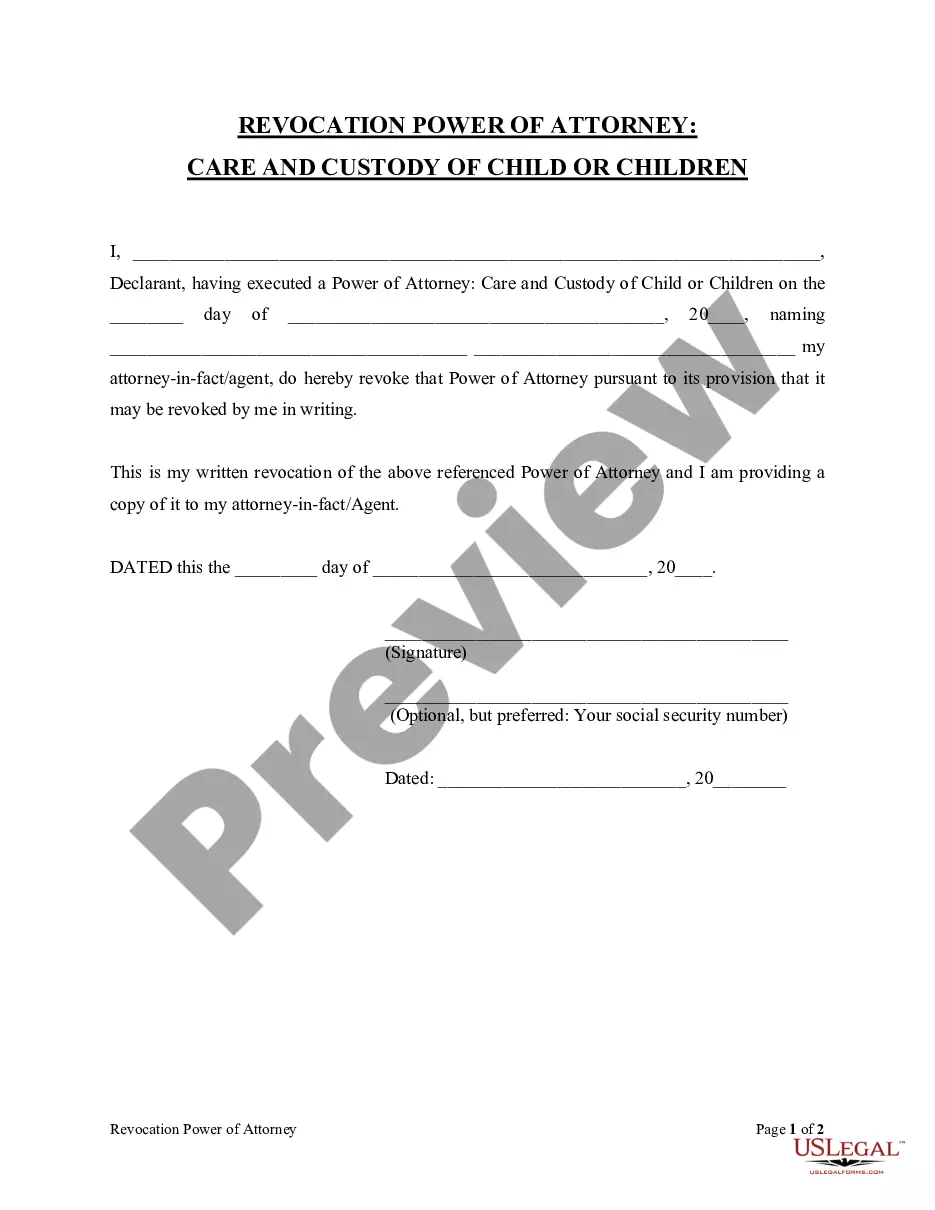

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

If you desire to complete, download, or create authentic document templates, utilize US Legal Forms, the largest collection of authentic forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Michigan Declaration of Gift Over Several Year Period in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Michigan Declaration of Gift Over Several Year Period.

- You can also access forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for your specific area/region.

- Step 2. Use the Review option to examine the form’s content. Be sure to read the details carefully.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the display to locate alternate versions of the legal document format.

Form popularity

FAQ

The IRS becomes aware of gifts primarily through the submission of Form 709, which must be filed if your gifts exceed the annual exclusion amount. Additionally, certain transactions may also be reported by financial institutions. Transparency is key in this process, and maintaining a clear record of your gifts is crucial. To simplify managing your declarations, consider utilizing uslegalforms for your Michigan Declaration of Gift Over Several Year Period.

You declare gifts on your tax return by reporting them on Form 709 if they exceed the annual exclusion limit. It’s essential to include information about the recipient and the amount of the gift. Make sure to keep accurate records to support your declarations. Using resources such as uslegalforms can help ensure that your Michigan Declaration of Gift Over Several Year Period is compliant with tax regulations.

If you gift more than $15,000 in a year to a single individual, you are required to report this via Form 709. Although it doesn’t necessarily mean you will owe gift tax, it does count against your lifetime exemption limit. Keeping track of your gifts can prevent any surprises as you plan your financial future. The Michigan Declaration of Gift Over Several Year Period serves as a helpful framework for your gifting strategy.

As of now, Form 709 cannot be filed electronically, which may feel a bit inconvenient. Instead, you must print the form and mail it to the IRS. Ensure that you include all required information accurately to avoid processing delays. Using resources like uslegalforms can simplify this process, making sure you have the correct form and guidance for your Michigan Declaration of Gift Over Several Year Period.

When you gift more than the annual exclusion amount, which is currently set at $15,000 per recipient, you may need to file a gift tax return using Form 709. This form helps to report the amount exceeding the exclusion. It's important to remember that the excess amount counts against your lifetime gift tax exemption. Therefore, considering the Michigan Declaration of Gift Over Several Year Period can help you manage and strategize your gifts effectively.

To report your lifetime gift exemption, you must file Form 709 to officially indicate your total taxable gifts. This report is essential for tracking your use of the lifetime exemption under the Michigan Declaration of Gift Over Several Year Period. Accurate reporting helps you avoid unexpected tax liabilities down the line, so be diligent in your record-keeping.

You can report your lifetime gift tax exemption by using Form 709 when you make gifts that exceed the annual exclusion limit. This form tracks your exempted gifts related to the Michigan Declaration of Gift Over Several Year Period, ensuring that you are keeping a record of your cumulative gifts. Always consult a tax professional for guidance tailored to your specific financial situation.

To document a gift for tax purposes, keep thorough records of the transaction which include the date, amount, and recipient’s information. Use a written declaration or a formal agreement, especially when it involves substantial sums related to the Michigan Declaration of Gift Over Several Year Period. This documentation will help ensure clarity and compliance with IRS regulations.

Yes, you need to file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if your gifts exceed the annual exclusion amount. This form is crucial especially if you are making gifts documented under the Michigan Declaration of Gift Over Several Year Period. Ensure you file this form separately from your regular tax return to properly account for your gifting activities.

To gift a house in Michigan, start by preparing a gift deed that complies with state law. After execution, file this deed with your local county register of deeds. Furthermore, familiarize yourself with the Michigan Declaration of Gift Over Several Year Period to break down the gift into manageable portions if needed. This can help in minimizing taxes and simplifying the overall process.