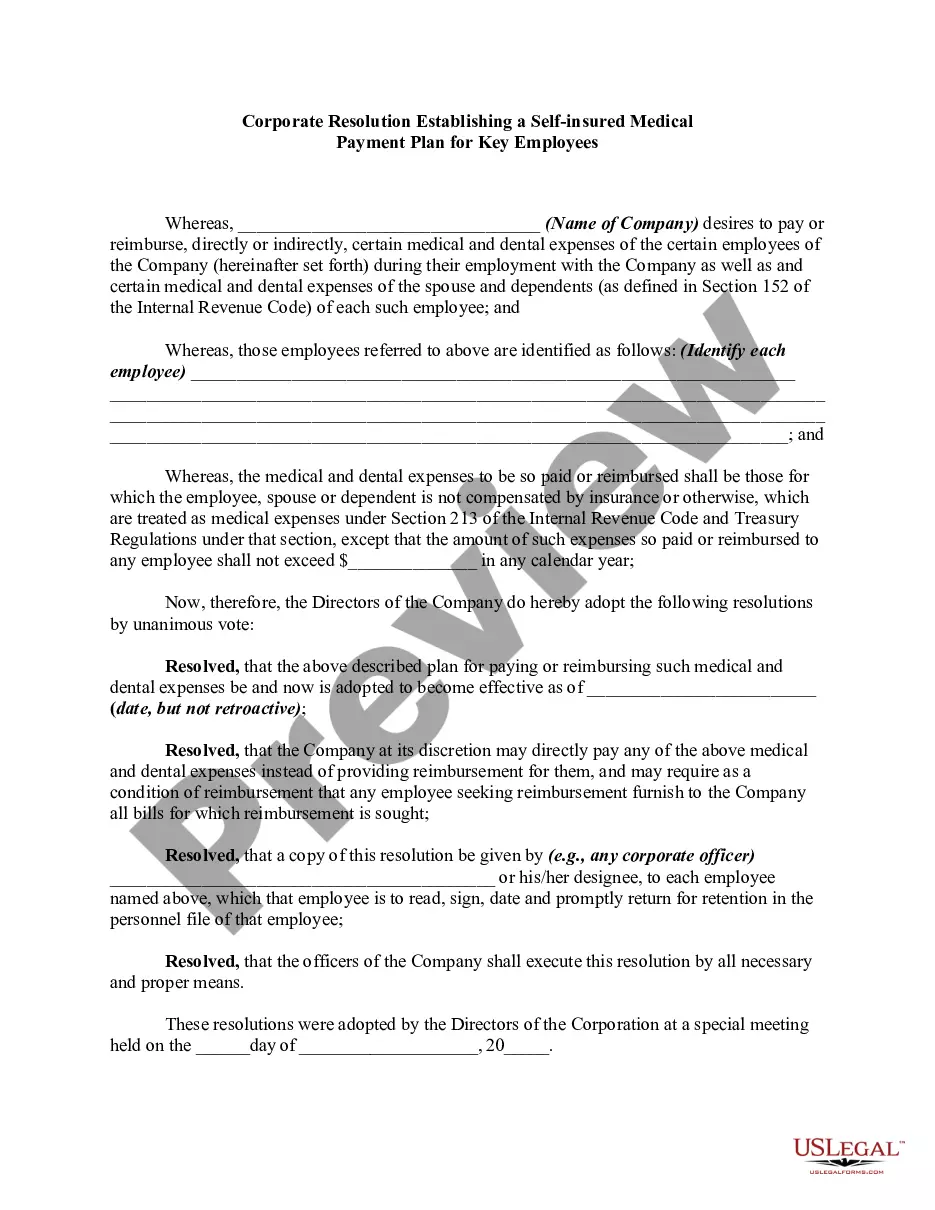

Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

If you need extensive, download, or printing legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's simple and user-friendly search to locate the documents you need.

Numerous templates for business and personal applications are organized by categories and states, or keywords.

Step 4. When you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Acquire button to obtain the Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

- You can also find forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to examine the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

If you believe your employer is not complying with health insurance regulations, you can report them to the Department of Labor or the Michigan Department of Insurance and Financial Services. Ensure you have gathered any necessary documentation to support your claim. Additionally, discussing options like a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with your HR department may lead to viable solutions without having to file a complaint.

Generally, you cannot sue an employer solely for not offering health insurance, as there are no blanket laws requiring all employers to do so. However, if your employer is violating specific laws or regulations related to health care benefits, you may have legal grounds. Consulting with an attorney would provide clarity on the situation and may reveal if a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees could be a path for compliance.

If your employer does not offer health insurance, you can investigate options through state or federal health marketplaces. You may also consult with a professional about negotiating a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, which could provide additional coverage options. Exploring these alternatives can help ensure you have the protection you need.

In Michigan, employers are not mandated by law to provide health insurance to all employees unless they are part of a larger organization. However, for companies with 50 or more full-time employees, the Affordable Care Act sets requirements. By considering a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, businesses can offer competitive health benefits to attract and retain talent.

In Michigan, employers are not legally required to provide health insurance to employees until a certain number of employees are reached or until the employer chooses to do so. However, delaying the offering of health insurance could affect employee retention and morale. Employers might consider opportunities like a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees to enhance benefits and support staff sooner.

insured employee health plan is a health benefits strategy where an employer assumes the financial risk for providing health care benefits to its employees. Instead of paying premiums to an insurance company, the employer pays for medical expenses directly. With a Michigan Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees, employers can create tailored benefits that meet their unique workforce needs.

If your employer does not provide health insurance, you can explore other options such as purchasing a plan through the Health Insurance Marketplace. You may also consider negotiating with your employer for a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, which can offer alternatives to traditional insurance. Additionally, you can look into government assistance programs that may be available to you.

The insurance plan that pays healthcare claims first is known as the primary insurance plan. This plan must be clearly identified to avoid delays in payment and ensure providers are promptly compensated. Implementing a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can help businesses define this structure and streamline their insurance claims process.

When an insurance company pays a healthcare provider, this transaction is commonly known as a claim payment. It is a critical part of the healthcare payment process, ensuring that providers receive compensation for their services. For businesses considering a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, understanding this concept helps in effectively managing health-related expenses.

In Michigan, employers are not universally required to offer health insurance, but larger employers often face mandates under federal laws, such as the Affordable Care Act. However, providing a robust health plan can attract and retain top talent, which is vital for any business. Opting for a Michigan Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can be a strategic move to enhance employee benefits.