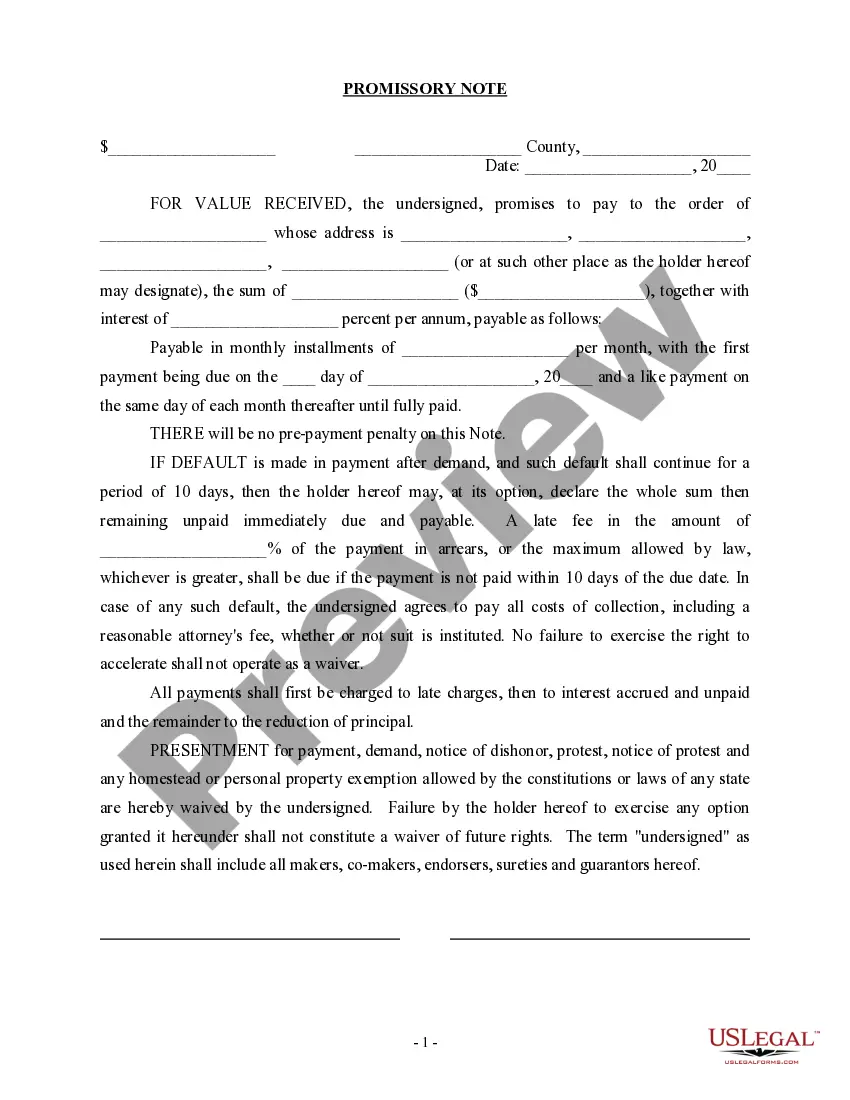

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Michigan Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Locating the appropriate legal document template can be quite a challenge.

Clearly, there is an array of templates accessible online, but how do you identify the legal form you require.

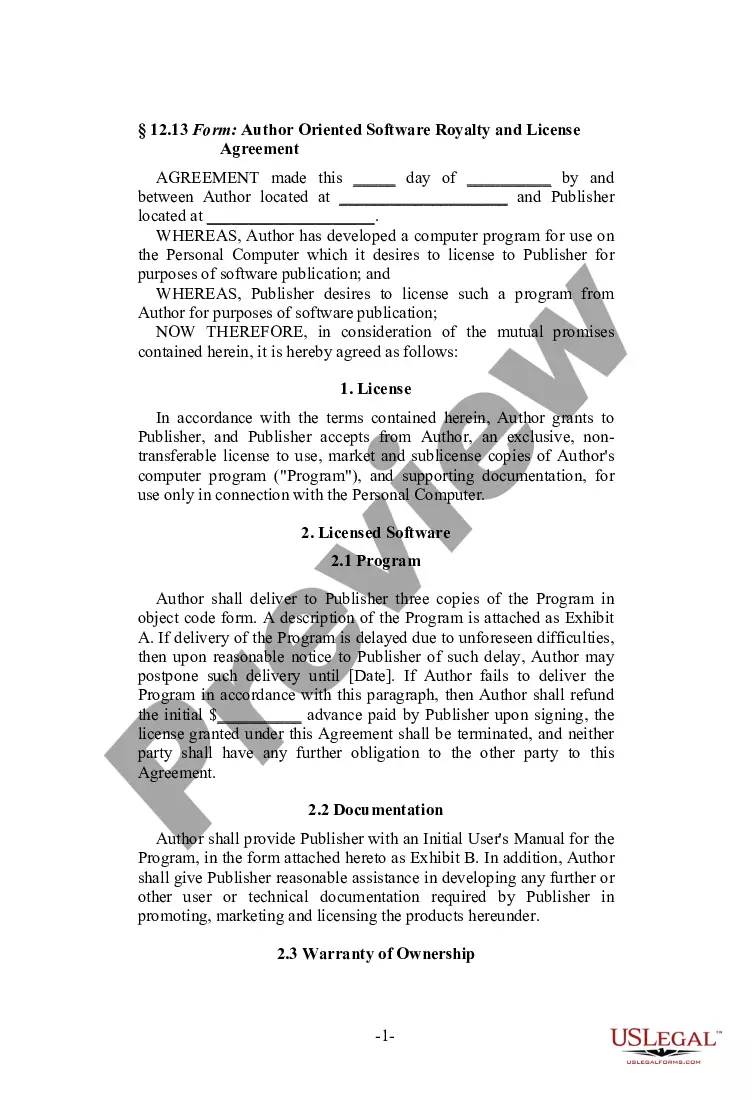

Utilize the US Legal Forms website. This service offers a vast selection of templates, including the Michigan Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase, suitable for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

Once you are confident that the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you desire and enter the required details. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired Michigan Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase. US Legal Forms is the largest repository of legal documents where you can discover numerous record templates. Use the service to obtain professionally crafted documents that adhere to state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Michigan Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- Use your account to view the legal forms you have purchased previously.

- Navigate to the My documents section of your account to download another copy of the required document.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- First, ensure you have chosen the correct form for your city/state. You can preview the form using the Review button and examine the form summary to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate template.

Form popularity

FAQ

Yes, a promissory note can indeed be secured, and in many cases, it is beneficial to do so. By securing the note with collateral, such as real property, the lender gains additional protection. This means that if the borrower fails to repay, the lender may have the right to claim the collateral as compensation.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Types of Promissory NotesSimple promissory note.Demand promissory note.Secured promissory note.Unsecured promissory note.

Homebuyers usually think of the mortgage as the contract they're signing with the lender to borrow money to buy a house. But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage is to provide security for the loan that's evidenced by a promissory note.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.